PAST WEEK'S NEWS (MAY 05 – JUNE 09, 2023)

Coinbase and Binance, two of the largest cryptocurrency platforms in the world, are facing lawsuits from the US Securities and Exchange Commission (SEC) for allegedly violating securities laws. The SEC accuses Coinbase of trading unregistered crypto assets and evading disclosure requirements, while it accuses Binance of operating a "web of deception" and misleading investors. The lawsuits are part of the SEC's crackdown on the crypto industry, which aims to bring cryptocurrencies under the jurisdiction of the federal securities laws. The lawsuits could have a significant impact on the crypto market, as they could force Coinbase and Binance to comply with stricter regulations or face penalties. The lawsuits could also affect the prices and liquidity of various crypto tokens that are traded on these platforms.

New York City faced a hazardous air pollution crisis on June 7 and 8, 2023, as smoke from Canadian wildfires blanketed the city with an orange haze. The city's PM2.5 levels reached over 200 μg/m3, which is considered very unhealthy for everyone. The city issued an air quality alert and advised residents to limit outdoor activities, especially for sensitive groups such as children, older adults, and people with respiratory conditions.

U.S. Treasury Secretary Janet Yellen in CNBC interview stated that the U.S. economy is strong overall, with robust consumer spending, but some sectors are slowing down. She expects inflation to decrease while maintaining a strong labour market. Yellen also highlighted potential challenges for banks in commercial real estate and expressed support for consolidation. Additionally, she called for additional regulation in the cryptocurrency space and mentioned international efforts towards a global corporate minimum tax.

Legendary European Billionaire George Soros is passing control of his vast empire, including the Open Society Foundations (OSF), to his son Alexander, who plans to continue supporting left-leaning political candidates and expand the foundation's focus to include voting and abortion rights as well as gender equity. Alex Soros has been elected chairman of OSF and now oversees political activity as the president of his father's political action committee, with the foundation allocating approximately $1.5 billion annually to various causes promoting human rights and democracy.

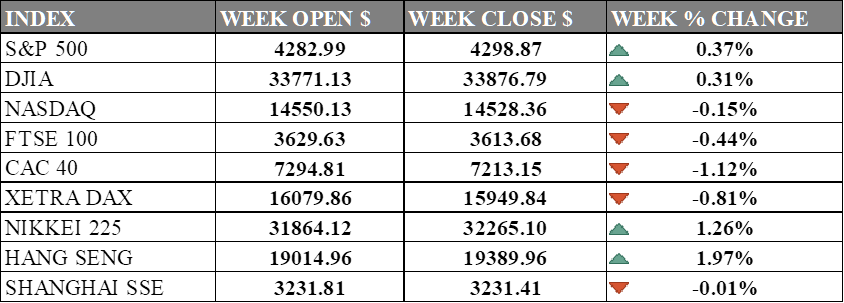

INDICES PERFORMANCE

The week ending on June 9, 2023, saw mixed results for the major stock market indices around the world. Four indices recorded positive gains, while five indices suffered losses. The Asian markets outperformed the European and American markets, possibly reflecting different economic conditions and expectations in the regions.

The best performing index was the Hang Seng, which rose by 1.97%, followed by the Nikkei 225, which gained 1.26% on stimulus euphoria. The S&P 500 and the DJIA also posted modest increases of 0.37% and 0.31%, respectively. The worst performing index was the CAC 40, which dropped by 1.12%, followed by the XETRA DAX, which declined by 0.81%. The FTSE 100 and the Shanghai SSE also ended the week with negative returns of -0.44% and -0.01%, respectively.

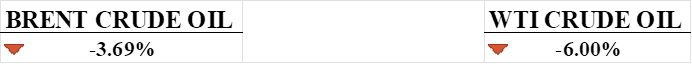

CRUDE OIL PERFORMANCE

Despite a highly publicized production cut by Saudi Arabia, crude prices have continued to decline. The market was not significantly impacted by the production cut, indicating a lack of effectiveness. Traders are cautious due to the backdrop of a deteriorating economic outlook. The OPEC+ alliance, consisting of OPEC members and other oil-producing countries like Russia, has decided to maintain current production levels, which further adds to the uncertainty in the market. Additionally, a false report about a potential US-Iran nuclear deal caused prices to plunge. The market is described as jittery, with concerns about a potential recession and the impact on oil demand. Overall, the oil market is characterized by volatility, a lack of confidence in production cuts, and a challenging economic outlook.

OTHER IMPORTANT MACRO DATA AND EVENTS

Saudi Arabia's energy minister, Prince Abdulaziz bin Salman, emphasized the kingdom's desire to collaborate rather than compete with China, dismissing Western concerns over their deepening ties. The bilateral relationship, rooted in hydrocarbon trade, has expanded to include security, sensitive technology, and potentially a free trade deal between China and the Gulf Cooperation Council, causing unease in the United States.

The Federal Reserve is considering a brief pause in raising interest rates before tightening monetary policy again, which would be the shortest break in modern history. This move aims to give policymakers more time to assess the economic landscape and prevent financial conditions from loosening too much, although it raises questions about the Fed's inflation goals and credibility.

The battle to raise the U.S. debt ceiling has sparked a debate in Congress over funding for Ukraine, with House Speaker Kevin McCarthy stating that he currently has no plans to increase defence spending beyond the recent agreement. McCarthy's comments suggest that it may be more challenging for President Joe Biden to secure additional funds for Ukraine in the future, despite the expectation that more funds will be requested by August or September.

What Can We Expect from The Market This Week

Treasury note auction: The 3-year and 10-year note auctions in particular are of interest as there will be another round of liquidity injection into the TGA and demands are expected to stay low as rates stay inflated.

Inflation report: The consumer price index (CPI) from the US and Germany will be closely watched as it will set expectations for the upcoming interest rate environment in both economies.

Industrial & Manufacturing: Production reports from the UK, China, and Philadelphia representing the US will be used to set expectations for economic growth.

US Retail Sales and Initial Jobless Claims: Although there was a surprising rise in jobless claims last week, retail sales are expected to be steady as consumer spending stays resilient with credit purchases.

Interest Rate Decision: The week is riddled with uncertainty as the market expects the federal reserve to pause in June before hiking in July if necessary, while the ECB is expected to continue hiking rates as Eurozone CPI stays inflated.