The United States launched a large-scale military operation in Venezuela that resulted in the capture and removal of President Nicolás Maduro, marking one of the most dramatic U.S. interventions in the region in decades. The overnight mission saw explosions, power outages, and a nationwide mobilization order, raising risks to domestic stability and regional security. President Donald Trump said Washington would temporarily administer Venezuela, a shift from sanctions and diplomatic pressure to direct control, a move that has drawn global condemnation especially Iran and Cuba. The intervention carries major implications for global energy markets, as the U.S. aims to reopen Venezuela’s vast oil reserves to American companies, though years of mismanagement, legal disputes, and decayed infrastructure mean any output recovery would take years. Overall, the operation challenges norms of sovereignty, heightens geopolitical risk across Latin America, and a significant energy market power shift.

Silver prices was one of the main events of 2025 after gaining more than double in value to surpass $80 per ounce amidst a structural supply deficit and intense institutional demand. This unprecedented rally triggered widespread rumours in early January 2026 that a systemically important US bank had defaulted on a massive margin call after being caught on the wrong side of the trade. In response to the growing instability, the Federal Reserve reportedly intervened by injecting billions into the banking system through emergency overnight repo facilities to support liquidity. While official sources characterized these moves as routine market stabilization, the removal of emergency lending caps further fuelled speculation regarding a "hidden" bailout for a major bullion player. Concurrently, the CME Group implemented aggressive hikes in silver margin requirements to limit speculative volatility, leading to a sharp year-end "flash crash" and subsequent violent consolidation.

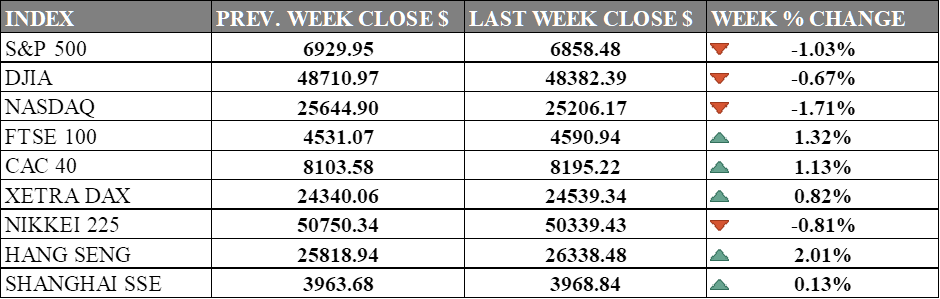

INDICES PERFORMANCE

Wall Street's major indices declined this week. The S&P 500 fell 1.03% to 6,858.48, while the Dow Jones Industrial Average dropped 0.67% to 48,382.39. The Nasdaq underperformed, declining 1.71% to 25,206.17, as technology stocks faced continued selling pressure amid valuation concerns and reduced expectations for Federal Reserve rate cuts going forward. Market sentiment remained cautious amid ongoing assessments of corporate earnings, evolving expectations for Federal Reserve policy, and macroeconomic data releases.

European markets showed strength this week. The UK's FTSE 100 gained 1.32% to 4,590.94, marking a notable recovery. France's CAC 40 rose 1.13% to 8,195.22, while Germany's XETRA DAX advanced 0.82% to 24,539.34. Investor sentiment in the region improved, reflecting resilient corporate performance and growing optimism about economic stability despite ongoing monetary policy considerations.

Asian markets were mixed this week. Hong Kong's Hang Seng Index surged 2.01% to 26,338.48, leading regional gains. China's Shanghai Composite edged up 0.13% to 3,968.84, showing modest stability. In contrast, Japan's Nikkei 225 declined 0.81% to 50,339.43, giving back some of its previous gains. The regional performance reflected a mix of positive policy signals from China and ongoing concerns about global macroeconomic uncertainties.

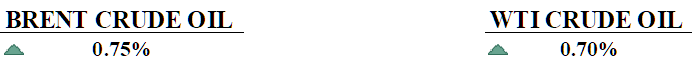

CRUDE OIL PERFORMANCE

Oil prices whipsawed in volatile trading Monday after the U.S. captured Venezuelan President Nicolas Maduro, though last week ended in moderate gain. The dramatic geopolitical shift raised prospects of increased global oil supply from Venezuela, which holds the world's largest proven reserves, though analysts warned any production boost would take years given the country's aging infrastructure. OPEC+ added to market uncertainty by keeping production unchanged at a weekend meeting, maintaining its pause on output increases amid growing oversupply concerns. Oil markets have been battered in 2025, with prices plunging over 18%, their worst annual performance in five years, with fears of a supply glut and weakening demand overwhelm geopolitical risk premiums. Analysts said ample global supply would likely absorb any near-term disruptions to Venezuela's already-constrained exports, which had fallen to around 500,000 barrels per day in December.

OTHER IMPORTANT MACRO DATA AND EVENTS

Canada’s manufacturing sector shrank for an 11th straight month in December, with PMI stuck below 50 as tariff-driven trade uncertainty weighed on output and new orders while input and output prices continued to rise.

Hong Kong’s retail sales rose 6.5% year on year in November, marking a seventh straight monthly gain, supported by improving consumer sentiment and a sharp rebound in inbound tourism despite slower growth in sales volumes.

What Can We Expect from The Market This Week

ISM Manufacturing PMI: Manufacturing in the United States has been in contraction since February last year, with the market expecting the index to come in around 48.3, essentially flat from November's 48.2 reading, continuing the trend as tariffs continue to disrupt supply chains.

German CPI: Germany's consumer price inflation held steady at 2.3% year-on-year in November 2025, confirming preliminary estimates and matching October's rate. The December 2025 CPI preliminary data is expected to decline to around 2.0%.

US Nonfarm Payrolls: The December 2025 employment report is expected to show modest gains of around 55,000-170,000 jobs, down from November's additional 64,000 jobs, as the labour market shows signs of moderation following disruptions earlier in 2025.

China CPI: China's consumer price index shot up to 0.7% annually in November 2025, marking the highest growth rate in recent months and up from October's 0.2%. The December data is expecting 0.8% growth, a gradual improvement in consumer demand.

German Factory Order: Germany purchase orders increased 1.5% monthly in October 2025, rebounding from previous weakness. However, November data is expected to decline to -0.9%, as Germany's manufacturing sector faced a deepening downturn at the end of 2025 with declining output and export orders.