PAST WEEK'S NEWS (November 25 – November 29, 2024)

Thanksgiving was here, and retailers should be grateful after online sales in the U.S. grew 4% during the first half of Thanksgiving, thanks to attractive discounts, compared to 2% last year, according to Salesforce. Retailers like Walmart and Amazon already gained more than 9% since the start of November, standing to gain more this season. Apparel brands Abercrombie & Fitch and Gap raised its forecasts on strong demand, contrasting with those from Kohl's and Macy's. Salesforce data shows the peak shopping window will be between 7 p.m. and midnight, driving 35% of Thanksgiving's online sales. Overall, the holiday shopping season seems healthy, although it's set to grow at its slowest pace in six years.

President-elect Donald Trump continued to stir the markets by saying that his administration will potentially impose tariffs on the United States’ major trading allies. Trump intends to implement a 25% tariff on goods from Mexico and Canada, citing concern regarding border security and drug issues, along with a 10% additional tariff on China imports. The market responded positively, with the US dollar gaining 1 percent against Canadian dollar and 2 percent against the Mexican peso. William Reinsch and other experts see these tariffs as a move in negotiations, that Trump is using pressure to push countries into making concessions. The suggested tariffs might breach the U.S.-Mexico-Canada Agreement (USMCA), leading to changes in global trade patterns and raising concerns among economists about higher inflation and altered global supply chain dynamics. The Chinese government has responded by warning against the notion of another trade war, with a spokesperson reiterating that "no one will win a trade war."

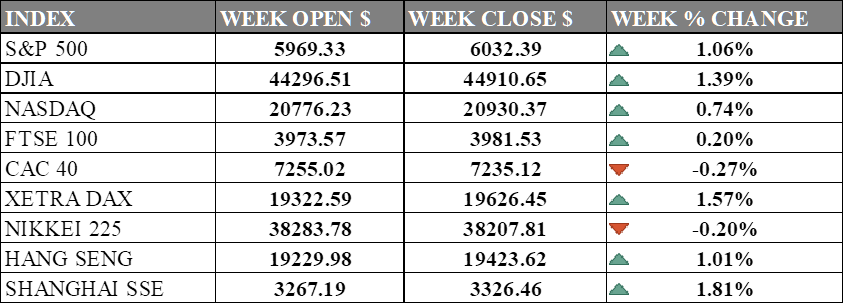

INDICES PERFORMANCE

Wall Street ended in a broadly positive week across major indices. The S&P 500 gained 1.06% to close at 6,032.39. The Dow Jones Industrial Average advanced 1.39%, finishing at 44,910.65, while the Nasdaq showed more modest performance with a 0.74% increase to close at 20,930.37. The market gains reflect growing investor optimism in the cyclical sector instead of tech, with ongoing discussions about the timing of potential interest rate cuts by the Federal Reserve.

European markets showed mixed performance. The UK's FTSE 100 gained a slight 0.20%, closing at 3,981.53. France's CAC 40 saw a marginal decline of 0.27%, closing at 7,235.12. Germany's XETRA DAX showed stronger gains, rising 1.57% to end at 19,626.45. The varied performance in European markets suggests regional differences in economic outlook and investor sentiment.

Asian markets displayed a more nuanced picture. Japan's Nikkei 225 declined 0.20% to close at 38,207.81, showing mixed performance compared to other regional markets. Chinese markets demonstrated resilience, with Hong Kong's Hang Seng Index rising 1.01% to close at 19,423.62. The Shanghai Composite in mainland China posted the most notable regional gain, rising 1.81% to 3,326.46. The performance in Asian markets reflects diverse economic conditions and investor sentiments across the region.

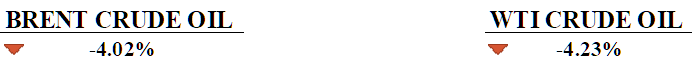

CRUDE OIL PERFORMANCE

Crude oil prices close the week and month with losses even though Middle East ongoing tensions and risk around OPEC+ production quota. Brent crude fell to $72.03 per barrel and WTI to $68.11, both dropping around 4% this week as traders reacted to a U.S.-brokered ceasefire between Israel and Hezbollah, though its stability remains questionable with both sides claiming violations. Heightened Russia-Ukraine tensions provided limited support, with Russia targeting Ukraine’s energy infrastructure, raising fears of Western retaliation and full involvement. OPEC+ postponed its meeting to next week, with analysts widely expecting a delay in production hikes due to weak demand and oversupply concerns. China’s slowing oil demand added to bearish market sentiment, alongside IEA projections of a surplus next year. Investors are watching for clearer signals from OPEC+ and geopolitical developments for oil market’s next moves.

OTHER IMPORTANT MACRO DATA AND EVENTS

Eurozone inflation edge higher to 2.3% in November, mostly by base effects, while core inflation stayed at 2.7%, keeping pressure on the ECB as it considers rate cuts. Markets expect a cautious 25 basis point cut on Dec. 12, with further easing likely through mid-2025.

Tokyo inflation accelerated to 2.2% in November, keeping market eager for a Bank of Japan interest rate hike in December. The yen strengthened on the data, as the BoJ faces rising price pressures, particularly in rent, utilities, and services, while labour market tightness supports the case for further rate hike.

What Can We Expect from The Market This Week

JOLTs Job Openings: The US JOLTs report showed job openings fell to 7.44 million in September, missing the expected 7.98 million and down from 7.86 million in August. The decline highlights continued contraction in the labour market, with hiring and separations remaining stable at 5.6 million and 5.2 million, respectively.

US Nonfarm Payroll: The October nonfarm payrolls shocked the market with just 12,000 jobs added, mainly due to hurricanes and strikes, while the unemployment rate remained at 4.1%. November is expected to show a strong rebound in payroll growth, potentially offsetting October's weakness, projecting a 202,000 jobs addition.

ISM Manufacturing PMI: Manufacturing continues to contract, dropping 0.7 points to 46.5 in October, the lowest reading of 2024, marking seven consecutive months of decline. Only one of five key subindexes, supplier deliveries, remained in expansion, while production and new orders contracted further, and just two major industries expanded.

Eurozone GDP Q3: Preliminary data shows that the eurozone economy grew 0.4% in the third quarter, exceeding expectations of 0.2%, with notable contributions from Spain (0.8%) and Ireland (2%), while Germany avoided a recession with 0.2% growth. Analysts forecast slower GDP growth in the fourth quarter, as weaker business activity goes on even though inflation is easing and ECB rate cuts are being made.

Fed Chair Powell Speech: Federal Reserve Chair Jerome Powell is set to participate in a moderated discussion at the New York Times DealBook Summit on Wednesday, where investors will closely monitor his speech on the labour market's strength, the inflation outlook, and any clues pertaining to interest rate cuts at the December meeting.