PAST WEEK'S NEWS (OCTOBER 09 – OCTOBER 13, 2023)

The September CPI report shows headline inflation steady at 3.7% and core inflation slightly lower at 4.1%, with food and energy costs rising. The Fed survey indicates households foresee expenses growing by 5.3% next year but incomes by just 3%, and more people are struggling with debt payments. Though the Fed may raise rates again, most expect no hike in November as they try to tame service inflation of 5.7%. While the 30-year mortgage rate reached 8%, no housing market crash is expected since foreclosures did not approach 2010 levels just yet. The Fed aims to curb inflation but risks higher unemployment and an economic downturn in the process.

The decades-long Israeli-Palestinian conflict escalated after initial Hamas "Al-Aqsa Storm" operations, with Israel imposing a total blockade on Gaza, leading to essentials shortages. Israel launched severe airstrikes across Gaza, killing over 700, while Gaza militants killed 900 Israelis. Violence spread across the occupied West Bank and Lebanon. International protests erupted, with the UN Security Council unable to find consensus on a statement. The conflict claimed migrant workers too, with Thailand confirming 18 citizens were killed, The prospect of de-escalation remained distant despite rising casualties on both sides.

The Federal Reserve minutes from September revealed officials were divided on whether further interest rate hikes would be needed before year-end. Long-term Treasury yields have risen significantly since the September meeting, which could reduce the need for more rate hikes if sustained. The minutes showed officials thought the risks of raising rates too much or too little were more balanced now. Some officials said communications should shift from how much to raise rates to how long to hold them at restrictive levels. All agreed rates need to stay restrictive for some time until inflation reaches the 2% target. Several officials are closely watching the real fed funds rate, which could rise as inflation falls if nominal rates are held steady.

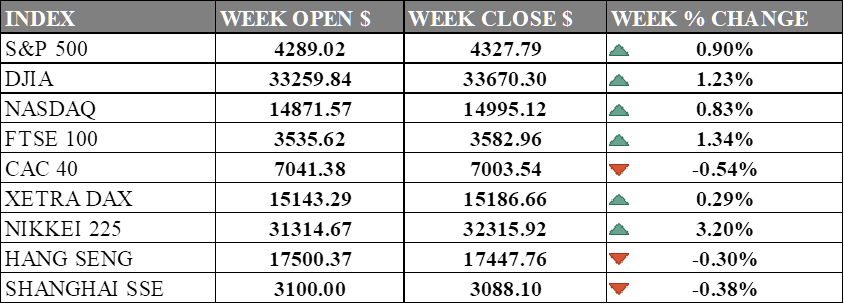

INDICES PERFORMANCE

In the week ending October 13, 2023, the U.S. stock market ended up higher on positive economic data. The S&P 500 index opened the week at 4289.02 but ultimately closed at 4327.79, marking a 0.90% increase. This gain was attributed to the Fed's possible shift in its monetary policy stance. The Dow Jones Industrial Average (DJIA) experienced a 1.23% increase, closing at 33670.30. The DJIA's rise was driven by gains in banking as earnings is in season. The tech-heavy NASDAQ rose 0.83% during the week to finish at 14995.12. The index offset its losses in tesla with amazon and apple recovery.

Meanwhile, European markets were mixed. The UK's FTSE 100 index rose by 1.34% to close at 3582.96, up from its opening level of 3535.62. France's CAC 40 experienced a 0.54% decline, closing at 7003.54. Germany's XETRA DAX increased by 0.29%, settling at 15186.66. The European market welcomed dovish fed comments while ECB signalled that rate has peaked. UK FTSE was one of the highest performing index due to depreciating sterling that fell 0.77% against the greenback.

In Asia, markets were mostly higher. Japan's Nikkei 225 jumped by 3.20% week-over-week, closing at 32315.92, up from its opening level of 31314.67, as Yen weakened, which benefited Japan's exporters and contributed to the favourable investment backdrop. Hong Kong's Hang Seng index fell 0.30%, closing at 17447.76 on lingering growth concerns. China’s Shanghai Composite declined 0.38%, closing at 3088.10, down slightly from its opening level of 3100.00 after a week of market close. Although Asian markets had mixed results, the gains in Japan provided an upbeat note.

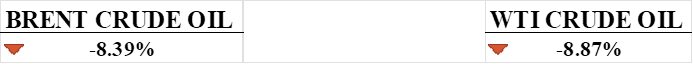

CRUDE OIL PERFORMANCE

Crude prices rose last week due to escalating conflict in the Middle East, gaining as much as 7% before paring back on news of a large increase in US crude stockpiles. Crude production reached a record high of 13.2 million barrels per day according to EIA data, while exports dropped nearly 2 million barrels per day. The Biden administration is considering new sanctions on Iran which could further constrain oil supplies, though evidence of direct Iranian involvement in Middle East conflict is lacking. Technical analysis suggests WTI resistance at $88-90 range and support around $86, with potential to retest $96 on upside breakout or drop to $83 on downside breakdown. The direction of the crude market in the coming week depends on geopolitics and the next US inventory report.

OTHER IMPORTANT MACRO DATA AND EVENTS

Eurozone households expect inflation to remain slightly above the European Central Bank's 2% target for the next three years, potentially influencing wage demands and impacting confidence in the ECB's inflation management. The ECB's Consumer Expectation Survey, conducted in August, revealed that respondents foresee inflation at 2.5% in three years, up from 2.4% in the previous month's survey, while the ECB continues its efforts to control rising prices amid a global debate on inflation targets.

China's vehicle sales saw a 5% increase in September, driven by promotions and holiday expectations, with the new-energy car sector growing by 10.7% year-on-year. Tesla's Shanghai plant contributed to a 50% year-on-year export growth. Despite EU concerns, the China Passenger Car Association (CPCA) remains optimistic about the industry's growth.

U.S. consumer prices in September grew faster than expected, with the annual CPI at 3.7%. The Federal Reserve is now cautious about its policy decisions, as they need to strike a balance between curbing inflation and avoiding negative economic impacts, especially in light of recent increases in U.S. Treasury yields.

What Can We Expect from The Market This Week

US Retail Sales: Gauging the health of the consumer in a high-interest environment that will affect the Fed November interest rate decisions. Unrelenting consumption, although maybe through credit, will be used by the Fed to further hike the rate, which saw 0.6% growth, while the market is expecting lower figures at 0.3% for September.

China GDP Q3: GDP growth is expected to be driven by positive high-frequency indicators in September, with consensus standing at 4.4%, lower than last quarter's 6.3%. Yet, concerns loom over economic challenges and eroding consumer confidence, with the World Bank lowering its growth forecast due to a looming property crisis that may have widespread economic repercussions.

UK CPI: Inflation in the UK has become a cause for concern in the market due to its elevated inflation rate, which stood at 6.7% in August and remains significantly above the Bank of England's 2% target. Despite the Bank of England's multiple interest rate hikes, there are worries that these measures may not be sufficient to bring inflation back to the desired level as the progress of disinflation has slowed.

US Building Permits: While building permit applications increased by 2% in August 2023, there is a concern as housing starts declined by 11.3% in August 2023. The market saw building permits added to 1.54 million in August and expected to be lower in September, which will reduce supply and increase inflationary pressure.

US Initial Jobless Claims: US initial jobless claims remained historically low, with a slight uptick to 209,000 in the week ending October 12, 2023. Nonetheless, the four-week moving average hit its lowest point since February, underscoring the ongoing strength of the labour market, which holds significance as the Federal Reserve contemplates future monetary policy.