PAST WEEK'S NEWS (March 03 – March 07)

The escalating trade tensions between the United States and China intensified as the 20% tariff on all Chinese goods, up from 10%, was retaliated against after China introduced tariffs of 10% to 15% on various U.S. imports, including agricultural products such as soybeans and wheat, and added 15 U.S. entities to an export control list and 10 firms, like Illumina Inc., to an unreliable entities list. The U.S. also levied 25% tariffs on Canada and Mexico, calling for more efforts over border security and fentanyl smuggling, with no retaliation from Mexico but a reciprocal 25% from Canada on more than $20 billion worth of U.S. imports. Analysts predict these measures could lead to a recession in Mexico, higher U.S. inflation, and lower U.S. growth. Within the tensions, speculation has arisen about a potential "Mar-a-Lago Accord" to devalue the dollar and rework trade deals, though this remains unconfirmed.

President Donald Trump is hosting the inaugural White House crypto summit on Friday, convening over 25 key figures from both the crypto industry and government. Chaired by David Sacks and Bo Hines, the event aimed to advance his vision for a U.S. crypto strategic reserve under Executive Order 14178. Trump was expected to unveil reserve details, with Commerce Secretary Howard Lutnick highlighting a special status for Bitcoin alongside other major cryptocurrencies. The summit came at a time with high volatility in Bitcoin, where prices bounced back and forth in the measures of billions triggered by unusual market speculation and Trump’s pro-crypto stance. Trump touted the gathering as a move toward establishing the U.S. as the "crypto capital of the world," countering previous administration policies.

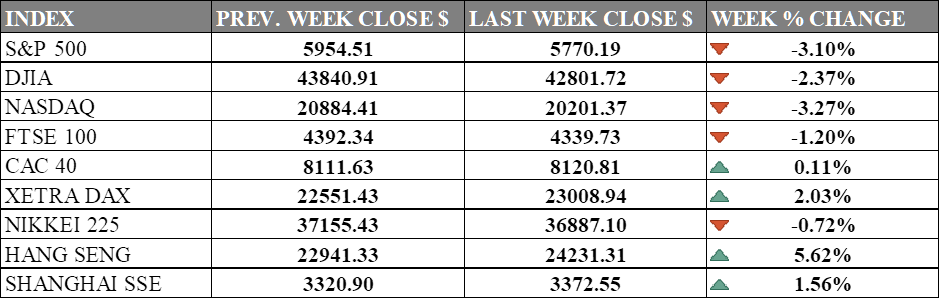

INDICES PERFORMANCE

Wall Street ended the week with significant losses. The S&P 500 fell by 3.10%, closing at 5770.19, reflecting broad market weakness. The Dow Jones Industrial Average (DJIA) experienced a decline of 2.37%, finishing at 42801.72, showing vulnerability amid market volatility. Meanwhile, the Nasdaq decreased by 3.27%, closing at 20201.37, as the tech-heavy index faced heavy selling pressure. Falling consumer confidence, rising jobless claims, and slowing price growth has raised the market volatility index to fearful. Shifts are underway as equal-weighted and defensive sectors outperform traditional tech-heavy benchmarks, with international markets also showing strong gains

European markets showed mixed results. The UK's FTSE 100 declined by 1.20%, closing at 4339.73, reflecting broader market uncertainty. France's CAC 40 experienced a minor gain of 0.11%, ending at 8120.81, while Germany's XETRA DAX rose significantly by 2.03%, closing at 23008.94. This is a far better performance than expected given U.S. takes on the Ukraine situation. However, a 7% drop in Germany manufacturing new orders highlight growing concerns about short-term industrial performance.

Asian markets displayed mixed trends. Japan's Nikkei 225 declined by 0.72%, closing at 36887.10, reacting to decline in tech sector performance in the U.S. In contrast, Hong Kong's Hang Seng Index strengthened substantially, rising by 5.62%, finishing at 24231.31. In mainland China, the Shanghai Composite Index posted a gain of 1.56%, ending at 3372.55. The strength in Chinese markets comes despite growing concerns over Trump's tariff plan and potential retaliatory measures from the Chinese government with growth in Tech especially artificial intelligence which investor say will kill profits.

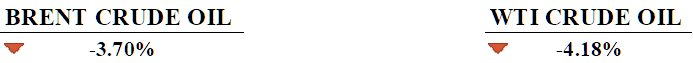

CRUDE OIL PERFORMANCE

Crude oil prices ended the week lower even with a small bounce on Friday, weighed down by OPEC+’s plan to boost production in April, rising U.S. oil stockpiles, and weak global demand. Geopolitical tensions, including U.S. threats of sanctions on Russia and new tariffs on China and Canada, added volatility, but gains were limited by Saudi price cuts and signs Russia is open to Ukraine peace talks. Concerns about oversupply—fueled by rising Russian exports and slowing demand from China—overshadowed potential price supports like U.S. plans to refill oil reserves and possible disruptions to Iranian supply. While most analysts see a bearish trend, prices could climb if OPEC+ changes course or geopolitical tensions flare up. For now, the market is caught between supply risks and weakening demand.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. layoffs soared to 172,017 in February, a 245% jump to recession-era levels, driven by federal job cuts, cancelled contracts, and trade war fears. Federal agencies, contractors, and spending cuts by Elon Musk’s DOGE contributed to the cut.

U.S. private payrolls grew by just 77,000 in February, the smallest gain since July, as key sectors saw job losses and small business hiring dipped. Weak consumer spending and trade uncertainties have affected economic sluggishness and employer caution.

What Can We Expect from The Market This Week

US CPI February: February data is expected to print a modest slowdown in inflation with a monthly increase of 0.2–0.3%, down from January’s 0.5% rise, and headline figures are expected to remain in the 2.8–3.0% range alongside a steady core rate of 3.1–3.3%. Recurrent cost pressures in housing and services, combined with evolving trade dynamics, are projected to increase inflation in the near term.

BoC Interest Rate Decision: The Bank of Canada is expected to cut rates again to support economic growth and counteract the volatility brought on by U.S. tariffs. If they proceed with the cut, their next direction will depend on economic data and tariff developments, potentially leading to further cuts if the situation worsens or a pause if conditions stabilize.

JOLTs Job Opening: Private job openings for January 2025 are estimated at 7.71 million, supported by a stable labour market with steady employment growth and a 0.9% rise in personal income. Expectations for future job openings could be threatened if consumer confidence stays frail.

German CPI February: Inflation in Germany currently stands at an annualised rate of 2.3% for the second month, with a month-on-month increase of 0.4% with consensus at the same figure for February. This stability is influenced by modest rises in energy and food prices, supported by the European Central Bank's monetary policy and external factors like falling energy markets.

UK GDP January: Economic growth for the United Kingdom in December was 0.4%, while the consensus for January is only 0.1%. With inflation standing at 3%, exceeding the Bank of England's 2% target, the BoE is likely to adopt a cautious approach, potentially delaying interest rate cuts to address ongoing price stability concerns while economic growth stay modest.