PAST WEEK'S NEWS (April 14 – April 18)

In a speech at the Economic Club of Chicago, Federal Reserve Chair Jerome Powell declared that the Supreme Court case regarding President Trump's firing of federal officials likely doesn't apply to the Fed, affirming the central bank's stability and political independence. Powell warned that Trump's tariffs will trigger higher inflation while simultaneously slowing economic growth, creating potential tension between the Fed's dual mandate goals. The Fed is firm in maintaining its current policy stance while awaiting clarity on tariff impacts, as first-quarter growth shows signs of deceleration with only modest consumer spending increases. Tariffs will generate at least temporary inflation with the risk of persistent effects if inflation expectations become unanchored, Powell cautioned. His remarks led to immediate market reactions, with stocks falling and Treasury yields declining as investors absorbed the implications. Despite these challenges, Powell maintained that the economy remains in a "solid position" even with the projected slowdown.

In response to President Trump's tariffs, Chinese manufacturers are now seen promoting direct-to-consumer sales of luxury goods at dramatically discounted prices without brand logos while maintaining identical materials and craftsmanship. Short videos from Chinese suppliers reveal luxury brands mostly source their products from China, exemplified by a Birkin bag costing $1,400 to produce yet retailing for $34,000, with one supplier claiming "more than 90% of the price is for the logo." Chinese manufacturers are countering "Made in China" stereotypes by showcasing their production processes, exposing trade partners, and covering import duties to attract American consumers. This strategy brewed hotter after the escalating trade war, where the US has imposed tariffs up to 145%, with Chinese exporters reporting cases of vanishing orders and job cuts, prompting companies to find alternative markets or shift production abroad to relieve these anxieties from importers. LVMH, a conglomerate with the most extensive luxury brand portfolio, was hit hard because of it, down more than 6%.

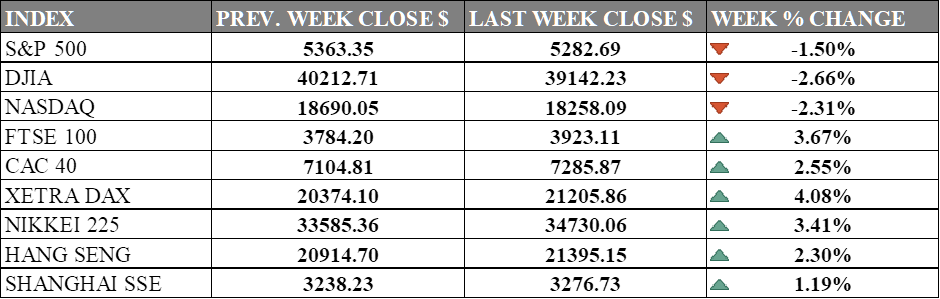

INDICES PERFORMANCE

Wall Street still suffering from “sell America” sentiment evidenced by its declining stock and dollar index. The S&P 500 declined by 1.50%, closing at 5282.69, with continued pressure from trade war. The Dow Jones Industrial Average (DJIA) saw a substantial drop of 2.66%, finishing at 39142.23, showing vulnerability amid market pessimism. Meanwhile, the Nasdaq also retreated with a notable decline of 2.31%, closing at 18258.09, as tech stocks faced selling pressure. This downward movement suggests waning investor confidence rather than temporary profit-taking.

European markets showed strong performance for the week, diverging from the U.S. decline. The UK's FTSE 100 gained 3.67%, closing at 3923.11. France's CAC 40 experienced an increase of 2.55%, ending at 7285.87, while Germany's XETRA DAX surged by 4.08%, closing at 21205.86. European markets appear to be responding to regional economic optimism despite the negative sentiment in U.S. markets.

Asian markets also displayed strength, with consistent gains across the region. Japan's Nikkei 225 posted a solid gain of 3.41%, closing at 34730.06. Hong Kong's Hang Seng Index showed significant resilience, rising by 2.30%, finishing at 21395.15. In mainland China, the Shanghai Composite Index advanced by 1.19%, ending at 3276.73, potentially reflecting improved outlook on economic growth and recovery from easing regional tensions despite ongoing concerns about tech resource dependencies.

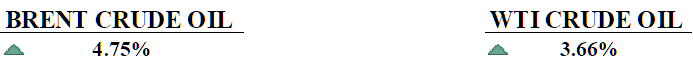

CRUDE OIL PERFORMANCE

WTI crude oil closed up $2.25 to settle at $63.68 per barrel on Thursday, primarily driven by new U.S. sanctions targeting buyers and shippers of Iranian oil, including a Chinese refinery that purchased over $1 billion of Iranian crude. The oil market is facing increased supply as OPEC+ prepares to return 411,000 barrels per day of production cuts next month, while the International Energy Agency reported oil supply was already up by 0.6 million bpd in March. U.S. oil inventories rose by 0.52 million barrels last week, marking the fifth increase in six weeks, further contributing to supply pressures. The price of Russia's Urals crude dipped below the G7 price cap of $60 per barrel in early April, trading at $53.50 on Thursday, which has reduced shipping costs to India and could negatively impact Russia's economy. Russia's Economy Ministry has revised its oil price forecast downward, now expecting Brent crude to average $68 per barrel this year, down from the previous estimate of $81.7 per barrel. Market sentiment remains cautious as President Trump's tariff policies threaten global growth, with the International Energy Agency noting that concerns about inflation, economic slowdown, and trade disputes are weighing on oil prices.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. retail sales saw their largest growth in over two years, with consumers rushing to purchase vehicles and other goods before tariff-related price hikes. However, economists warn that this surge is likely temporary, as consumer sentiment declines and economic uncertainty remains, leading to reduced spending in the coming months

U.K. inflation slowed with the annual consumer price inflation rate dropping to 2.6%, opening ways for the Bank of England to cut interest rates in May. However, the impact of U.S. trade tariffs on U.K. growth and inflation may hinder the plan.

What Can We Expect from The Market This Week

US Durable Goods Orders: New orders for manufactured durable goods in the US increased by $2.7 billion, or 0.9%, month-over-month to $289.3 billion in February 2025, exceeding market expectations of a negative 1.1% growth. This marks the second consecutive month of growth, showing resilience in the manufacturing sector despite earlier predictions of a decline.

UK Retail Sales: Consumer spending in the UK climbed 2.2% year-on-year in February 2025, beating forecasts of a 0.5% rise and accelerating from a downwardly revised 0.6% growth in the previous period and 2.0% in the next. The figure could be higher from a rush purchase ahead of a tariff war.

Canada Retail Sales: Consumer spending in Canada decreased 0.6% to $69.4 billion in January 2025, following December's outsized gain of 2.6%, while preliminary February data shows a lower figure at minus 0.4%. Sales were down in three of nine subsectors, with decreases led by lower sales at motor vehicle retailers, suggesting some moderation in consumer spending.

US Initial Jobless Claims: Unemployment claims lowered to 215,000 in mid-April, down by 9,000 from the previous week's revised level of 224,000. This figure came in below the forecast of 225,000, pointing to strength in the labour market with layoffs remaining at historically low levels.

US New Home Sales: Sales of new single-family homes in the U.S. rose 1.8% to a seasonally adjusted annual rate of 676,000 in February 2025, partially recovering from January's revised upward figure of 664,000. It's still pale compared to the December figure, although the housing market remains resilient despite high mortgage rates and prices.