INTRADAY TECHNICAL ANALYSIS NOVEMBER 08th (observation as of 08:00 UTC)

[EURUSD]

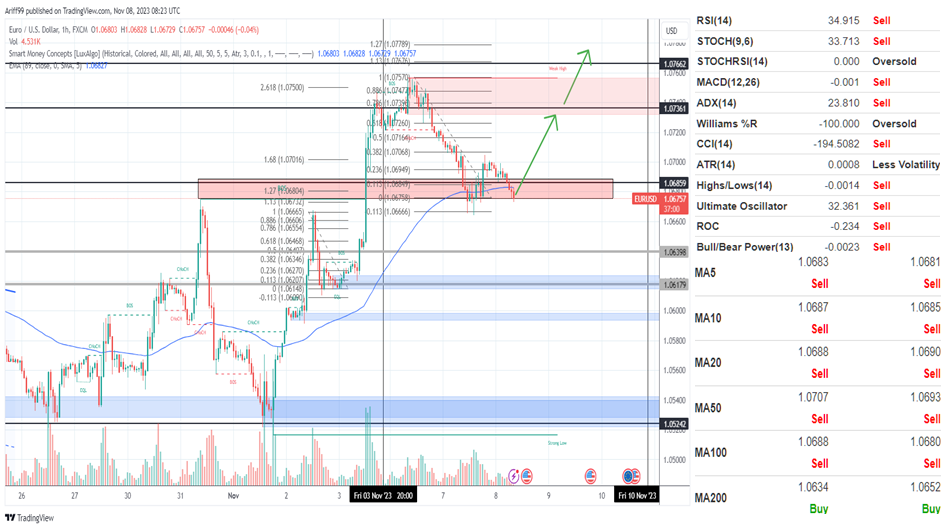

Important Levels to Watch for:

- Resistance line of 1.06859

- Support line of 1.06666

Commentary/ Reason:

1. The price have been in a strong pullback that seen price pulling back to about 61.8% of its previous strong rally as USD weakened at the end of last week and it now saw a slight increase before losing momentum.

2. There is apparent weakness in the greenback that saw falling treasury yields after the fed paused in its last meeting prompting lower expectations of rate hike and cuts by March next year.

3. Fed chair powell speech are in sight on Wednesday while german inflationary data will probably sway the market even though it would probably not affect the ECB interest rate path as it would not be without risk to economic growth.

4. The price is expected to rebound at its previously established support level that saw a short-lived rally that stems from bullish engulfing that may be early indication to a reversal but a break below may invalidate it.

5. Technical indicators are determined with selling signals while moving averages agrees with majority although longest term averages are still at buy.

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.90433

- Support line of 0.90107

Commentary/ Reason:

1. The pair have dropped in a single hour by a lot late last week, showing weakness in the greenback, establishing a possible ABCD pattern that results in a reversal which are the price have been observed to steadily rising upward.

2. The Swiss National Bank's substantial foreign exchange sales have helped boost the franc's strength and mitigate the impact of import inflation due to rising energy prices.

3. Although there is no substantial economic events from the swiss, fed chair powell speech is in sight other than german inflation data, UK economic growth, and US unemployment claims.

4. The price is expected to steadily rally to resistance level that coincide with 168% target level from previous pullback levels although price channel is not fully established yet.

5. Technical indicators are certain to buying signals as well as moving averages.

[USDJPY]

Important Levels to Watch for:

- Resistance line of 150.779

- Support line of 150.574

Commentary/ Reason:

1. The Japanese yen have been weakening from multiple bond buying activities that saw price going as far as 151.72, far above intervention level that the BoJ say they are monitoring which question whether they still have any cards left to control their currency valuation.

2. The weakness came as stronger dollar and higher Treasury yields prompt investors to assess Federal Reserve monetary policy, with the recent Bank of Japan's measures to address long-term interest rate gaps having failed to alleviate selling pressure on the yen.

3. Although there is no substantial economic events from Japan, fed chair Powell speech is in sight other than German inflation data, UK economic growth, and US unemployment claims.

4. The price is expected to continue rising as there is less expectation that the BoJ can interfere strengthening USD as fed officials say the door is open to more interest rate hike while a break in immediate resistance will cement its continuation.

5. Technical indicators are in majority pointing toward buy as well as moving averages as prices rally since the start of the week.

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.22891

- Support line of 1.22202

Commentary/ Reason:

1. The pair have jumped late last week and continue on Monday before price finally reverse as USD recovered its strength and profit taking activity is taking place.

2. Sterling weakened on potential policy moves by the Fed and the Bank of England, with recent dovish Fed expectations and sterling gains post-payrolls last Friday unwinding, and the focus shifting to upcoming U.S. and UK CPI data to determine the extent of recent inflation changes and the potential for central bank rate cuts.

3. There is a slurry of economic data coming from UK on Friday such as GDP Q3, Industrial & Manufacturing Production, and UK Trade balance while the US are eyeing fed chair powell speech and unemployment claims.

4. The price is expected to continue its bearish streak since the start of the week on the greenback strengthening and sterling holding its expectation ahead of economic growth data.

5. Technical indicator is pointing toward sell as well as most moving average except the longer term.