PAST WEEK'S NEWS (Jan 10 – Jan 16, 2022)

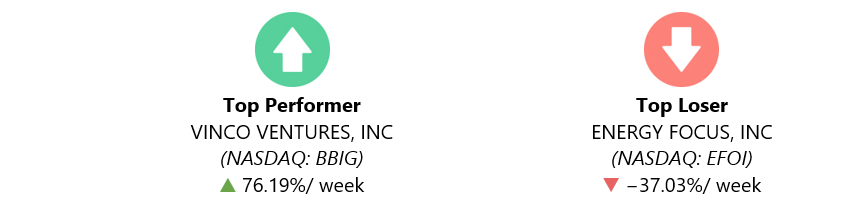

Vinco Ventures Inc shares closed the week higher. The shares of the digital media merger and acquisition company gained significantly since last year due to social media-driven hype and its considerable short interest, which triggered a speculative play. The company also is actively promoting its Lomotif app, attempting to compete with the social media behemoth TikTok. While it’s still not as popular as TikTok, Lomotif could present a similar, ground-floor opportunity.

Stocks Performance

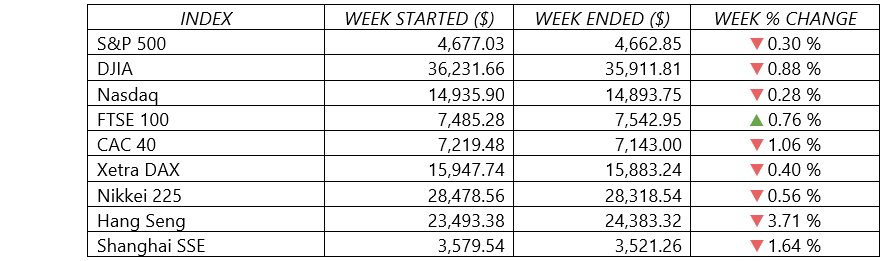

The second week of 2022 delivered another negative result for the major stock indexes, as investors faded a half-hearted rebound bid during the week. Concerns about rising inflation and interest rates seemed to largely loom over sentiment throughout the week.

A multidecade jump in consumer prices was a reminder that inflation is a key driver and risk for the year ahead, impacting the Federal Reserve’s policy, consumer spending, bond yields and sectors leadership.

The unofficial start of fourth quarter earnings season began. Financials shares came under pressure on Friday, as JPMorgan Chase, Citigroup, and BlackRock fell sharply following their earnings reports, though Wells Fargo pleased shareholders. Consumer discretionary, utilities, real estate, and health care sectors were also weak in the week. Energy shares meanwhile outperformed as oil prices continued their climb back to late-October highs.

Indices Performance

The large-cap indexes recorded their second consecutive weekly loss to start the year, while the technology-heavy Nasdaq Composite its third. Concerns about more aggressive monetary policy tightening by the U.S. Federal Reserve continued to weigh on sentiment, also dragging the shares in Europe. However, the UK’s FTSE 100 Index advanced as traders reckon Britain's economy can survive a surge in Omicron COVID-19 cases.

Japan’s stock market returns also were negative for the week, with confidence was dented by the government extending the ban on non-resident foreigners entering Japan until the end of February, as well as an apparent sixth wave of the coronavirus hitting the country’s capital, Tokyo.

Chinese markets fell for the week, weighed by headlines about refinancing difficulties in the country’s troubled property sector.

Crude Oil Performance

U.S. crude oil prices climbed to more than $84 per barrel on Friday and posted the fourth weekly gain in a row. After briefly tumbling below $66 in early December following the emergence of the Omicron variant, the price of oil is back near a recent high reached in late October.

The benchmarks of late were supported by supply concerns in Libya and Kazakhstan and a drop in U.S. crude inventories to 2018 lows. Some investors are also optimistic that Omicron's impact on the global economy and oil demand will be short-lived.

Other Important Macro Data and Events

All eyes were justifiably on inflation last week, with the released data revealing the fastest price increases in decades. Came in largely in line with expectations , the CPI rose 7% in December from a year ago, the fastest pace since 1982 and the eighth straight month in which inflation exceeded 5%. Excluding the volatile categories of food and energy, inflation rose 5.5%, the most since 19911.

Meanwhile at a congressional hearing on his nomination to a second term as chair of the U.S. Federal Reserve, Jerome Powell said that the U.S. economy is healthy, yet also needs tighter monetary policy to address high inflation. Powell reaffirmed plans for a series of interest-rate increases this year as well as continued tapering of the Fed’s bond-purchasing program.

Other data offered mixed signals about the possibility of such a 1970s-style spiral. The week’s biggest surprise, arguably, was a 1.9% drop in retail sales in December. Relatedly, retail inventories rose 1.3% in November, the biggest increase since February and perhaps an indication of easing supply challenges. Import and export prices also reversed course and fell during the month, while industrial production contracted slightly.

Weekly jobless claims rose unexpectedly to 230,000, the highest number since mid-November. Continuing claims fell more than expected to 1.56 million, however—the lowest number since June 1973, when the civilian labor force was just over half (55%) its current size. The University of Michigan’s index of consumer sentiment ticked down to a new pandemic-era low of 73.2, with many surveyed citing inflations worries.

After climbing above 1.80% during intraday trading Monday, a near two-year highs, the yield on the benchmark 10-year U.S. Treasury note slid to 1.74% by Friday morning, as longer-term U.S. government debt rallied amid wavering risk sentiment.

Core eurozone bond yields ended lower, mostly tracking moves in U.S. Treasury yields. Peripheral eurozone bonds and UK gilts broadly followed core markets.

Gold set its for its best weekly gain since November, buoyed by a weaker US dollar and Treasury yields.

Restrictions and lockdown by countries also were in focus for the week, with some countries started easing the restrictions. The Netherlands is set to ease its nationwide lockdown from Saturday, local media reported, citing government sources. The UK, Switzerland, and Norway cut the self-isolation period for those who test positive for COVID-19, suggesting a belief that the coronavirus is becoming endemic. France also eased restrictions on travellers from the UK. Spain is changing its strategy from quarantines and restrictions to a monitoring system.

However, Germany plans to further restrict access to bars and restaurants, while anyone 50 years or older in Italy and 60 years or older in Greece will be fined if they are unvaccinated. In Japan, the Prime Minister Kishida announced that the ban on non-resident foreigners entering Japan, which came into force on November 30, 2021, would be extended until the end of February. China suspended dozens of international flights and issued more restrictions. Hong Kong, which had reported no local infections for months, reimposed some social and travel restrictions after a string of positive cases, dealing a setback to the city’s reopening hopes. Shanghai curbed tourist activity as it rushed to head off local infections as imported cases rose.

What Can We Expect from the Market this Week

With quarterly earnings season just starting, Wall Street analysts expect companies in the S&P 500 to report a more than 20% increase in net income compared with the prior year’s Q4, according to FactSet. Of the 20 companies that had reported as of January 12, a dozen cited labor costs and shortages as a negative factor that weighed on their quarterly results.

The earnings season this week will heat up with big reports due in from Goldman Sachs, Procter & Gamble, Travelers and Netflix. Guidance updates are expected to vary widely depending on the ability of individual companies to battle through inflation pressures.

The economic calendar in the week ahead meanwhile features updates on housing starts, building permits, existing home sales and the Philadelphia Fed Index. It will be a quiet week for Fed officials with a blackout period in place ahead of the FOMC meeting set for January 26, but Treasury yields will still be watched closely with the 10-year Treasury yield standing at 1.79%.