PAST WEEK'S NEWS (Nov 1 – Nov 7, 2021)

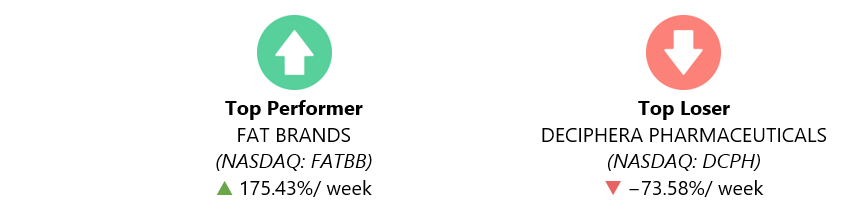

Fat Brands Class B shares skyrocketed for the week, on Fazoli's acquisition and social media pump. The shares skyrocketed on Wednesday, a day after the company announced plans to acquire Fazoli’s Restaurant Chain for $130 million. Hype in StockTwits and Twitter also talking up the name. FAT Brands is a leading global franchising company that strategically acquires, markets and develops fast casual and casual dining restaurant concepts around the world.

Deciphera Pharma stock plunges after disappointing trial results. The study failed to meet the primary endpoint of improved progression-free survival (PFS) compared with the standard of care Pfizer’s Sutent (sunitinib).

Stocks Performance

November started off on solid footing, with equity markets posted impressive weekly gains. A relatively dovish Federal Reserve policy meeting, accelerating jobs gains and strong corporate earnings all boosted sentiment toward equities.

As expected, the Federal Reserve said that it will soon begin to trim the $120 billion in bond purchases that it’s been making each month to support economic growth. The Fed continued to characterize the recent spike in inflation as “transitory,” though acknowledged that price increases have been faster and more enduring than they had forecast.

Quarterly earnings season continued with ongoing strong results, as profit margins held up well despite higher commodity prices and supply chain disruptions in various industries. A promising COVID-19 oral antiviral pill by Pfizer also contributing to positive sentiment. Pfizer said its COVID-19 oral antiviral reduced the risk of hospitalization or death by 89% in interim data.

From a sector perspective, advancing sectors were led by the consumer discretionary, followed by gains in information technology and materials. The health care and financials sectors closed lower. Energy sector also hurt as the oil prices dropped from their recent highs.

Indices Performance

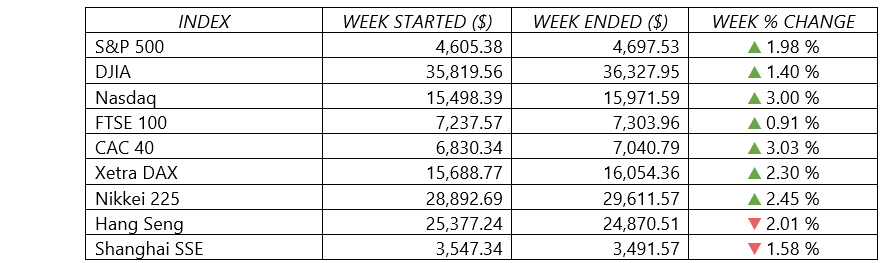

Each of the major indices rose for the fifth consecutive week, and all three indexes pushed their record levels higher. The NASDAQ added about 3%, outperforming its peers by a wide margin for the second week in a row.

Shares in Europe rose on strong corporate earnings results and signals from the ECB that interest rates staying low for some time.

Japanese equities were also buoyed over the week by the convincing election victory of Prime Minister Fumio Kishida’s party.

Chinese markets recorded a weekly loss, as headlines about the beleaguered property sector and a growing COVID-19 outbreak across the country dampened sentiment. Kaisa Group Holdings became the latest developer in China’s $5 trillion property sector to reveal that it was having debt problems. The Shenzhen-based company, which has the most offshore debt coming due over the next year in the sector after China Evergrande Group, reportedly put 18 property projects valued at $12.8 billion on the auction block. The Kaisa asset sale plan follows a missed payment on a wealth management product and $11 billion of dollar bonds from the company, which guaranteed the wealth management product and said it was facing unprecedented liquidity pressure.

Oil Sector Performance

Oil market recorded its second weekly losses in more than two months. The contracts steadied early in the week after OPEC+ rebuffed a U.S. call to raise supply and instead maintained plans to continue with their current output plan, rollover its August program to gradually increase oil production by 400,000 barrels per day each month.

Oil prices then dropped from their recent highs after Biden administration officials mentioned the possibility of releasing supply from the strategic petroleum reserve, as well as following a report that Saudi Arabia's oil output will soon surpass 10 million bpd for the first time since the outset of the COVID-19 pandemic.

Other Important Macro Data and Events

U.S. Treasury yields decreased amid the Fed’s signals that it will take a patient approach toward monetary policy tightening. The 2-yr yield dropped ten basis points to 0.39%, and the 10-yr yield slipped to 1.45%. A couple of days earlier, it had climbed to nearly 1.60%.

The Federal Reserve announced that it will begin to taper its monthly pace of bond purchases, currently at $120 billion, by $15 billion per month. At this pace, the Fed will phase out the purchases entirely by next June. The Fed’s Chair Powell also reiterated the view that inflation pressures are expected to be transitory and that the Fed will be patient on rate hikes. In the absence of a hawkish surprise, and a decision by the Bank of England to hold rates steady against expectations for a hike, equity markets rallied to new highs, and market expectations shifted from pricing in 2.5 Fed hikes next year to slightly less than two.

Economic data released during the week were generally robust, showing that the economy gained strength as the late-summer wave of the delta variant eased. Factory orders increased 0.2% in September, slightly more than consensus expectations. The government’s October employment report, released on Friday morning, showed 531,000 jobs added, topping consensus estimates. The unemployment rate fell to 4.6%. The Labor Department also said that the economy gained 235,000 more jobs in August and September than it originally estimated.

In the eurozone, the core eurozone bond yields slipped from earlier highs after ECB President Christine Lagarde pushed back against raising interest rates in 2022, citing the bank’s expectations that inflation would remain “subdued” over the medium term. Core yields fell further after the BoE stood pat on rates. Peripheral eurozone bond yields and UK gilt yields also fell.

What Can We Expect from the Market this Week

The rush of earnings reports slows down just a bit in the week ahead, but still sees big names like Disney, Unity Software, Coinbase Global and Aurora Cannabis stepping in.

The U.S. consumer prices scheduled to be released on Wednesday will show whether the recent spike in prices carried over into October. The CPI released last month showed that prices surged 5.4% for the 12-month period that ended in September—in line with the elevated levels seen over the summer amid rising energy costs and disruptions in global supply chains.