PAST WEEK'S NEWS (June 6– June 12, 2022)

Stocks Performance

Equity markets gave up some of the gains of the past couple of weeks, as the economic data supported further tightening by central banks. U.S. monthly inflation on Friday overshadowed some of the other releases, pushing up interest rate expectations and weighing on equity markets. The major indices pushed higher on Monday and Tuesday, before went downhill for the rest of the week.

The U.S. CPI increased 8.6% YoY in May, eclipsing the 8.5% level reached in March and marked its largest increase since December 1981, sparked concerns about the Fed pursuing more aggressive policy actions to get inflation under control.

Those concerns also showed up in the Treasury market. The week’s decline in prices of government bonds accelerated, sending the yield of the 10-year U.S. Treasury bond higher, to 3.16%. That was up from a yield of 2.74% just two weeks earlier, and it marks the second time this year that the yield has exceeded 3.00%, with the first occurring in early May.

Losses in the tech-heavy Nasdaq Composite were worse than in the broad market as higher interest rates reduced the appeal of companies that may not generate meaningful earnings until well into the future. Value stocks held up better than growth stocks.

An index that measures investors’ expectations of short-term U.S. stock market volatility surged in the wake of Friday’s report on inflation. The Cboe Volatility Index—also known as the VIX—jumped 6% in afternoon trading, reversing course after declining the two previous weeks.

The best-performing sector of the week was energy, having been insulated on account of the rise in energy prices. The next best-performing sector was consumer staples. Meanwhile the hardest-hit sectors this week were financials, information technology, real estate, consumer discretionary, and materials.

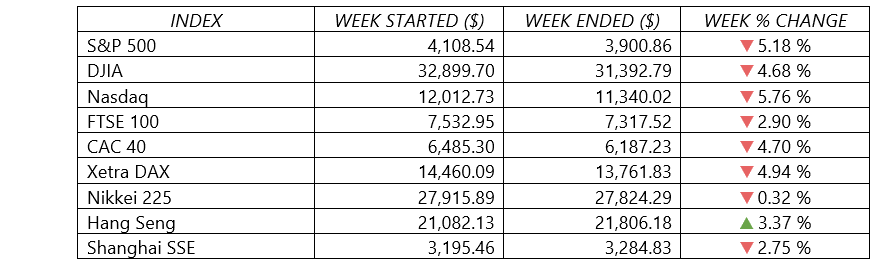

Indices Performance

The major U.S. stock indexes fell hard, with the S&P 500 and the NASDAQ posting the ninth negative weekly result out of the past ten.

A European stock index also fell sharply, dropping more than 2%, after the ECB suggested it would boost its benchmark interest rate from minus 0.5% to 0.0% or higher after July.

Stocks in China rallied amid hopes for looser monetary policy and signs that Beijing was easing its years long crackdown on the technology sector.

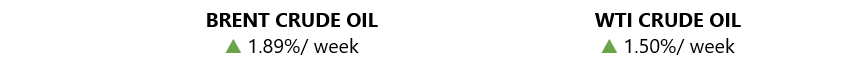

Crude Oil Performance

Oil prices climbed for most of the week before falling on Friday, finishing the week modestly higher.

Other Important Macro Data and Events

U.S. Treasury yields increased, with yields on short- and intermediate-term maturities climbing sharply after the CPI release. Hawkish policy signals from the ECB and soft demand for the Treasury Department’s sale of new 10-year notes helped drive U.S. government debt yields higher. The 10-year Treasury yield rose 22 basis points to 3.16% from 2.94%.

Core eurozone government bond yields jumped, mostly in response to the ECB policy meeting, which markets perceived as more hawkish. Over the week, the German 10-year bund yield rose 24 basis points to 1.51% from 1.27%. The UK 10-year gilt yield ended the week 30 basis points higher, up from 2.15% to 2.45%.

The ECB signalled that it plans to start raising its key deposit rate by 25 basis points at the July meeting and that it will follow suit with more rate hikes in September and beyond. It also announced the end of its net asset purchase program on July 1 and raised its 2022 annual inflation forecast to 6.8% from 5.1% and its 2023 annual inflation forecast to 3.5% from 2.1%.

Amid high inflation, a monthly gauge of U.S. consumer sentiment fell to the lowest level ever recorded by the survey, which dates to the 1970s. The University of Michigan on Friday said its sentiment gauge fell to a preliminary June reading of 50.2 from May’s already-depressed level of 58.4.

And in a sign that the labor market may be loosening, weekly initial jobless claims increased and hit their highest level since January. However, the acceleration in headline inflation is keeping pressure on the Fed to raise rates aggressively and leading to anticipation of more hikes of 50 basis points each into the second half of the year. The next Fed policy meeting is June 14‒15.

The Reserve Bank of Australia and the Reserve Bank of India both raised their key policy rates more than expected.

Japan’s government and central bank expressed concern on Friday about a recent sharp decline in the yen, which fell to the lowest level in two decades versus the U.S. dollar. The rare joint statement came as Japanese policymakers continued to embrace accommodative monetary policies amid pressure to potentially intervene to support their weakened currency.

Several Shanghai districts meanwhile were back in lockdown for COVID testing and entertainment venues in a Beijing district were closed amid COVID concerns.

What Can We Expect from the Market this Week

Overall investor sentiment continues to be quite weak and may remain so until there is greater clarity on the path of inflation and central bank posture. Headlining the action, this week’s policy statement and rate decision by the Fed will help set the stage for whether the market is overly aggressive in its expectations.

Another important economic data being released this week include reports on producer prices, retail sales, Fed funds target interest rate and producer price data.

Cisco, New York Times, and Splunk hold big investor events this week, while the Kroger earnings report has the potential to either rattle or soothe the jittery retail sector. In the crypto world, Ethereum could make some news as it continues to work to shift from the energy-intensive proof-of-work method for securing the network to a proof-of-stake model with lower transactions costs. If cryptocurrencies are lined up to make a comeback, the ETH shift could be the catalyst.