INTRADAY TECHNICAL ANALYSIS October 17th (observation as of 08:00 UTC)

[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.05586

- Support line of 1.05351

Commentary/ Reason:

1. The price dropped strongly late last week after the US reported higher inflation, increasing expectation that the federal reserve should hike rate.

2. Although the price have now looking at recovery as expectation for a rate pause in November meeting are in the majority.

3. Fed chair Powell are expected to give a speech that may contain clues to future fiscal policy while China GDP and Industrial production are expected to move the Asian market significantly.

4. The price is expected to rebound higher as weakness in USD in the short term as there will be days before the important speech by fed chair as the price made a higher highs and lows, higher than last week short rebound after data-bound drop.

5. Technical indicators are mixed with most are at neutral while shorter term moving averages are pointing toward buy signals.

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.90211

- Support line of 0.89842

Commentary/ Reason:

1. The pair have been steadily dropping but spiked upward late last week due to inflation data that affect expectations of higher rate, but the price have pulled back to lows previously established before the data is released.

2. The franc also saw ongoing backing due to increased interest from investors assessing the potential for increased geopolitical tensions in the Middle East as some investor sees the franc as a more stable currency than the greenback.

3. Fed chair Powell are expected to give a speech on Thursday that may contain clues to future fiscal policy while China GDP and Industrial production are expected to move the Asian market significantly.

4. The price has already hit a resistance level and expected to further decrease to a pivotal point where it could either break below on USD weakness or rebound higher if US retail sales came in higher.

5. Technical indicators are more certain to buying signals while moving averages suggest more sell signals which suggest that the price will be at a uncertain point in the near future.

[USDJPY]

Important Levels to Watch for:

- Resistance line of 149.704

- Support line of 149.314

Commentary/ Reason:

1. The Japanese yen has been weakening that saw price reaching over 150 before price plunge in free fall in expectation of government intervention as it is a sensitive level but has since move in a volatile fashion, nearing the 150 level once again.

2. The yen are exposed to the risk China economic growth which do affect all Asian market, but more to Japanese market as it is on a risky position with treasury yields fell briefly last week.

3. Fed chair Powell are expected to give a speech on Thursday that may contain clues to future fiscal policy while China GDP and Industrial production are expected to move the Asian market significantly.

4. The price is expected to move in consolidation to form a triangle pattern that will break below and test support level or shoots up and reach 150 level before an intervention is expected once more, but it is unlikely as USD is expected to weaken.

5. Technical indicators are mostly mixed as well as moving averages as half of indicators signals sell while the other signal buy and neutral. Longer term moving averages, however, are pushing buying signals.

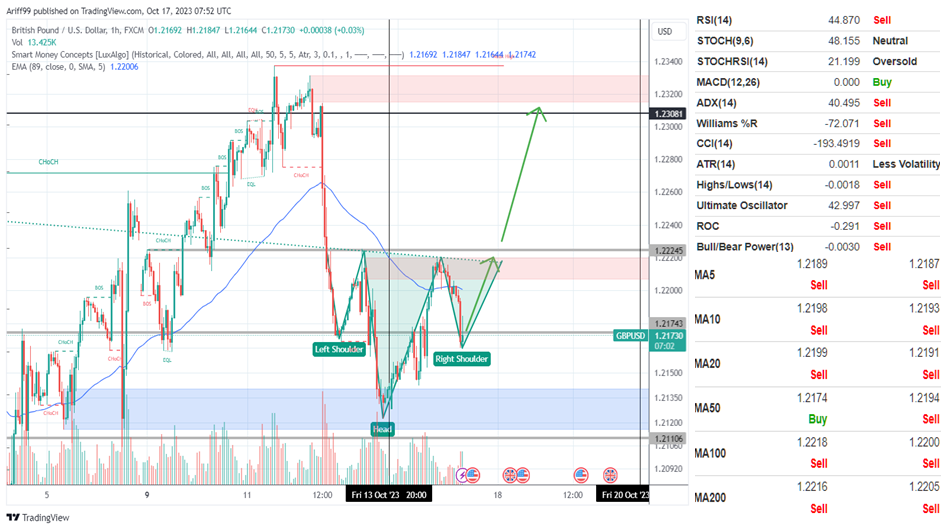

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.23081

- Support line of 1.21743

Commentary/ Reason:

1. The pair have been moving steadily upward for the last week as the greenback weakening but fell by a lot in a short term on the consumer inflation data by the US that push expectations that the fed will hike rate, but recovery from the fall have not been quick.

2. Data indicated that regular pay growth in the UK moderated slightly to 7.8% in the three months up to August, although the market has already agreed that BoE have no room to hike without risking collapse.

3. Fed chair Powell are expected to give a speech on Thursday that may contain clues to future fiscal policy while China GDP and Industrial production are expected to move the Asian market significantly.

4. The price is expected to complete its head and shoulder pattern and possibly reaching to resistance level at 1.23 but if the price continue lower, the price may establish a double bottom instead before continuing although unlikely as USD is weakening.

5. Technical indicator is pointing toward sell more than buy or neutral as do moving averages with only MA50 sending buy signals as price rebounded briefly on Monday.