INTRADAY TECHNICAL ANALYSIS October 24th (observation as of 08:00 UTC)

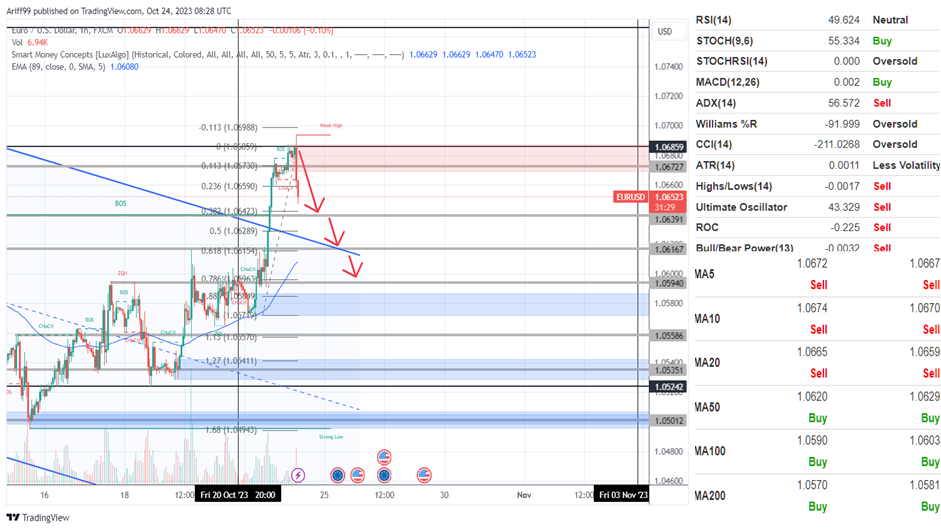

[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.06859

- Support line of 1.06391

Commentary/ Reason:

1. The price shot up, breaking through price channel indicating strong momentum on the upside but currently enter a profit taking area where price is expected to pullback, but a slight pullback may signal for more upside movement.

2. There is apparent weakness in the greenback that saw ECB gaining strength ahead of its interest rate decision this week as treasury yield pulled back especially its 10-year term, gaining after its yield briefly touched 5%.

3. Preliminary purchasing managers data are due from Europe and the U.S. on Tuesday and will provide direction for both currencies besides numerous giant corporation earnings in the U.S.

4. The price is expected to continue declining before having any chance to rebound as it broke through price channel but a rebound is expected either at Fibonacci level 38.2%, 61.8% or even lower at 78.6% which coincides with support levels while also decrease upside momentum as it goes lower.

5. Technical indicators are mixed with most are at sell while shorter term moving averages are pointing toward buy signals for longer term and sell for shorter term.

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.89547

- Support line of 0.88761

Commentary/ Reason:

1. The pair have been steadily dropping while having short rebound as the price of USD weakening while swiss franc are steady sailing amid turmoil in the U.S. bond market.

2. Switzerland's central bank is significantly reducing its reserves, primarily held in dollars and euros, which is exerting strong influence on EUR/USD movements, with sight deposit drops and intervention actions serving to contain volatility and anchor the currency pair within a narrow range, despite potential future fluctuations.

3. Slurry of macroeconomic data is coming from the U.S. namely Building Permits, new home sales, and a speech from fed chair Powell on Wednesday followed by economic growth data and PCE price index that are significant to Fed’s future fiscal policy.

4. The price steadily decline, rebound by around 50% before continuing downward with target price of 127% already reached and a bullish engulfing candle formed although it may be short fluctuation with overall direction still pointing downward.

5. Technical indicators are more certain to buying signals while moving averages suggest more sell signals to its longer term movement which suggest that the price will be having a short rebound before continuing downward.

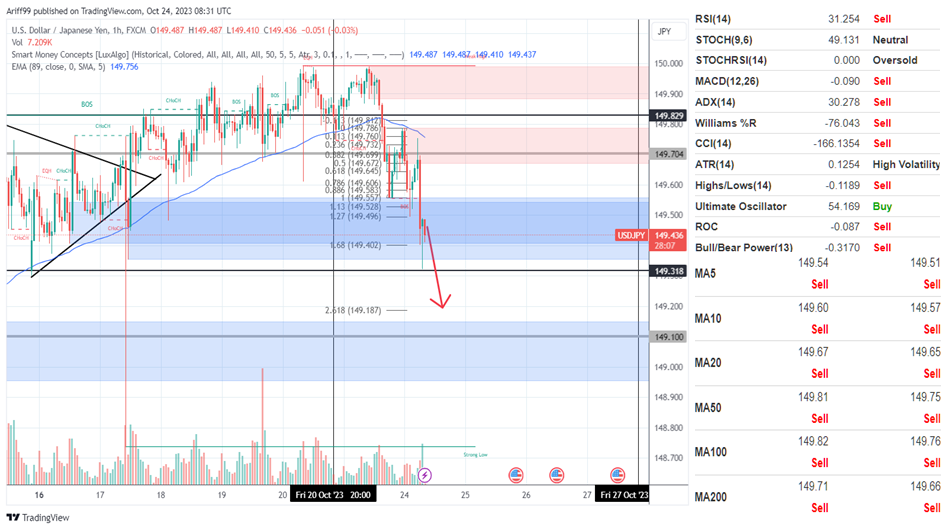

[USDJPY]

Important Levels to Watch for:

- Resistance line of 149.704

- Support line of 149.318

Commentary/ Reason:

1. The Japanese yen has been weakening that saw price nearing 150 before price pulled back in expectation of government intervention as it is a sensitive level with price breaking out of consolidation in a violent fashion before recovering that saw price dropped 1650 pts in a single hour candle.

2. Although weakening USD gave the yen some breathing space, Japan might intervene to strengthen the yen soon, but there aren't many significant events this week, except for potential news from Japan or US GDP data.

3. Slurry of macroeconomic data is coming from the U.S. namely Building Permits, new home sales, and a speech from fed chair Powell on Wednesday followed by economic growth data and PCE price index that are significant to Fed’s future fiscal policy.

4. The price is expected to continue pushing down to 261.8% although it is more likely for the price to rebound after hitting 168% before continuing down if USD continue to weaken.

5. Technical indicators are in majority pointing toward sell as well as moving averages as prices decline since the start of the week.

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.23081

- Support line of 1.22202

Commentary/ Reason:

1. The pair have been moving in a volatile wide range sideway before breaking above resistance level that confirm its medium-term trend as prices established a higher lows although price is still far from a higher high.

2. The pound reached 2 weeks high as investor sold the dollar and UK unemployment increased to 4.2%. The Bank of England is likely to hold interest rate with Governor Andrew Bailey said inflation figures were close to what they expected, and Moody's improved Britain's outlook to "stable" from "negative".

3. Slurry of macroeconomic data is coming from the U.S. namely Building Permits, new home sales, and a speech from fed chair Powell on Wednesday followed by economic growth data and PCE price index that are significant to Fed’s future fiscal policy.

4. The price is expected to rebound at 23.6% before continuing its upward momentum which appears to still be strong as initial breakage of resistance is supported by a double bottom.

5. Technical indicator is pointing toward buy more than sell or neutral as do moving averages with shorter term MA sending sell signals as price pullback on profit taking activity.