INTRADAY TECHNICAL ANALYSIS September 20th (observation as of 08:00 UTC)

[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.06986

- Support line of 1.06737

Commentary/ Reason:

1. The price dropped strongly late last week after ECB signalled the end of its rate hike, pushing expectations that there are no room left for fiscal policy manipulation to strengthen its currency.

2. Although the ECB action weaken Euro, the USD is about to have the same fate which most market participants voted on which saw euro recovering from its huge drop last week.

3. Major central bank meeting this week will saw prices move in a volatile fashion as more investor either staying cautious or sitting on the sidelines with fed decision on Wednesday while BoJ, SNB, and BoE on Thursday.

4. The price is expected to rebound after establishing double bottom and being at the trough of the price channel while a big movement are expected to the downside if the fed raise rate which are not the main consensus but technically possible.

5. Technical indicators are confident with buy signals as the price engulf on the upside although more sensitive stochrsi are turning overbought while moving averages are flashing buy signals.

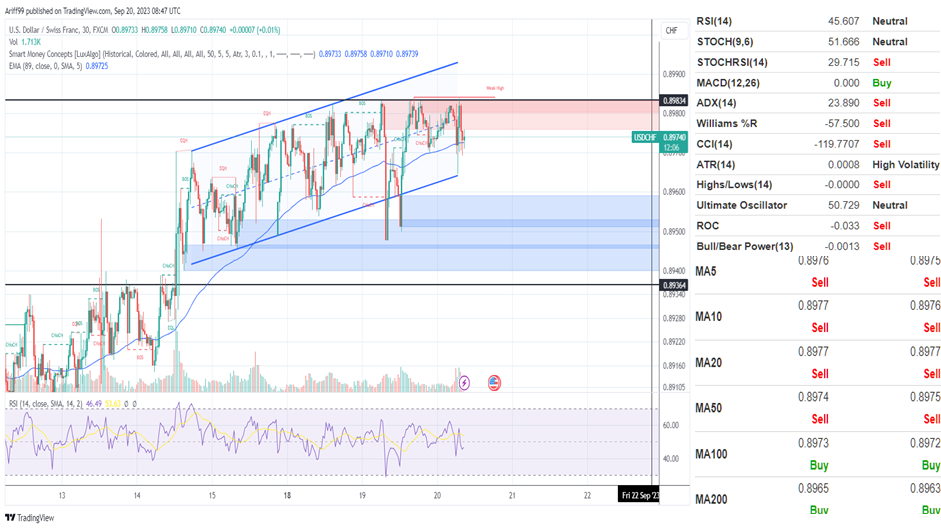

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.89834

- Support line of 0.89700

Commentary/ Reason:

1. The pair have been moving in a volatile fashion although in a very limited price range as the volatility are coming mostly from the USD while CHF staying relatively stable .

2. Although the SNB is expected to raise rate Thursday, the market are staying put as the federal reserve interest rate decision come first.

3. Major central bank meeting this week will saw prices move in a volatile fashion as more investor either staying cautious or sitting on the sidelines with fed decision on Wednesday while BoJ, SNB, and BoE on Thursday.

4. The price is expected to be limited to the resistance level 0.89834 and consolidate until federal reserve rate decision is released.

5. Technical indicators are mixed but sell are more prominent while moving averages sees sell in the shorter term and buy on the longer term.

[USDJPY]

Important Levels to Watch for:

- Resistance line of 148.166

- Support line of 147.948

Commentary/ Reason:

1. The Japanese yen has been weakening from government intervention while the USD continue to strengthen that may saw it hits 150 soon which will invoke more intervention but into easing bond buying to strengthen its currency instead of its economy.

2. The yen are exposed to the risk of moving away from ultra-loose policy but suggestion from policymakers are that it is not likely in Thursday meeting although China stabilizing market may provide some sigh of relief.

3. Major central bank meeting this week will saw prices move in a volatile fashion as more investor either staying cautious or sitting on the sidelines with fed decision on Wednesday while BoJ, SNB, and BoE on Thursday.

4. The price is expected to fall back to resistance-become-support at 147.948 before any hope of continuing upward but the market can expect it falling through if the fed pauses its rate.

5. Technical indicators are mostly pushing buying signals as well as moving averages as prices jumps for the last few hours but it is unlikely sustainable.

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.23704

- Support line of 1.23081

Commentary/ Reason:

1. The pair have been depreciating since early September as the situation in UK aren’t improving while the BoE is expecting to pause its historical continuous rate hike as inflation is cooling even though its higher than the average inflation.

2. Surprise falling inflation in UK CPI data triggered a selloffs on renewed expectation of rate pause that saw price falling below major support level and now seeking to test another major support.

3. Major central bank meeting this week will saw prices move in a volatile fashion as more investor either staying cautious or sitting on the sidelines with fed decision on Wednesday while BoJ, SNB, and BoE on Thursday.

4. The price is expected to continue downward to a multi-months lows before it have any chance of rebounding on federal reserve interest rate decisions although it is unlikely that it will be sustainable as expected BoE pause will plunge the price lower on Thursday.

5. Technical indicator is mixed but leaning more toward sell while most moving average are pointing toward sell after price broke below important support level