Stocks Performance (U.S. Stocks)

The wave of positive news on COVID-19 vaccines boosted global equities for the second week in a row earlier in the week to all-time highs, including the S&P 500, the DJIA and the MSCI All-Country World Index. However, the S&P 500 and the Dow retreated to end the week lower, as tightening restrictions in many areas weighed on sentiment. This was also worsened by a public disagreement between the Treasury and the Federal Reserve over releasing funds aimed at supporting the economy.

Earlier in the week, Pfizer (NYSE: PFE) and BioNTech (NASDAQ: BNTX) filed for emergency use authorization for their COVID-19 vaccine after concluding their Phase 3 study, which indicated that their vaccine is 95% effective; Moderna (NASDAQ: MRNA) said its vaccine is 94.5% effective, and AstraZeneca (LON: AZN) and Oxford's vaccine showed encouraging immune responses in older patients in Phase 2 data.

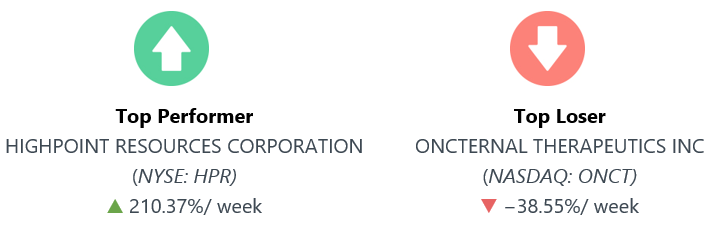

By sectors, the most outperformed weekly stocks were led by Energy Minerals sector at 144.49%, followed by Consumer Durables at 8.51%, Industrial Services 3.77%, and Consumer Services at 2.10%. Meanwhile, the weakest sectors were from the Health Services at -3.80%, Utilities at -2.12%, Health Technology (-1.36%), and Communications sector (-0.69%).

Indices Performance

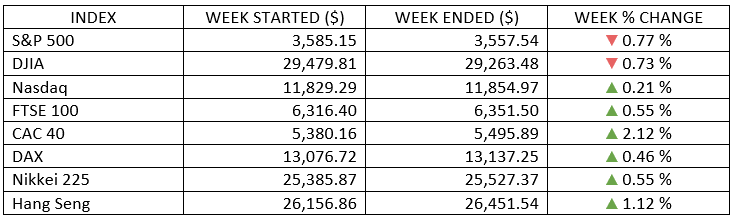

The S&P 500 and the Dow were slightly negative, the NASDAQ was modestly positive, and none of the major U.S. indexes moved more than 1% for the week.

All major stock markets in Europe and Asia were higher. Countries especially hard hit by COVID-19 earlier this year and seen as major beneficiaries of vaccine progress (for example, Italy and Spain) were strongest. Asian equities received a boost after many countries in the region signed the RCEP agreement, the world’s largest free-trade agreement.

Oil Sector Performance

Oil prices rose on hopes for vaccine news, as well as signals that OPEC and other major oil exporters would delay a global production increase planned for January.

Market-Moving News

Uneven Path

It was another choppy week for stocks, with big daily moves early in the week but little change overall. The S&P 500 and the Dow were slightly negative, the NASDAQ was modestly positive, and none of the major indexes moved more than 1% for the week.

Small-Cap Surge

For the second week in a row, U.S. small-cap stocks outperformed the broader market by a wide margin, as the Russell 2000 Index, a small-cap benchmark, climbed more than 2%. At Friday’s close, the index was up 23% from a recent low on September 23.

Financial Support to End

U.S. Treasury Secretary Steven Mnuchin on Thursday said he would not extend most of the emergency lending programs that his agency has been running in tandem with the U.S. Federal Reserve amid the coronavirus pandemic. The decision to curb the programs at the end of December comes as the economy faces new challenges from the latest spike in COVID-19 cases.

Earnings Wrap

Figures from the just-completed quarterly earnings season show that profits at S&P 500 companies fell an average 6.6% compared with the same quarter a year earlier, according to FactSet. That’s the fourth-largest quarterly decline since 2009. Healthcare posted the strongest earnings growth at the sector level, rising 13.0%.

Bitcoin's Surge

The price of the cryptocurrency bitcoin extended its recent rally, rising about 14% for the week. The price has risen nearly 160% year to date; since early October, it’s up around 75%.

Shopping Sentiment

The latest U.S. retail sales numbers entering the holiday shopping season were mixed. Sales inched up just 0.3% in October relative to September, marking a slowdown in the positive momentum from recent months. Electronics and home improvement supplies were among the areas that showed big sales gains; clothing and department store sales were down.

Other Important Macro Data and Events

Positive news on COVID-19 vaccines boosted global equities for the second week in a row. Following Pfizer Inc.’s announcement that its vaccine candidate was more than 90% effective, Moderna Inc. added to the optimism that vaccines will eventually end the pandemic when it said that its candidate was 94.5% effective. Not to be outdone, Pfizer soon followed with updated results claiming more than 95% effectiveness for its vaccine. Encouraging data was also released regarding the Oxford-AstraZeneca vaccine, and the US Food and Drug Administration approved the first at-home COVID-19 test kit.

Confidence that vaccines will accelerate the return to normal economic activity sent some safe havens, such as gold, lower. The U.S. 10-yr yield fell six basis points to 0.86% amid increased demand despite the encouraging vaccine news. This was possibly in response to signs that the economic recovery is losing momentum and that the chance of additional federal stimulus in the U.S. is fading.

Economic data mostly pointed to a slowing of activity: claims for unemployment benefits rose for the first time in five weeks, retail sales rose at the slowest pace in six months, and the Empire State Manufacturing Index fell more than expected.

What We Can Expect from the Market this Week

The resurgence in coronavirus cases and record U.S. hospitalizations, along with new restrictions in several states, are a reminder that the near-term path to a full economic recovery will be bumpy. Added with another broad lockdowns in Europe, economic activity and mobility have taken a hit, threatening to stall or possibly reverse the recovery. Though, the market took the vaccine news as well as one could have hoped.

With Q3 earning wrapped, a balancing act between incoming positive vaccine news, economic data releases and ever-growing economic restrictions is to be expected throughout the week.

Wednesday will be a busy day this week as U.S. markets will be closed Thursday due to the Thanksgiving holiday, and markets will close early for the day on Friday at 1 P.M., ET. Releases scheduled including unemployment claims, quarterly GDP, durable goods orders, personal income and consumer spending, new home sales, and U.S. Federal Reserve meeting minutes. Tuesday brings consumer confidence index and home price index.