PAST WEEK'S NEWS (MAY 29 – JUNE 02, 2023)

Oil prices opened higher on Monday as Saudi Arabia, the world's leading oil exporter, announced significant production cuts starting in July. The country plans to reduce output to 9 million barrels per day next month, a decrease of approximately one million barrels per day from May's production levels, with the potential for an extended cut. Additionally, OPEC and its allies, including Russia, agreed during a weekend meeting to decrease overall production goals by 1.4 million barrels per day from January 2024, in an effort to bolster oil prices amid worries of sluggish demand and slowing global growth. The price however declined lower as price momentum is not enough to squeeze the short sellers.

China's services sector experienced accelerated growth, according to a private survey. The Caixin services purchasing managers' index (PMI) increased to 57.1, surpassing expectations and marking its fifth consecutive month of growth, driven by rising consumer demand and employment in the industry. In contrast, the country's manufacturing industry contracted during the same period, potentially indicating a slowdown in the overall post-pandemic recovery of the Chinese economy.

Apple has finally revealed its highly anticipated mixed reality headset, the Apple Vision Pro. The headset is set to hit the market early next year with a starting price of $3,499. This innovative device allows users to seamlessly view and engage with digital content within their physical surroundings, providing a truly immersive experience that goes beyond conventional displays. Equipped with 4K displays, infrared cameras, LED illuminators, as well as the powerful M2 and R1 chips, the Vision Pro delivers cutting-edge technology. It offers a mixed-reality mode, enabling users to perceive the real world, along with a virtual-reality mode for even more immersive experiences. With features like eye tracking, gesture tracking, and voice input, users can interact with the content in a natural and intuitive manner. Apple's entrance into the mixed reality market is highly anticipated and expected to set a new trend, validating the importance of this emerging category.

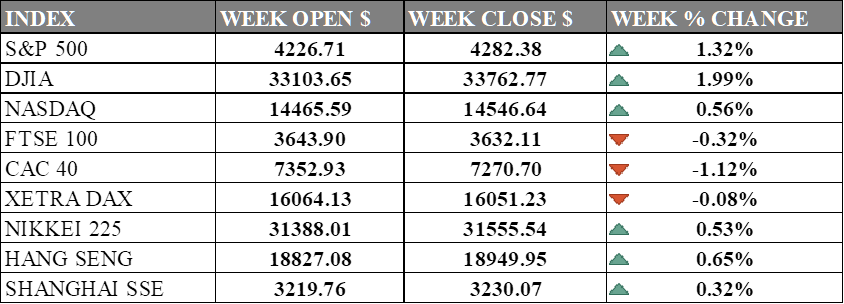

INDICES PERFORMANCE

The US indices showed a positive performance, with the S&P 500 gaining 1.32%, the DJIA gaining 1.99%, and the NASDAQ gaining 0.56%. The US markets were boosted by strong economic data, such as the nonfarm payrolls report that showed a higher-than-expected job growth in May and a decline in the unemployment rate to 3.7%. The US also announced a new infrastructure spending plan of $1.2 trillion, which was seen as supportive for growth and recovery.

The European indices showed a mixed performance, with the FTSE 100 losing 0.32%, the CAC 40 losing 1.12%, and the XETRA DAX losing 0.08%. The European markets were weighed down by concerns over high inflation and high interest rate that could further prompt the European Central Bank to tighten its monetary policy to 4%.

The Asian indices showed a modest performance, with the NIKKEI 225 gaining 0.53%, the HANG SENG gaining 0.65%, and the SHANGHAI SSE gaining 0.32%. Stimulus package issued by Bank of Japan along with weakening yen have been a strong catalyst to the rise of Nikkei as superstar index in the Asian market. China reported higher services PMI although its manufacturing sector is slowing down amid lower PMIs.

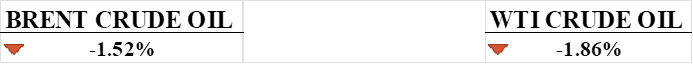

CRUDE OIL PERFORMANCE

The price of crude oil fell even on expectation that the OPEC will announce additional cut. Over the weekend, Saudi Arabia has pledged additional output cuts from July, leading to a global shortfall in crude oil supply that is expected to deepen in the third quarter. Analysts predict that this move, combined with extended production cuts by OPEC+ until 2024, could push Brent crude oil prices towards $100 per barrel by the end of the year. While the immediate impact may be limited, the reduction in supplies is likely to tighten the market and result in a strong rally in prices in the second half of the year.

OTHER IMPORTANT MACRO DATA AND EVENTS

The financial market's concerns about a possible U.S. credit default were alleviated when both the House of Representatives and the Senate agreed to raise the government's debt ceiling for an additional two years. The agreement was passed and sent to the White House to be signed into law before the June 5 deadline, which posed the risk of the government being unable to meet its financial obligations.

Once again, the strength of the U.S. labour market surpassed economists' predictions when it added 339,000 jobs last month, exceeding the consensus forecast. This latest monthly figure was slightly below the average monthly gain of 341,000 jobs over the past 12 months. Additionally, the total job numbers for March and April were revised upward by 93,000 jobs in total.

The “Fear index” tracking investors' short-term expectations of volatility in the U.S. stock market experienced a significant decline of approximately 19% during the week, reaching its lowest point in over three years. On Friday, the CBOE Volatility Index dropped to 14.6, only slightly higher than its level before the onset of the COVID-19 pandemic in February 2020.

In May, inflation in eurozone countries showed a greater-than-anticipated improvement, as the annual inflation rate decreased from 7.0% to 6.1% compared to the previous month. This figure marks the lowest inflation rate for the eurozone since February 2022.

What Can We Expect from The Market This Week

UK Composite, Services, and Construction PMI: The sterling has had a prosperous week as it rose against the USD, but the latest PMI will determine if that can continue.

RBA, BoC, Russia, and India interest rate decisions: The cost of borrowing in all 4 countries is expected to stay the same as more countries are pausing their rate hikes amid slowing inflation.

US Services PMI: An indicator of health in the services industry as the largest contributor to the US GDP

Australia and Japan's GDP Q1: The gross domestic product report will show the growth of the economies in both countries amid slowing economies.

EIA Short-term Energy Outlook: The outlook will be mostly updated in reaction to the recent OPEC meeting, which saw an additional cut of 1 million bpd with the oil market barely reacting.