PAST WEEK'S NEWS (Oct 4 – Oct 10, 2021)

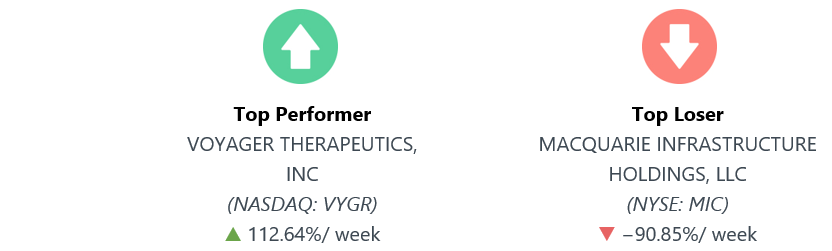

Voyager Therapeutics, Inc. stock jumped, mostly on Wednesday after announced licensing option agreement with Pfizer for capsids generated from Voyager's RNA-driven TRACER screening technology. The agreement could be valued at $630 million.

Stocks Performance

The major equities advanced last week, recovering a portion of the previous week’s losses as investors bought the dip and breathed a sigh of relief that a debt-ceiling agreement was reached in the Senate. A temporary deal to raise the debt ceiling by $480 billion until December boosted investor optimism, although volatility remained elevated amid a surge in energy prices, persistent supply-chain disruptions, and labour-market shortages. U.S. September nonfarm payrolls increased by only 194,000, which led some to reasonably argue that the Fed could delay its taper announcement past November.

The global energy crunch was unsettling markets: natural gas prices - up as much as 40% at one point - turned lower after Russia’s President Vladimir Putin said the country is ready to help. Debt problems at another Chinese property developer also dampened sentiment, as did rising tensions between China and Taiwan, along with U.S. attempts to force China to meet certain commitments under the Phase One trade deal

Energy sector led the gains as major oil exporters decided not to increase production more than their previously agreed-upon amount. Another outperformed sector include the financials, retail and transportations. Conversely, the real estate, health care, and communication services sectors closed lower.

Indices Performance

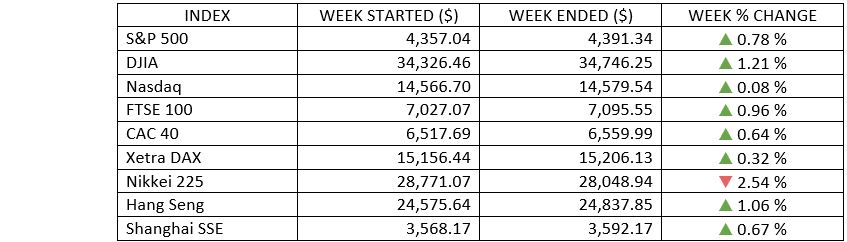

Most of the major benchmarks recorded gains, with the S&P 500 Index recovering a portion of the previous week’s losses after a debt-ceiling agreement was reached in the Senate. The Dow Jones Industrial Average outperformed with a 1.2% gain, while the Nasdaq Composite increased just 0.1%. Shares in Europe also ended higher despite significant volatility.

Against the broader backdrop of worries about global inflation, oil prices, and the Chinese property market, Japan’s stock markets lost ground for the third week in a row. Share price declines were also due to investors’ concerns about the prospective policies of newly inaugurated Prime Minister Fumio Kishida; these stemmed largely from Kishida indicating that he might support a capital gains tax increase, which could be perceived as a step back from efforts to make Japan more shareholder-friendly.

Chinese markets rose Friday following the weeklong Golden Week holiday. Investors looked past the government’s regulatory crackdown, property sector turmoil, and a nationwide power crunch and focused on positive economic data. Data released Friday showed the Caixin/Markit services PMI rose to 53.4 from 46.7 in August, rebounding from the lowest level seen since the height of the 2020 pandemic.

Oil Sector Performance

Crude oil holds on to its rally, driven by concerns about energy supply on signs of tightness in crude, natural gas, and coal markets. The OPEC+ on Monday said it would maintain an agreement to increase oil production only gradually, ignoring calls from the U.S. and India to boost output as the world economy recovers from the coronavirus pandemic. The group agreed to stick to an existing pact to raise oil output by 400,000 barrels per day in November.

