The financial crisis of 2008 showed that investors choose gold to provide them with financial cover during uncertain times. So far, it seems that gold continues to grow even during coronavirus crisis. Within last year, gold price increased in more than one third. Golden Brokers has observed other precious metals to confirm that these metals also serve as safe havens during times when huge amount of investment is being pumped into economies and national currencies might be undervalued in the future.

We have found out that in terms of performance more experienced investors benefit from diversifying their portfolios with more precious metals.

Gold

Even though the beginning of the year pushed gold prices down due to low demand on China’s markets, where coronavirus pandemic began, the metal managed to break the level of 1700 USD per ounce, and is currently growing even higher. In addition, gold could soon reach the value of 1800 USD per ounce. Performance of the instrument grew in 36% only during last year, and even higher growth is expected. Some predict that gold could reach 3000 USD per ounce till the end of 2020. Considering the current situation on capital markets, global economic slowdown, and escalating U.S.-China trade tensions, there’s chances that gold price could grow even faster than expected in the beginning of January. However, purchasing ETF currently seems more profitable. Purchasing physical gold from intermediaries has also became popular due to supply disruptions caused by the pandemic, and prices of gold bricks became more expensive, similarly to purchase of face masks after the coronavirus pandemic outbreak. When an ounce of gold was traded around 1735 USD on 17th May 2020, purchase of one physical ounce of gold was roughly 1735 EUR, what represents roughly 1895 USD per ounce, depending on a producer and an intermediary. We can see similar progress with physical gold coins and silver.

Silver

Silver represents the second most popular precious metal, which is perceived as a cheaper alternative to gold. During last year, its value grew in 18% to 17 USD per ounce, even despite March drop when prices were around 11 USD per ounce. About a year ago, silver was significantly undervalued against gold based on Gold to Silver ratio – 1 ounce of gold was worth 85 ounces of silver. Fall in silver price compared to its value is currently ever deeper – 100 ounces. For a comparison, 50 ounces of gold were equal to 1 ounce of gold in the past. Moreover, silver is one of the best metals with thermal conductivity, and is used in many sectors, such as healthcare, industry, or furniture industry, where it’s used in mirrors. And its supplies keep dropping. It is probable, that larger investors‘ profits from silver are yet to come.

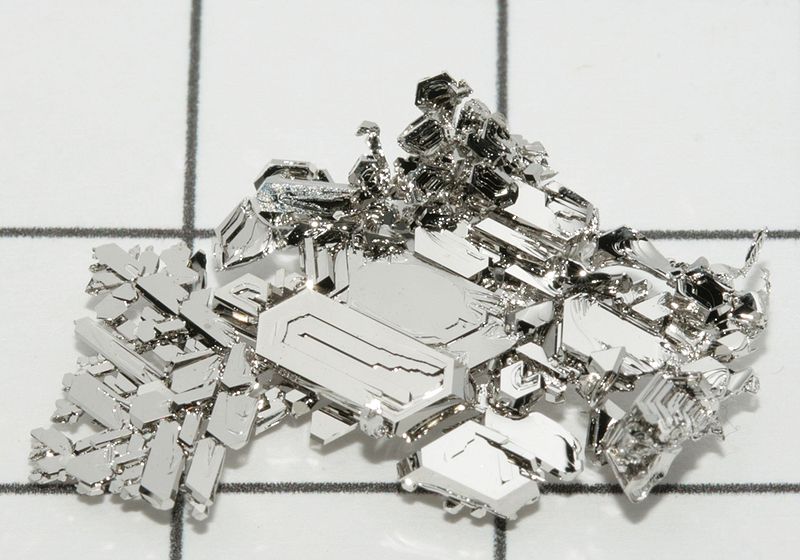

Palladium

Palladium price dropped in 52% in terms of its annual performance. While the metal was traded around 1300 USD per ounce last year, on 17th May 2020 the value was roughly 2000 USD per ounce. On Monday trading, palladium price was even 2025 USD per ounce. Nevertheless, neither palladium price remained resistant against coronavirus pandemic impact. The metal was traded slightly under 2860 USD per ounce in the end of February. Price growth before the coronavirus pandemic outbreak was supported by rapidly growing demand, which exceeded offer of the metal. Palladium is used to control the degree of pollution in catalytic converters of petrol car engines, due to replacing them with diesel engines. This factor could affect palladium price growth during global economy restart once anti-pandemic restrictions are eased.

Platinum

Even though last year was quite favorable for evaluation of precious metals, platinum was the least successful. During a year, the metal added only 3.6%, when its value rose from 800 USD per ounce in the end of May 2019 to its current value of 830 USD per ounce. Platinum price was above 1000 USD in January 2020, yet it slumped due to impact of coronavirus pandemic. Gold to Platinum Ratio index shows that platinum appears in the most undervalued levels against gold. It means that 1 ounce of gold was worth roughly 0,9 ounces of platinum in 2008, yet currently the value of the yellow metal equals to 2,3 ounces of platinum. A more significant growth of platinum price may come.

Rhodium

Rhodium may serve as an interesting alternative to diversify portfolios of more experienced investors. Rhodium, one of the most precious metals, is similarly to palladium used in automotive sector, but also in other industries. During the last crisis, rhodium surpassed the level of 10,000 USD and even grew to 13,800 USD per ounce in the first quarter of 2020. The coronavirus pandemic has not only stopped economic activities, but also decreased demand for metals. In past two months, the pandemic pushed rhodium price even deeper. In the beginning of this week, MetalsDaily reported that rhodium was traded around 7,724 EUR per ounce (roughly 8,700 USD per ounce), but as many countries ease their anti-pandemic measures, the price could grow. In terms of performance, rhodium was worth 3,000 USD in the end of May 2019, which represents 190% evaluation. Traders, who decided to invest in these assets will not appear in loss. Despite the price growth, it’s important to bear in mind that rhodium price is significantly volatile and investing in this metal is very risky.

Every investor must consider which instrument to invest in. However, it seems that in case of purchase of precious metals, buyers were rather successful with investing into the above mentioned metals during last year.