PAST WEEK'S NEWS (SEPTEMBER 11 – SEPTEMBER 15, 2023)

Apple, in its latest event dubbed “Wonderlust”, unveiled the all-new iPhone 15 models with faster chips, improved cameras, and brighter displays but kept its Pro version pricing unchanged from last year. The new watches added health-related features, a brighter display, and indirect "double tap" gestures. Apple hopes the iPhone 15 Pro's new 48MP camera and A17 chip will appeal to creators and consumers as they are capable of supporting ray tracing, opening the possibility of PC gaming experience. The investors, however, are not impressed, probably due to lower profit expectations as the new iPhone lineup moves to Type-C, increasing costs and losing proprietary accessory sales.

Headline CPI inflation accelerated to 3.7% in August, up from 3.2% in July, as energy prices spiked. Core inflation, excluding food and energy, moderated slightly to 4.3%. Food inflation remains elevated at 4.3% year-over-year, with egg, butter, and milk prices falling while meat and bread costs rose. Shelter inflation jumped to 7.3%, showing the lagging but persistent impact of higher housing costs. Services inflation ticked down to 5.9% but remains nearly triple the Fed's 2% target. Overall, this higher-than-expected inflation report will likely keep the Fed on track for further interest rate hikes to combat stubborn price pressures.

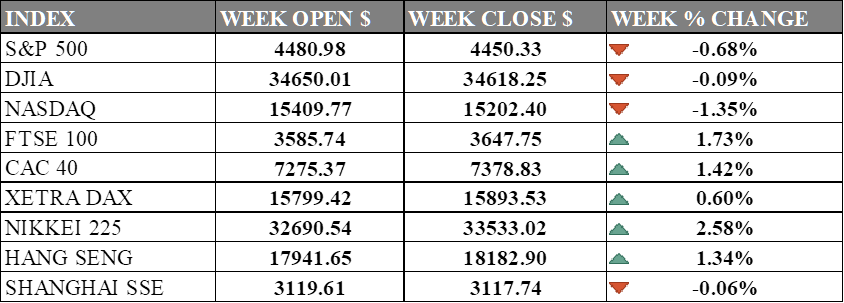

INDICES PERFORMANCE

In the week ending September 15, 2023, the U.S. stock market faced notable challenges. The S&P 500 index opened the week at 4480.98 but ultimately closed at 4450.33, marking a 0.68% decline. This drop was attributed to auto-workers strike overshadowed optimism that the Fed will pause rates next week. Similarly, the Dow Jones Industrial Average (DJIA) experienced a 0.09% decrease, closing at 34618.25. The DJIA's decline was driven by sell-off that was attributed to plunging chip stocks and mixed economic data, including a miss in consumer sentiment expectations. The tech-heavy NASDAQ composite also struggled, falling 1.35% during the week to finish at 15202.40. The index extended its losses due to Apple shedding more than 1.7%, although market are expecting positive news from ARM Holding’s IPO.

Meanwhile, European markets faced their own challenges. The UK's FTSE 100 index rose by 1.73% to close at 3647.75, up from its opening level of 3585.74. France's CAC 40 experienced a 1.42% recovery, closing at 7378.73. Germany's XETRA DAX increased by 0.60%, settling at 15893.53. These European indices recovered primarily due to prospect of The European Central Bank's nearing the end of its monetary tightening cycle added positive sentiment in the risk environment. Should the Bank of England indeed implement a rate hike, it is fair to anticipate it will resemble the approach taken by the European Central Bank, and subsequent remarks are expected to suggest that further rate increases are unlikely.

In Asia, market dynamics were shaped by various factors. Japan's Nikkei 225 surged by 2.58% week-over-week, closing at 33533.02, down from its opening level of 32690.54, partly due to a weakening yen. Hong Kong's Hang Seng index faced a similar prosperity of 1.34%, closing at 18182.90, primarily driven by positive industrial and retail sales data. China’s Shanghai Composite however fell by 0.06%, closing at 3117.74 after opening at 3119.61. These Asian markets recovered from negative sentiment and risk-stabilization after China’s property succeed in debt restructuring, averting huge default.

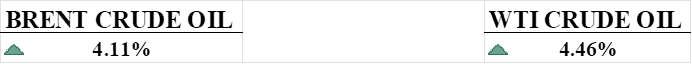

CRUDE OIL PERFORMANCE

Crude oil prices hit a 10-month high, marking their third consecutive weekly gain, driven by Saudi Arabian production cuts and optimism over Chinese demand. Brent crude settled at $94.20 per barrel, while U.S. West Texas Intermediate closed at $91.77 per barrel, up 4.46%. Both reached 10-month highs and posted around 4% weekly gain. These gains are set to deliver the largest quarterly rise since early 2023. Supply cuts by Saudi Arabia and Russia, strong Chinese economic data, and expectations of reduced U.S. output have all contributed to the recent price surge, though some profit taking is expected in Asian trading.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer sentiment dipped for the second consecutive month in September, reaching 67.7, lower than the expected 69.1, but their economic outlook improved slightly due to reduced near-term inflation expectations, with the one-year expectation at 3.1%, the lowest since March 2021.

U.S. retail sales exceeded expectations in August, driven by a surge in gasoline prices, rising 0.6%, though underlying spending on goods slowed due to higher inflation and borrowing costs. Despite this, consumer spending on services like concerts and movies remained robust, and the overall economy showed strength, with no expected immediate impact on monetary policy as the Federal Reserve was anticipated to keep interest rates unchanged this week.

Argentina's annual inflation rate surged to 124.4% in August, the highest since 1991, causing widespread financial hardship and anger. Shoppers are struggling to cope with daily price fluctuations, while the country faces economic crises and political uncertainty ahead of upcoming elections.

What Can We Expect from The Market This Week

Federal Reserve Interest Rate Decision: With continued strength in parts of the economy and inflation still elevated, Wall Street expects the Federal Reserve to hold interest rates steady but remains split on whether additional hikes are coming this year, as polled in June.

SNB Interest Rate Decision: Swiss inflation held steady at 1.6% in August, firmly within the Swiss National Bank's 1.75% target range, and pricing in derivatives markets indicates traders see a 60% chance of no rate change.

UK CPI August: Inflation is expected to show a slight increase in headline and a small decrease in core inflation. This reflects ongoing inflationary pressures like rising rents, air fares, and restaurant bills.

BoE Interest Rate Decision: The Bank of England is expected to raise interest rates again this week, but policymakers are growing concerned about a cooling economy, and a pause in rate hikes may be on the horizon.

Eurozone CPI August: The ECB raised its inflation forecast for 2023 to 5.6% from 5.4% previously and for 2024 to 3.2% from 3.0%, even as it hiked interest rates to 4% to stay within the 2% target limit.