PAST WEEK'S NEWS (February 19 – February 23, 2024)

China surprised the market by lowering its five-year loan prime rate, the benchmark for most mortgages, by 25 basis points to 3.95% while keeping its one-year rate unchanged at 3.45%. This was the first cut in the five-year rate since June 2023 and was larger than expected by economists. The move aimed to revive the depressing property market landscape, which suffered from Beijing’s debt clampdown on developers in 2020. The central bank also injected 1 trillion yuan ($139.8 billion) in long-term capital by cutting the reserve ratio requirements for banks and encouraging lending to high-quality real estate firms. The rate cut was seen as a positive sign of the health of the banking sector and the government’s support for the housing market, but the sustainability of easing credits remains a question.

Nvidia's stock skyrocketed after exceeding Q1 2024 revenue expectations by 233%. This rally, adding $277 billion to its market value in a single day, is a world record and suggests Nvidia is on track to become a $2 trillion company within a year. Analysts remain bullish, citing Nvidia's "seemingly insatiable" AI demand and "early innings" dominance in key growth areas. Contras argued that hardware businesses ran strong but ran out faster as there would be a limit to the underlying growth of businesses that utilised them. However, the sheets don't lie, and its booming growth has made it the sixth largest company by market cap, a shining success for the Californian-born tech emperor.

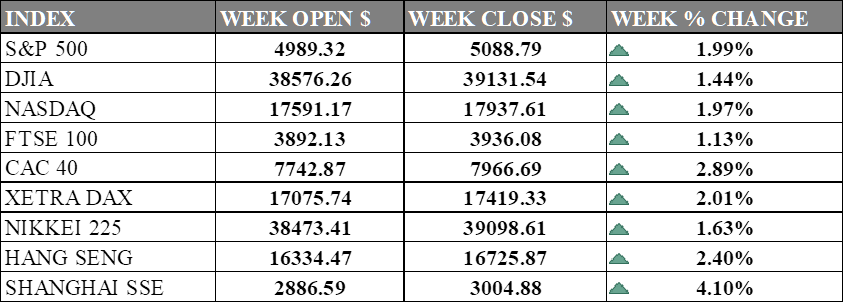

INDICES PERFORMANCE

The major U.S. stock indexes ended mostly higher last week, supported by major company’s earnings. The S&P 500 rose 1.99% to close at 5088.79, up from its open of 4989.32. The Dow Jones Industrial Average climbed 1.44% to finish at 39131.54 compared to its starting point of 38576.26. The tech-heavy Nasdaq gained 1.97% to 17937.61 after opening the week at 17591.17. This growth was largely due to strong performances from several of its component companies, particularly those in the technology and consumer discretionary sectors.

In Europe, the major indexes were mostly higher. The UK's FTSE 100 increased 1.13% to close at 3936.08 compared to its open of 3892.13. France's CAC 40 jumped 2.89% to end the week at 7966.69 after opening at 7742.87. Germany's XETRA DAX rose 2.01% to settle at 17419.33 from its starting point of 17075.74. The German economy showed signs of stabilization with a slight uptick in sentiment among German companies despite confirming an economic contraction in the final quarter of 2023. However, the economy stuck in a de facto stagnation since the start of the war in Ukraine, compounded by structural weaknesses and cyclical headwinds.

Asian indexes were mixed but mostly higher on the week. Japan's Nikkei 225 surged 1.63%, closing at 39098.61 versus its open of 38473.41 driven by foreign investors' enthusiasm for rising corporate profits, reflects a lingering wariness among Japanese investors after decades of market malaise. Hong Kong's Hang Seng climbed 2.40% to finish at 16725.87 from its starting level of 16334.47. China's Shanghai Composite jumped 4.10%, closing at 3004.88 compared to its open of 2886.59. Investor sentiment improved following the Lunar New Year break, supported by government measures aimed at stimulating economic growth and market confidence, despite ongoing challenges in sectors like real estate.

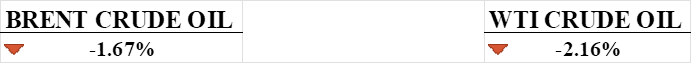

CRUDE OIL PERFORMANCE

Crude oil prices remained pressured by demand concerns as the market digested hawkish signals from the Federal Reserve regarding higher interest rates for an extended period. This overshadowed geopolitical tensions in the Middle East that previously provided some support. Focus shifts on key economic data releases this week, including inflation figures from major economies and US GDP figures, which are expected to solidify the Fed's stance on maintaining elevated interest rates, potentially hindering oil demand growth. Although a slowdown in China's economic recovery is expected to continue, recent stimulus measures offer tentative optimism for sustained currency stability instead of economic growth.

OTHER IMPORTANT MACRO DATA AND EVENTS

The surprising decline in jobless claims hints at continued robust job growth, easing the pressure on the Federal Reserve to consider interest rate cuts. While concerns linger about specific sectors, the overall tightness in the labour market, evident in both low unemployment claims and a slight uptick in housing market activity.

The German government expects the economy to grow by only 0.2% this year, down from a previous forecast of 1.3%, due to weak global demand, geopolitical uncertainty, and high inflation. Economy Minister Robert Habeck stressed the need for action to enhance Germany's competitiveness in the face of these challenges, with projections indicating a 1% growth next year and around 2% inflation in 2025.

What Can We Expect from The Market This Week

US New Home Sales: The sale of a new house saw an 8% monthly increase and 4% annual growth in December 2023, ending a two-year decline. This rebound is attributed to decreasing mortgage rates, which have stimulated market activity and are expected to drive a stronger housing market in 2024.

CB Consumer Confidence: The CB Consumer Confidence Index, a key indicator of economic health, is expected to stagnate in February 2024 after it was hit hard in October, which saw figures decline below 100, not seen since July 2022. This decline was largely due to worsening expectations, although it is now on the rise again.

US GDP Q4: Economic growth for Q4 2023 increased at an annualised rate of 3.3% in earlier reports, surpassing the Wall Street consensus estimate of a 2% gain. This growth, which was higher than the 2.5% annualized pace for all of 2023, was driven by strong consumer spending and government expenditures.

German CPI: a key indicator of inflation trends, recorded a lower inflation rate of +2.9% in January 2024, down from +3.7% in December 2023. This change, coupled with a 0.2% rise in consumer prices compared to December 2023, reflects the effect of continued monetary tightening and its impact on the economy, which is in recession but far from deflation.

US PCE Price Index: a key measure of inflation, showed a slowdown year-over-year and is expecting a rate of 2.4% in January 2024, down from 2.6% in December 2023. This consensus, along with a decrease in core prices to 2.9% from 3.2% in December 2023, signifies dynamic adjustments in monetary policy and economic forecasting in response to evolving economic conditions.