What is Silver?

Silver is a chemical element with the symbol Ag, derived from the Latin word "argentum." It is a soft, white, and radiant metal, valued for its high electrical and thermal conductivity. Its antimicrobial and non-toxic properties explain why silver was historically used for storing fresh food and liquids. Its price currently fluctuates around $ 30 per ounce.

When you think of precious metals like gold or silver, jewelry is likely the first use that comes to mind. However, silver has a much broader range of applications beyond necklaces and rings. In fact, silver has far more diverse uses than gold. It is extensively used in electronics, solar panels, or smartphones. As the economy grows and strengthens, so does the demand for silver, particularly in industrial applications, even as demand for jewelry and silverware declines.

Uses for Silver

To fully understand the demand for silver, it’s important to explore its many applications. According to the Silver Institute, global silver demand reached a record 31.5 thousand tons (1.112 billion ounces) in 2022.

Silver's demand is spread across various sectors, with electronics and electrical appliances leading the way, accounting for 49.0% of global consumption. This is followed by investment, where silver bars and coins represent 25.3% of demand. Jewelry is not far behind, making up 18.3% of total silver usage. Meanwhile, silverware contributes 4.8%, though this sector has seen a decline in recent years. Other uses include silverware with 4.8% in terms of global demand and photography (2.6%) which used to consume far greater share of silver.

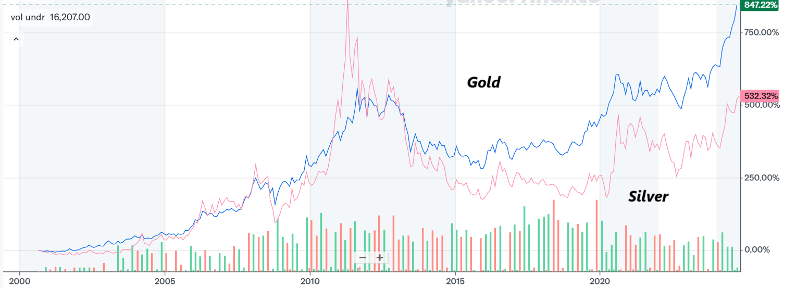

Graph: Price of gold (blue line) compared to price of silver (red line)

Source: Yahoo Finance

Greater Volatility Than Gold

Though gold is often seen as a more stable investment over the long term, silver presents its own opportunities. Like gold, silver can provide a hedge against inflation, as its price tends to rise when interest rates fall behind the rising cost of living.

Silver's price also tends to be more volatile than gold. On average, a 1% change in gold's volatility can lead to up to a 3% change in silver. This means that potential gains (or losses) are far more pronounced than with gold.

Additionally, silver's dual role as both an industrial metal and an investment asset makes it highly sensitive to macroeconomic conditions. High interest rates and a weak economic outlook generally lower the price of silver. In contrast, falling interest rates and positive economic sentiment, both of which we currently experience often boost its value.

How to Invest in Silver

There are several ways to invest in silver, depending on your financial goals and risk tolerance:

Physical Silver: You can purchase silver bullion or coins. However, this approach can be inefficient due to high transaction costs, and selling physical silver is more complicated than selling silver through a broker.

Silver ETFs (Exchange-Traded Funds): These track the price of silver and provide exposure without the need to own the physical metal. ETFs offer a more liquid and cost-effective way to invest in silver.

Silver Mining Stocks: Investing in shares of silver mining companies is another option. This can be done through individual stocks or ETFs that focus on the silver mining sector.

CFDs (Contracts for Difference): For seasoned investors willing to take on higher risk, CFDs offer a way to trade silver with leverage. While this can lead to greater gains, it also increases the potential for significant losses. CFDs are complex financial instruments and should be approached with caution.

By understanding these different methods, you can choose the approach that best aligns with your investment strategy and risk tolerance.