PAST WEEK'S NEWS (July 07 – July 11)

The Trump administration's decision to reinstate tariffs on Asian nations including Indonesia, Thailand, Malaysia, Japan, and South Korea had nations scrambling to negotiate trade deals to avoid them, such as offering increased U.S. purchases of crops, LNG, and industrial goods. The new tariffs, set to take effect on August 1, would raise average Asian import duties to 27% from 4.8%, putting greater economic strain on allies and disrupting global supply chains reliant on U.S. consumption. Countries like South Korea and Thailand, which had engaged in active negotiations, faced punitive rates (25% and 36%, respectively) in the path of Washington’s plan for unilateral trade balance and stricter enforcement against Chinese transhipment. Analysts warn the policies risk alienating longstanding allies, risking Asian economies to deviate from a stable relationship between the U.S. and China to single dependencies, complicating regional diversification efforts and strengthening conviction for BRICS to succeed.

Trump slapped a 50% tariff on copper imports, set to hit August 1st, along with a 25% sweeping tariff on Asian countries, with the main goal of reviving the U.S. copper industry he claims Biden ruined. Prices soared as traders raced to flood U.S. ports before the deadline, rerouting ships to Hawaii and Puerto Rico to shave days off delivery times. Chile, Canada, and Peru scrambled to dodge the hit, while domestic giants like Freeport-McMoRan cheered after its share rallied. Brazil’s Lula slammed Trump’s move as baseless, citing a $410B U.S. trade surplus over 15 years, and threatened tit-for-tat tariffs under Brazil’s retaliation law. Trump tied the tariffs to a bitter feud with Lula, who roasted him as an “unwanted emperor” after Trump accused Brazil of censoring U.S. social media. With global copper flows thrown into chaos, the possibility of a TACO trade or "nothing ever happens" rhetoric could hurt traders that are pulling off last-minute moves to dodge losses, as Trump’s hardline stance usually blows back in his face.

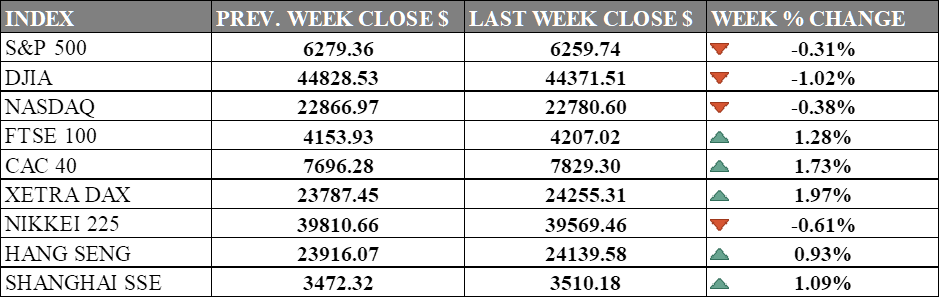

INDICES PERFORMANCE

Wall Street experienced mixed performance last week, with major indices posting modest declines as market sentiment turned cautious. The S&P 500 declined by 0.31%, closing at 6259.74, reflecting broader market uncertainty. The Dow Jones Industrial Average (DJIA) delivered the weakest performance with a notable decline of 1.02%, finishing at 44371.51. The Nasdaq also showed negative movement with a 0.38% decrease, closing at 22780.60, as tech stocks participated in the pullback. The negative trading activity reflected the fear of uncertainty regarding tariff as industrial sector struggle to adjust.

European markets showed resilience during the period, with solid gains across major indices. The UK's FTSE 100 rose by 1.28%, closing at 4207.02. France's CAC 40 posted a strong gain of 1.73%, ending at 7829.30, while Germany's XETRA DAX delivered the strongest performance with a 1.97% increase, closing at 24255.31. European markets are banking on softer tariff blows on its constituent while harder tariff on Asian country could mean a profit in trade rerouting while Germany inflation hit its target at 2%.

Asian markets displayed mixed performance with notable regional variations. Japan's Nikkei 225 posted a decline of 0.61%, closing at 39569.46, reflecting continued profit-taking after recent gains. Hong Kong's Hang Seng Index gained 0.93%, finishing at 24139.58, while mainland China's Shanghai Composite Index showed strength with a 1.09% gain, ending at 3510.18, as domestic economic data provided some support to investor sentiment.

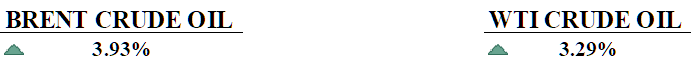

CRUDE OIL PERFORMANCE

Crude oil prices soared in recovery, with Brent climbing to $70.58 (+3.93%) and WTI reaching $68.66 (+3.29%), fuelled by summer demand, record refinery utilization, and geopolitical volatility overshadowing OPEC+ supply hikes and U.S. stockpile builds. The International Energy Agency (IEA) reiterated a structural imbalance, forecasting 2025 supply growth of 2.1 million bpd versus weak demand of 0.7 million bpd , yet near-term tightness from Northern Hemisphere travel season boosted refinery throughput by 3.7 million bpd since May. OPEC+’s August output increase of 548,000 bpd and Russia’s pledge to offset overproduction lead to short-term optimism, while lingering U.S.-Russia sanctions risks and Middle East tensions amplified price swings. Analysts flagged $70/barrel as a pivotal ceiling for WTI, though scepticism lingered over sustainability with conflicting signals emerging: cyclical demand resilience versus long-term oversupply pressures. RBC Capital Markets and the IEA warned that accumulated surpluses in APAC storage coupled with OPEC’s downward revision of 2026–2029 demand forecasts due to China’s economic deceleration could trigger downside pressure post-summer. Bulls bank on seasonal strength while bears bet on structural imbalances, potentially keeping the market stable until August tariff hit.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.K. economy shrank again in May, pressuring Bank of England to cut rates as weak output and political uncertainty drag growth.

U.S. jobless claims fell to a seven-week low, signs of employers holding on to workers even with a cooling labor market, while weak hiring, rising unemployment duration, and tariff uncertainty cloud the outlook and reduce urgency for Fed rate cuts.

What Can We Expect from The Market This Week

US CPI June: Consumer prices were 0.1% higher in May 2025 (seasonally adjusted) after rising 0.2% in April, with the annual inflation rate reaching 2.4% compared to 2.3% in the previous month. The shelter index was the primary driver of the monthly increase, while energy prices declined 1.0% over the month, moderating overall price pressures.

China GDP Q2: China's economy expanded by 1.2% quarter-over-quarter in Q1 2025, slower than the 1.6% growth recorded in Q4 2024 and below market expectations of 1.4%. This marked the smallest quarterly expansion since Q2 2024, with US tariffs rising to 145% on Chinese goods under President Trump's administration.

Philly Fed Manufacturing Index: The Philadelphia Fed Manufacturing Index remained at -4.0 in June 2025, unchanged from May, which suggests ongoing weakness in regional manufacturing activity. The employment index turned sharply negative, falling to -9.8 (its lowest level since May 2020), while new orders were lower and price inflation declined but remained high.

Eurozone CPI June: Eurozone annual inflation rose to 2.4% in December 2024, up from 2.2% in November, with services contributing the largest share (+1.78%) to overall figures. The inflation rate remains above the European Central Bank's 2% target, with significant variation across member states, ranging from Ireland's 1.0% to Romania's 5.5%.

UK Unemployment Rate: Unemployment rate in the kingdom was 4.6% in April, the second uptick since March data. The rise was attributed to moderating wage growth following sharp increases in payroll taxes and a 6.7% rise in the national minimum wage, while employment growth remained modest at 89,000 new jobs.