Oil prices also rose on signs some industries have begun switching fuel from high priced gas to oil, and on doubts the U.S. government would release oil from its strategic reserves for now. The U.S. Energy Department on Thursday said it has no plans “at this time” to tap into the nation’s oil reserves to help quell rising fuel prices.

U.S. crude inventories rose by 2.3 million barrels last week, the data from the U.S. EIA, against expectations for a dip of 418,000 barrels. Gasoline inventories also rose, while distillate inventories were down slightly.

Market-Moving News

Stocks Slight Recovery

In another week of choppy trading, the major U.S. stock indexes recovered from a sharp decline on Monday to finish positive overall for the week. With gains of around 1%, the Dow and the S&P 500 outpaced the NASDAQ; large caps outpaced their small-cap peers and the value equity style outperformed.

Yield Surge

Prices of U.S. government bonds fell again, sending the yield of the 10-year U.S. Treasury bond above 1.60% on Friday. That’s the highest yield in more than four months, and it marks a sharp increase from mid-September, when the yield slipped below 1.30%.

Another Jobs Disappointment

The pace of U.S. jobs growth slowed for the second month in a row and again fell short of most economists’ expectations. The economy generated 194,000 new jobs last month, trailing gains of 366,000 in August and 1.1 million in July. The unemployment rate fell to 4.8% from 5.2%, in part due to people leaving the labour force.

Costly Energy

U.S. crude oil prices climbed for the seventh week in a row, briefly eclipsing $80 per barrel in intraday trading on Friday for the first time since late 2014. Oil’s rise has come amid a broader rally in commodities including natural gas and coal, whose prices have been driven up by recent supply concerns, particularly in Europe and Asia.

U.S. Debt Ceiling Deal

A congressional agreement reached on Thursday for a short-term deal to lift the U.S. debt ceiling averted a potential default on the government’s debt obligations. Another debt deadline looms in early December. The deal followed weeks of partisan fighting and came less than two weeks before the government faced the likelihood of being unable to pay its bills for the first time ever.

Other Important Macro Data and Events

The week brought the highly anticipated monthly payrolls report, which seemed to receive a mixed reaction in markets when it was released Friday morning. The Labor Department reported that nonfarm payrolls grew by 194,000 in September, well below consensus expectations of around 500,000. The workforce participation rate also ticked lower, which some viewed as especially surprising given the expiration of extended unemployment benefits during the month. Previous months’ gains were revised higher, however, and the scarcity of job seekers was reflected in another month of strong wage gains.

The yield on the benchmark 10-year U.S. Treasury note climbed neared 1.62%, its highest level since early June. The acceleration in commodity prices in the first week of October helped push market-based inflation expectations and longer-term bond yields to the highest levels since early June. The debt limit headlines also caused distortions in the Treasury bill market.

Core eurozone bond yields rose on inflation concerns stemming from the surge in natural gas prices. They rose further, in sympathy with U.S. Treasury yields, after the U.S. Senate voted to raise the U.S. debt ceiling temporarily to prevent a government default. Peripheral eurozone bond yields and UK gilt yields tracked core markets. Gilt yields rose further after the BoE’s new Chief Economist Huw Pill raised concerns about high inflation potentially being more persistent than previously expected.

ECB policymakers viewed the recent surge in inflation as temporary but acknowledged that the risks to the outlook “were widely regarded as being tilted to the upside,” according to the minutes from its September meeting. Some policymakers were also worried by “upside risks” to inflation, the minutes indicated, expressed doubt that the forecasting models were accurately capturing changes in the economy and argued that closer attention must be paid to a possible “regime shift” in prices.

What Can We Expect from the Market this Week

Investors prepared to begin with some major bank announcements the following week, as the third-quarter earnings reporting season kick-off. JPMorgan reports on Wednesday, followed by BofA, Morgan Stanley and Citigroup on Thursday, and Goldman on Friday.

A government report scheduled to be released on Wednesday meanwhile will show whether the recent spike in consumer prices carried over into September. The CPI index released last month showed that prices rose 5.3% for the 12-month period that ended in August. While high, the rate of increase was down slightly from July’s figure and was markedly below June’s surge in inflation.

Another important economic data being released this week include the PPI, jobs opening, unemployment rate, and retail sales growth.