Stocks Performance (U.S. Stocks)

Global markets opened the week with great enthusiasm due to high hopes that a COVID-19 treatment is coming soon, as U.S. regulators approved emergency blood plasma for COVID patients, and reports that President Trump’s administration may fast track a vaccine candidate. American and Chinese officials delivered calming messages that they will continue to push forward on the implementation of the trade deal.

Companies that would benefit most from a full reopening of the economy, such as airlines, aircraft part manufacturers, and cruise lines enjoyed strong support at times. However, higher-valuation growth stocks outperformed lower-priced value companies, extending the 2020 trend. Large-cap companies easily outpaced small-caps, as large information technology firms continued to drive the market’s upward momentum.

By sectors, the most outperformed weekly stocks were led by Consumer Durables at 7.44%, followed by Technology Services at 5.01%, Retail Trade at 2.91%, Consumer Services at 2.61%, and Electronic Technology (1.82%). Meanwhile, the weakest sectors were from the Energy Minerals sector (-3.11Communications (-2.00%), %), Industrial Services (-1.39%), and Utilities sector (-1.12%).

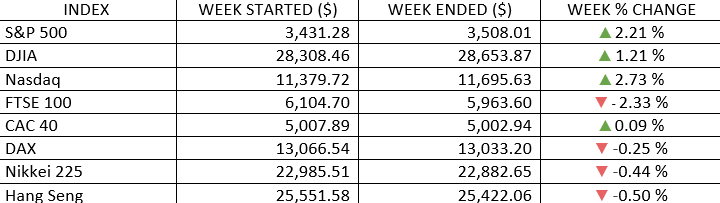

Indices Performance

Major market indices, such as the S&P 500 and Nasdaq, opened to record highs. By Wednesday, MSCI World Index hit a record, as cheap cash continued to flow into the equity markets across the globe.

In Japan, the Nikkei Index declined on Friday after Prime Minister Shinzo Abe announced that he is stepping down due to health reasons.

Oil Sector Performance

The price of crude went up due to Hurricanes Marco and Laura ravaging the U.S. Gulf Coast. Though not enough for weekly cumulation. More than half of crude production in the Gulf of Mexico has been shut down, and residents have been evacuated.

Market-Moving News

Upward Trend

The major U.S. stock indexes climbed around 3% and the S&P 500 recorded its eighth positive week out of the past nine. The S&P 500 and the NASDAQ continued to set new record highs; the Dow turned positive year to date while remaining about 3% below its historic peak.

Jobs Ahead

Friday’s monthly jobs report is expected to be the week’s most closely watched. The last monthly report showed that the economy generated nearly 1.8 million jobs in July as the unemployment rate fell to 10.2%.

GDP Drop-Off

The record plunge in U.S. economic output in the second quarter wasn’t quite as steep as initially estimated. A revised government estimate issued on Thursday put the GDP decline at 31.7%, compared with a 32.9% estimate released in late July. It’s expected that third-quarter data will show that GDP began to rebound, returning to an expansionary trend.

Q2 Earnings Recap

Q2 earnings for companies in the S&P 500 dropped nearly 32% from the same period a year earlier, the worst result since the first quarter of 2009. However, 84% of companies beat analysts’ consensus earnings expectations.

Lower for Longer

U.S. Federal Reserve Chairman Jerome Powell announced a shift in how the Fed views inflation, saying it won’t increase interest rates to respond to low unemployment levels and also won’t worry as much about low rates triggering a rise in prices. A review concluded that inflation could temporarily run slightly over the Fed’s 2% target if that’s what’s needed to maintain labor market strength.

Yield Rise

A sell-off in government bonds lifted the yield of the 10-year U.S. Treasury bond on Friday to 0.73%, the highest level in more than two months. Government bond prices ended the week on a volatile note following an inflation announcement on Thursday by Federal Reserve Chairman Jerome Powell.

Flagging confidence

U.S. consumer confidence fell for the second consecutive month to its lowest level in six years, as measured by a monthly report issued on Thursday by The Conference Board. The next day, a separate monthly consumer sentiment report from the University of Michigan found a slight rise in confidence, although its index remained near its low point since the coronavirus outbreak.

Dow reconstitution

Effective Monday, August 31, 3 of the 30 stocks in the Dow Jones Industrial Average will be replaced. S&P Dow Jones Indices announced that Salesforce.com will replace Exxon Mobil, Amgen will replace Pfizer, and Honeywell International will replace Raytheon. A stock split by another Dow constituent, Apple, prompted the move.

Other Important Macro Data and Events

U.S. Federal Reserve Chairman Jerome Powell spoke on Thursday in Jackson Hole, Wyoming, at the Fed’s Annual Policy Forum. On price stability, the FOMC adjusted its strategy for achieving its longer-run inflation goal of 2% by noting that it "seeks to achieve inflation that averages 2% over time." This means following periods when inflation has been running persistently below 2%, appropriate monetary policy will likely aim to allow inflation to run moderately above 2% for some time.

Personal spending rose 1.9% in July, the third month in a row showing growth, indicating that the economic recovery is underway.

The 2-yr yield was unchanged at 0.15%, while the 10-yr yield rose nine basis points to 0.73%. The U.S. Dollar Index fell 1.0% to 92.32.

In Asia, profits at China’s industrial firms grew for a third straight month in July and at the fastest pace since June 2018. Meanwhile, South Korean financial regulators announced this week that they are extending the ban on short selling of publicly listed shares until March 15, 2021 to control market volatility due to concern over resurgence of the COVID-19.

What We Can Expect from the Market this Week

Important economic news coming out this week including construction spending on Tuesday, factory orders on Wednesday, weekly unemployment claims and trade balance on Thursday, and monthly jobs report on Friday.

Friday’s monthly jobs report is expected to be the week’s most closely watched economic release and a key indicator of the labour market’s progress in recovering from the spring’s record-breaking job losses. The last monthly report showed that the economy generated nearly 1.8 million jobs in July as the unemployment rate fell to 10.2%.