Stocks Performance (U.S. Stocks)

Stocks finished higher for the third consecutive week on coronavirus-vaccine optimism & positive economic data.

News on vaccines developed for COVID-19 boosted stock markets last week. The outlook from Moderna and Oxford University helped investors shrug off rising infection rates and the backtracking of reopening plans in some parts of the world. Traders also kept a watchful eye on rising tensions between the U.S. and China, as well as on corporate earnings, as the quarterly reporting season got underway.

The market, however, was slowed down by the negative week in mega-cap technology stocks, U.S.-China tensions, and a rollback in the reopening process in California due to the rising coronavirus caseload. In addition, the inability of the S&P 500 to stay above its June 8 closing level (3232.39) kept the bulls in check.

By sectors, the most outperformed weekly stocks were led by Distribution Services at 6.03%, followed by Process Industries at 5.79%, Health Technology at 5.44%, and Transportations (5.40%). Meanwhile, the weakest sectors were from the Retail Trade sector (-2.99%), Technology Services (-2.36%), Miscellaneous (0.65%), and Consumer Durables (1.14%).

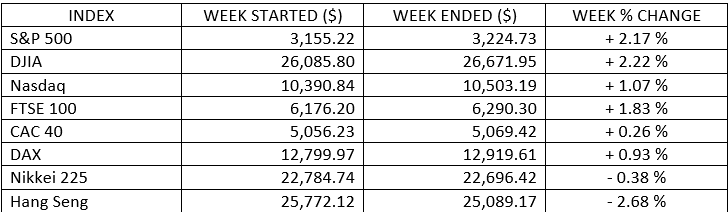

Indices Performance

The major indexes ended the week mixed. The S&P 500 Index marked its third consecutive week of gains and reached intraday peak on Wednesday. The index was also briefly in positive territory for the year. Within the S&P 500, industrials shares outperformed by a wide margin, while technology stocks lost ground.

A shift out of higher-valuation growth shares into value stocks caused the technology-heavy Nasdaq Composite Index to pull back from its all-time highs, however. The market rotation was also evident in the outperformance of smaller-cap stocks, which have lagged considerably in recent months.

Chinese stocks slumped in a volatile trading week amid indications of economic weakness, renewed U.S. trade tensions, and profit taking following recent gains.

Oil Sector Performance

The price of oil climbed to a four-month high before retreating after the OPEC decided to begin tapering its recent production cuts in August. OPEC and its allies agreed to scale back oil production cuts from August as the global economy slowly recovers from the coronavirus pandemic. Cuts will officially taper to 7.7 million bpd until December.

Market-Moving News

Divided Market

Though S&P 500 and Dow both rose for third week in a row, their gains were modest, and the NASDAQ slipped, with some of that index’s technology stocks enduring a rough week. However, industrial stocks rallied, lifting the Dow, which outperformed its peers.

S&P 500 Break-Even

With the latest weekly gain, S&P 500 came close to returning to its level at the end of last year, as it moved within 0.2% YoY break-even point; on a total return basis, it was up 0.9%. And on Friday, the index was up 44.1% from a recent low in March, though 4.8% shy of its record high achieved the previous month.

Stimulus Talks

Many investors kept a close eye on negotiations by government over an additional stimulus package to stabilize the economy. With enhanced unemployment benefits scheduled to expire at the end of the month, House Democratic leaders expressed optimism that they could reach a deal with the Republican-led Senate over measures such as a second round of cash payments to Americans.

Prolonged Unemployment

For the 17th week in a row, more than 1 million Americans filed claims for unemployment benefits, indicating that the labour market faces a long road back before it can return to normal. However, the 1.3 million claims in the latest report mark a sharp downturn from the record of nearly 7 million filed during a single week in March.

Fadeout in Confidence & Possibility to Re-Lockdown

The recent jump in U.S. coronavirus cases appears to be weighing on U.S. consumer confidence. A preliminary reading released Friday from the University of Michigan’s monthly confidence survey showed a sharp decline to a level that nearly erased the previous two months’ gains.

Other Important Macro Data and Events

Several central banks, including the Bank of Canada, the Bank of Japan, and the European Central Bank, held their accommodative policy rates steady and stated that the economic outlook remained highly uncertain. With official interest rates expected to remain low for many years, global government bond yields fell.

U.S. retail sales jumped 7.5% in June, and industrial production increased the most since 1959, both surprising to the upside. Following a two-month rebound, retail sales are almost back to their pre-virus levels, largely helped by the direct support and fiscal transfers from the government to consumers.

As the expanded unemployment benefits are due to expire at the end of the month, expectations are that Congress will manage to reach a deal on a new aid package, which is much needed to support the economic recovery. Over the coming months investors will likely continue to debate and balance promising vaccine news with the reality that cases continue to rise and that reopening measures could be rolled back.

What We Can Expect from the Market this Week

The week will mark the unofficial start of the earnings season and will be taking center stage, with 32 of the S&P 500 companies scheduled to report Q2 result.

Important economic news coming out this week includes existing home sales on Wednesday, weekly unemployment claims and the leading economic index on Thursday, and new home sales on Friday.

The Road Ahead: As economic and corporate fundamentals progress from recession to recovery, focusing only on the destination and not the journey could cause investors to miss both the risks and the opportunities that present themselves. Maintaining a diversified mix of bonds and stocks that match your risk tolerance can help you stay focused on the journey that matters most: reaching your financial goals over time.