Industrial Metals

Base or industrial metals refer to the metals used in the manufacturing, construction and technology sectors. The London Metal Exchange (LME) index is composed of aluminum, copper, zinc, lead, tin & nickel as industrial metals.

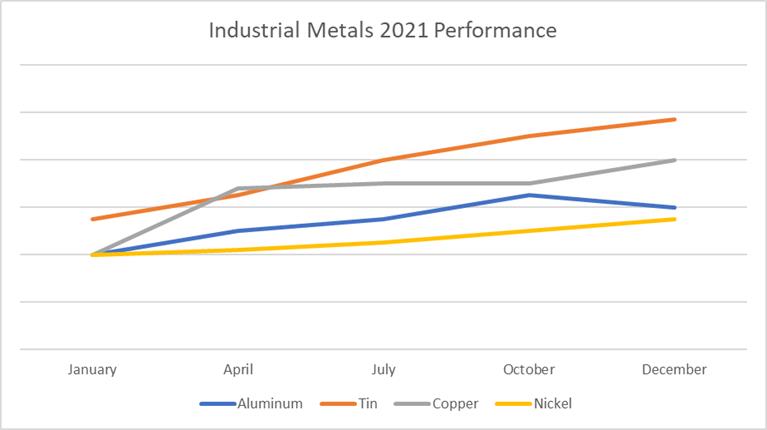

In 2021, industrial metals posted their largest gains, predominantly driven by aluminum and tin. The main reasoning behind the gains would be the tight supply and surging demand for industrial metals, as economies around the world exhibited strong recovery from the COVID-19 pandemic.

· Aluminum: Up 42% in 2021, 5% in 2022 YTD

· Tin: Up over 90% in 2021, 5.63% in 2022 YTD

· Copper: Up 26% in 2021, 2.5% in 2022 YTD

· Nickel: Up 25% in 2021, 7.4% in 2022 YTD

Limited supply is expected to keep industrial metal prices high, especially in the short term, given that the demand remains intact. Yet, with the spread of the Omicron variant of the coronavirus, demand may be volatile as economies tend to be shaken up with rising cases. Despite that, it is expected that demand will moderate and the world may witness a year of normalization in 2022 for industrial metals.

Precious Metals

Rare metals which possess high economic value are called precious metals. The most popular precious metals include gold, silver and platinum. They are deemed ‘precious’ due to several factors; their scarcity, historical purpose & role as a store of value, other than their industrial uses. Precious metals are also highly useful for inflation protection and portfolio diversification for investors & traders for decades, before they were used as the basis for money.

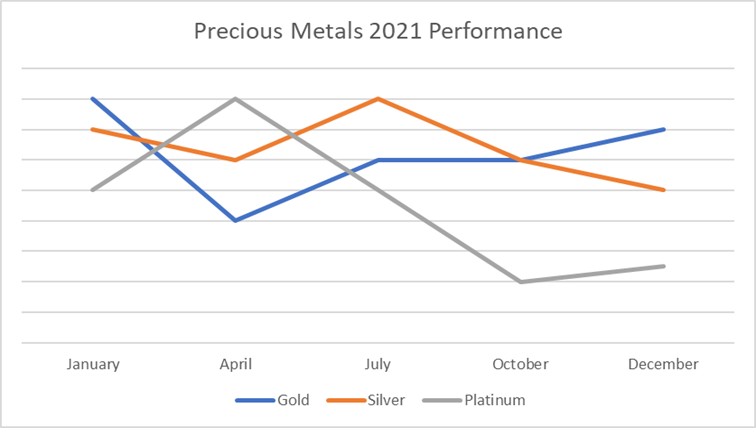

During 2021, the performance of precious metals was underwhelming to say the least. Gold underwent volatile months, fueled by investor & trader reactions to meetings from the U.S. Federal Reserve regarding monetary policy and interest rate hikes. Today, investors remain cautious as the Fed may begin hiking interest rates as early as March, which typically pushes the dollar upwards and the safe haven downwards amid increased investor appetite.

· Gold: Down 3.68% in 2021, up 2.2% in 2022 YTD

· Silver: Down 14% in 2021, up 2.6% in 2022 YTD

· Platinum: Down 10% in 2021, up 0.12% in 2022 YTD

Amid rising inflation and increased macroeconomic uncertainty caused by expectations of faster interest rate hikes, a stronger greenback & inflationary pressures can be foreseen. Hand-in-hand with diminishing worries of the potential impact of the Omicron COVID-19 variant, gold is expected to trade even lower in 2022.

Increased consumer confidence will likely exert more downward pressure on gold for 2022. However, silver may move inversely to gold as it’s used in the production of an array of goods across multiple industries, amid recovering economies. In the technology sector, this includes batteries, LED lighting, and touch screens, used in the growing electric vehicle industry.

2022 just come along, bearing the responsibility of bouncing back from a spiteful 2021 caused by COVID-19 and the Delta variant. Will Omicron cause history to repeat itself?