PAST WEEK'S NEWS (September 23 – September 27, 2024)

Right after the federal reserve cut its rate last week, its central bank came out and announced measures to support the economy, including a cut in banks' reserve requirement ratio and freeing up yuan for lending, especially for stock repurchases. The seven-day reverse repo rate will be reduced, with expectations of changes in lending facility rates and loan prime rates. To address housing, the down payment for second-home buyers will be lowered as well as mortgage rates. The securities regulator is expected to provide guidance for funds to enter the market and support mergers. Two tools have been introduced to achieve this: a swap program for access to stock-buying funds, and loans to banks for funding companies' share purchases. The move is timed as such to soften the blows compared to if the fed has not cut yet.

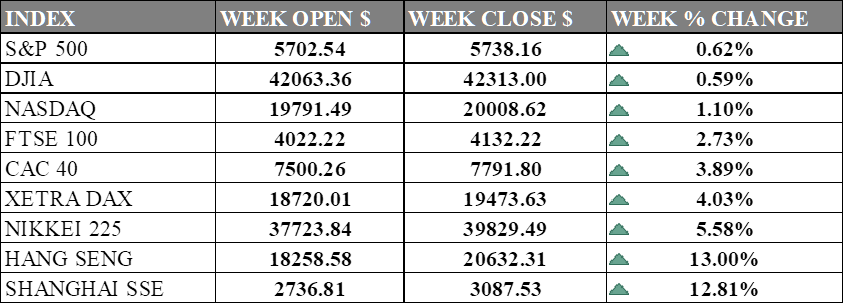

INDICES PERFORMANCE

Wall Street is in euphoria after the rate cut, with all major indices recording gains. The S&P 500 rose 0.62% to close at 5,738.16. The Dow Jones Industrial Average saw an increase of 0.59%, finishing at 42,313.00, while the tech-heavy Nasdaq performed the best among US indices, climbing 1.10% to close at 20,008.62. These market gains suggest continued investor confidence across various sectors, with future rate cut expected in which the projection surpassed the initial analyst consensus.

Across the pond, European markets see more significant gains. The UK's FTSE 100 rose 2.73%, closing at 4,132.22. France's CAC 40 saw a significant 3.89% increase, closing at 7,791.80. Germany's DAX experienced the largest climb among European indices, rising 4.03% to end at 19,473.63. European markets outperformed their US counterparts this week, with PBoC rate cut expected to have wide impact on growth.

Asian markets presented a strongly positive picture, with significant gains across the board. Japan's Nikkei 225 saw a substantial increase, rising 5.58% to 39,829.49. Hong Kong's Hang Seng Index posted an impressive gain of 13.00%, closing at 20,632.31. The Shanghai Composite in mainland China also experienced a significant surge, rising 12.81% to close at 3,087.53. These substantial gains in Asian markets, particularly in China and Hong Kong, contradict previous concerns about China's economy and suggest a more optimistic outlook for the region as investor gain confidence on China’s stimulus.

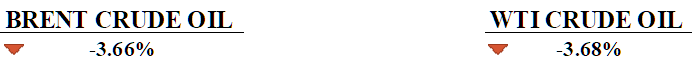

CRUDE OIL PERFORMANCE

The crude oil market undone the progress it made last week, with Brent futures falling to $71 per barrel, driven by strong supply prospects and weakening demand even with Middle East tensions escalating to a new heights. China's economic struggles, including manufacturing contraction and slowing services sector, added downward pressure on oil prices. Reports of Libya potentially restoring 500,000 barrels of crude exports and speculation about Saudi Arabia easing voluntary production cuts further contributed to the price decline. Although Israeli strikes targeting Hezbollah and Houthi forces have intensified, the limited direct involvement of Iran has minimized the impact on oil supply. Traders remain sceptical of Beijing's stimulus measures to boost demand, while the ongoing geopolitical tensions in the Middle East continue to be closely monitored for potential supply disruptions.

OTHER IMPORTANT MACRO DATA AND EVENTS

US consumer spending grew by 0.2% in August, slower than the expected 0.3%, while inflation pressures eased with the PCE price index rising just 0.1%. Household income growth also slowed, and core inflation decelerated to 0.1%, as the Federal Reserve show willingness to further rate cuts amid shifting focus towards supporting labour demand.

China's factory activity likely contracted for the fifth month in September, with a PMI of 49.5, below the growth threshold of 50. Industrial profits dropped 17.8% in August, and the government is pushing for stronger stimulus to meet growth targets.

What Can We Expect from The Market This Week

US Nonfarm Payrolls: This week's Non-Farm Payrolls report will likely drive market expectations for the Fed's November rate cut, whether 25bps or 50bps. The outcome will be key as the dollar hovers near support, and stocks rally on hopes of additional policy easing.

ISM Non-Manufacturing PMI: The Index measures the economic activity in the U.S. services sector, with a reading above 50 indicating expansion and below 50 signalling contraction. In September, the index rose to 51.5, with expectations of 51.6 in October, a modest growth in services after emerging from contraction in July, which had weighed on market sentiment due to concerns over slower economic recovery.

German CPI September: Germany's inflation have officially below 2% target level at 1.9% and upcoming preliminary data expecting 1.7%, although its economy expected to shrink by 0.1% this year . Even with lower inflation, weak consumption and industrial slowdowns are hindering recovery, with only gradual improvement forecasted in the coming years.

UK GDP Q2: Great Britain economic growth for Q2 2024 was revised down from 0.6% to 0.5%, implying slower economic expansion than previously thought. This slowdown, driven by inflation and global challenges, could strengthen the case for the Bank of England to consider continue cutting interest rates.

Fed Chair Powell Speech: A clearer picture of a significant interest-rate cut in November may develop in the coming week, as Jerome Powell addresses economists and the release of new employment data approaches. The Fed Chair is set to discuss the U.S. economic outlook at the National Association for Business Economics conference on Monday.