PAST WEEK'S NEWS (OCTOBER 23 – OCTOBER 27, 2023)

Although "Black Monday" did not happen as the topic gained traction on X, the stock market's performance has been seen to falter as hype surrounding AI and interest rate cuts fades, corporate earnings decline, and the Federal Reserve's monetary tightening weighs on valuations. While upcoming Q3 GDP forecasts are positive, fading household finances and plunging profits suggest limited upside. Moreover, despite reasonable valuations, downside surprises still loom as analysts set low profit expectations to cope with the deteriorating economic condition. Though a 2023 pivot is unlikely, when cuts come in 2024, stocks may continue declining, as historical data shows Fed easing often occurs too late to prevent a crisis.

New and used car prices are slowly falling from record highs, though they remain expensive compared to pre-pandemic levels. Incentives on new cars have risen to a 2-year high, now averaging $2,368 per vehicle, but this is still below pre-pandemic incentive levels. The UAW strike could further limit new car inventory and prevent faster price declines if it continues. Electric vehicle prices have plunged due to surging competition and new model introductions, with EV sales hitting new records. More Americans, especially subprime borrowers, are falling behind on car payments as interest rates rise, leading to increased repossessions.

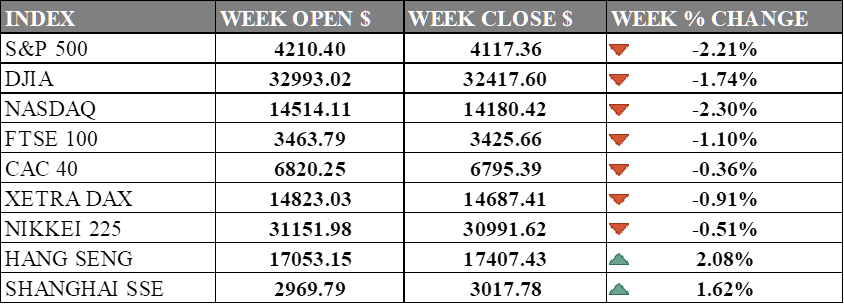

INDICES PERFORMANCE

The major U.S. stock indexes ended lower last week amid concerns over interest rates path and mixed earnings reports. The S&P 500 declined 2.21% to close at 4117.36, down from its open of 4210.40. The Dow Jones Industrial Average fell 1.74% to finish at 32417.60 compared to its open of 32993.02. The tech-heavy NASDAQ saw the largest drop, sinking 2.30% to 14180.42 after opening the week at 14514.11. The decline was attributed to disappointing third-quarter results from Big Tech companies and high Treasury yields. The S&P 500 fell 10% from the peak it reached in July, putting the benchmark index into what's called a "correction". More weakness is expected in the coming months unless there is a surprise macroeconomic data or action from the Fed that are set to meet on November 1st.

In Europe, the major indexes also posted weekly declines. The UK's FTSE 100 fell 1.10% to close at 3425.66 compared to its open of 3463.79. France's CAC 40 dropped 0.36% to end the week at 6795.39 after opening at 6820.25. Germany's DAX declined 0.91% to settle at 14687.41 from its starting point of 14823.03. Factors affecting the market included mixed earnings results from companies, concerns about the global economy, individual company news, and a rise in energy stocks due to higher oil prices driven by geopolitical concerns in the Israel-Palestine conflict that saw escalation.

Asian indexes fared better on the week. Japan's Nikkei 225 shed 0.51%, closing at 30991.62 versus its open of 31151.98. Hong Kong's Hang Seng jumped 2.08% to finish at 17407.43 from its starting level of 17053.15 amid gains in healthcare and real estate. China's Shanghai Composite rebound 1.62% to close at 3017.78 compared to its open of 2969.79 as there is growing optimism that fresh stimulus measures from Beijing could boost China’s economy. Asian markets showed mixed performance with Asian shares tracking Wall Street higher, led by Amazon's earnings relief, while bond markets rallied on signs of easing U.S. inflation. Concerns about geopolitical tensions and high bond yields impacted market sentiment in the region, but positive economic indicators and expectations of falling inflation could provide support soon.

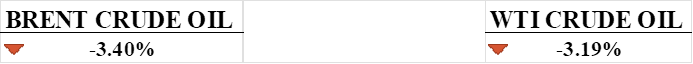

CRUDE OIL PERFORMANCE

Oil prices have fluctuated recently, with Brent crude falling from nearly $94 to around $85 as traders saw the war not yet affecting Middle East oil exports. The full conflict's impact on oil is uncertain, described as a "mess" by an energy hedge fund partner, with bullish and bearish factors remaining. While oil supply routes have been spared so far, a prolonged Gaza invasion risks Middle East export disruption, supporting prices. However, demand may suffer if the conflict spreads, global growth slows further, and stocks extend declines. Overall, oil's direction depends on shifting geopolitics, with both upside and downside risks from the fluid Israel-Palestine clashes.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. economy grew 4.9% in the third quarter, fuelled by strong consumer spending and businesses restocking inventories to meet demand. These defied predictions of a recession, though growth may slow in the fourth quarter due to factors like student loan repayments resuming. Underlying inflation also abated, with the core PCE price index rising just 2.4%, giving support for the Fed to pause interest rate hikes for now.

The average 30-year fixed mortgage rate jumped to 7.9%, the highest since September 2000, while mortgage applications fell to a 28-year low, as rising rates continue to price out homebuyers and suppress refinancing.

The Ifo institute's business climate index for German companies edged up in October, beating forecasts, but economists say the economy still seems likely to enter a recession in the second half of the year due to ongoing challenges. Sentiment improved slightly in manufacturing, services and construction, but remains at low levels indicating continued economic contraction.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The Federal Reserve is likely to keep interest rates unchanged in its upcoming meeting, extending the pause that started after the last rate hike in July. While there are uncertainties regarding U.S. inflation and economic growth, the recent positive surprise in GDP keeps investors cautious about the possibility of a rate hike in December.

JOLTs Job Openings: Along with other labour market data coming out, it will give insight into the US labour market, which is currently experiencing a surge in union activism across various sectors due to improved worker leverage in a tight job market and rising inflation. Strikes and negotiations have occurred in industries such as automobiles, healthcare, airlines, and entertainment, with workers demanding higher pay and better conditions.

German GDP: Germany's economy is expected to contract in the third quarter due to declining industrial production, construction sector shrinkage, and weakening consumption, potentially marking four consecutive quarters of negative growth.

China Manufacturing PMI: factory activity rose to 50.2 in September, signalling growth for the first time in six months and exceeding expectations. This uptick suggests that China's economy is stabilising after a period of decline, supported by improved factory output and retail sales. However, policymakers continue to grapple with a property sector debt crisis that poses challenges to the country's economic recovery.

CB Consumer Confidence: Consumer confidence fell to 103 in September from the previous month's 106, largely due to concerns about reinflation. High-income consumers exhibited the sharpest decline in confidence, which could potentially lead to reduced spending, although retail spending previously reported at 0.7% MoM is considered healthy growth.