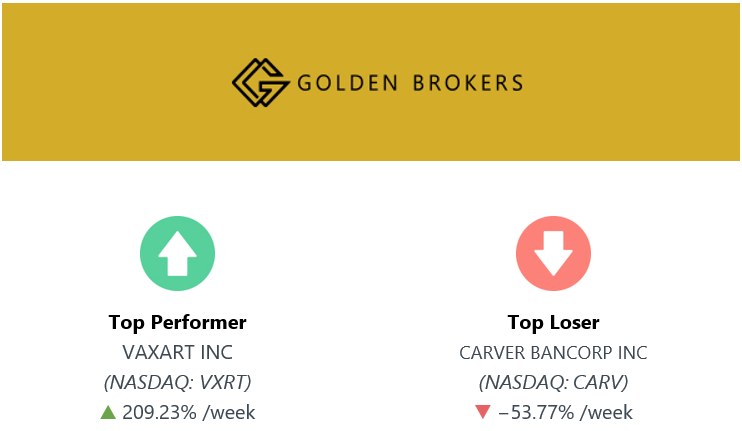

Stocks Performance (U.S. Stocks)

Equities began the week with two days of gains, with sentiment lifted by talk in the U.S. of potential additional fiscal stimulus. However, optimism faded after new COVID-19 cases spiked to record levels in some states. The mood continued to sour after the IMF downgraded its forecast, saying the global recession will be deeper, and the recovery slower, than it had anticipated just two months ago. Furthermore, trade tensions resurfaced between the US and both Canada and the European Union.

Weakness was widespread in the S&P 500. Technology and consumer discretionary fell the least. These two sectors are dominated by Apple Inc. and Microsoft Corp., and Amazon.com Inc., respectively. New all-time highs for each of these names pushed Nasdaq into record territory. Alphabet Inc. (Google) is the only one that did not touch a new high this week.

By sectors, the most outperformed weekly stocks were led by Non-Energy Minerals at 1.40%, followed by Consumer Non-Durables at 0.73%, Retail Trade at -0.95%, and Electronic Technology (-1.32%). Meanwhile, the weakest sectors were from the Industrial Services sector (-4.98%), Energy Minerals (-4.90%), Consumer Services (-4.36%) and Finance sector (-4.14%).

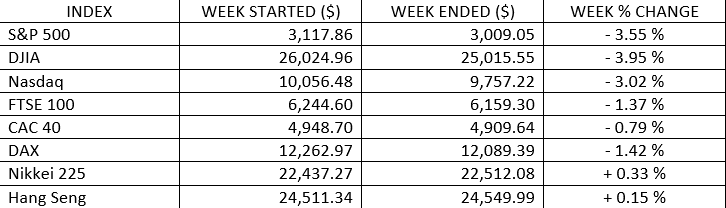

Indices Performance

Stocks continued to seesaw in June, with one week's gains being reversed the following week. Technology-heavy Nasdaq Composite Index fared best relative to other U.S. benchmarks, which mostly suffer losses. The declines pushed the S&P 500 Index back into correction territory.

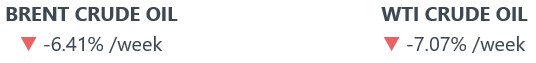

Oil Sector Performance

Oil prices fell for a second straight session. Despite efforts by OPEC and their allies including Russia to reduce supplies, crude inventories in the U.S., the world’s largest oil producer and consumer, have hit all-time highs.

Market-Moving News

Alarming Numbers

A surge in new coronavirus cases in the U.S. and other countries complicated plans to reopen the global economy, weighing on stock prices. In the U.S., some states had reinstated restrictions that previously lifted as the number of infections per day surged to an all-time high.

Global Slowdown

IMF expects the global economy will shrink 4.9% this year - a deeper decline than the 3.0% contraction predicted in April. The fund noted that social distancing and workplace safety precautions continue to weigh on economic activity, even as many businesses begin to reopen.

Oil Reversal

A recent run-up that had sent crude oil prices to around $40 per barrel stalled, resulting in just the second weekly decline since April. Rising crude oil inventories weighed on prices, as did growth in the number of coronavirus cases in many U.S. states. Oil finished Friday at around $38 per barrel.

Spending Spree

U.S. consumer spending jumped more than 8% in May, and followed a record decline of nearly 13% in April. Spending also dropped sharply in March, so there’s more ground to be made up before spending returns to pre-COVID-19 levels.

Reversing Course

U.S. stock indexes retreated around 3% - around the same amounts that they’d advanced in the previous week. The biggest drop came on Friday.

Buyback Boom

Share buyback activity increased for the third quarter in a row. Companies in the S&P 500 Index spent nearly $199 billion to repurchase shares in this year’s first quarter - fourth largest figure on record and a 9% increase over the previous quarter.

Yield Pullback

Prices of government bonds rallied, sending the yield of the 10-year U.S. Treasury bond to around 0.64%, lowest level in about a month and a half.

Other Important Macro Data & Events

Global stock markets retreated, gold prices climbed, and bond yields fell after accelerating COVID-19 cases in Japan, Germany, Australia and the United States caused investors to worry that the pace of business reopening might slowed down.

To date, the market has rebounded 35% from the March 23 low and is within 11% of the February 19 high. Yet along with this overall upward trend there have been occasional market pullbacks as the economy continues along the bumpy and unprecedented path of reopening and recovery.

The week’s economic data may have also helped shore up sentiment. IHS Markit’s gauges of both current service and manufacturing sector activity surprised modestly on the upside, and May durable goods orders, beat expectations by a wider margin. Existing home sales in May fell short of estimates, but new home sales came in well above consensus. Labour market data were mixed. Weekly jobless claims declined by less than expected, but continuing claims fell more than anticipated and moved below 20 million for the first time since late April.

What We Can Expect from the Market this Week?

The increase in U.S. COVID-19 infection rates has dented momentum across markets despite the improvements in the global economy, which continues to beat most data expectations.

U.S. financial markets will be closed Friday for Independence Day. Important economic data being released include pending home sales on Monday, consumer confidence on Tuesday, ISM manufacturing index on Wednesday and the June jobs report and payrolls on Thursday.