PAST WEEK'S NEWS (February 8 – February 14, 2021)

Stocks Performance (U.S. Stocks)

Global stocks pushed higher as investors continued to take comfort in the persistent expectations for additional fiscal stimulus plan, improving COVID-19 trends and progress on vaccine distribution rate, and positive corporate earnings reports.

The week began with stock gains after the U.S. Treasury Secretary Janet Yellen’s appearance on Sunday talk shows, where she spoke in favour of President Biden’s proposed economic aid package and employment plans. Later in the week, Fed Chair Jerome Powell delivered a speech where he reiterated that the Fed policy would remain stimulative for a long time. Powell’s dovish message, supported by a softer than expected U.S. CPI for January, pressed long-term government bond yields lower in the U.S. during most of the week, before rising growth expectations boosted them higher.

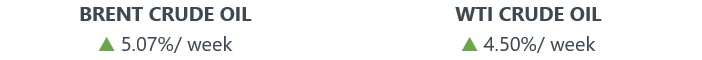

Energy stocks were higher as WTI crude prices climbed to their highest level in more than two years. By sectors, the most outperformed weekly stocks were led by Energy Minerals sector at 3.72%, followed by Electronic Technology at 3.69%, Commercial Services (3.51%), and Producer Manufacturing at 3.48%. Meanwhile, the weakest sectors were from the Utilities at -1.10%, Distribution Services at -0.36%, Communications (-0.25%), and Consumer Durables sector (-0.06%).

Indices Performance

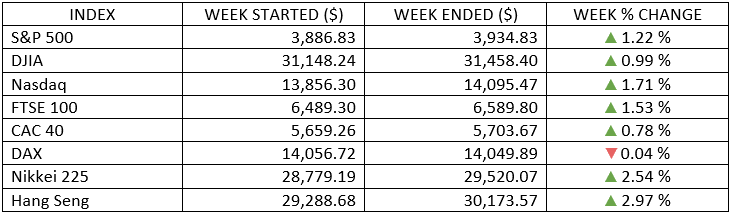

The major U.S. indexes rose for second week straight. While they couldn’t match the previous week’s strong results, the indexes all posted gains of more than 1% and set new record highs amid mostly quiet trading.

The European markets were mixed. Spain and Germany lost ground, while Italy led the advancers as Mario Draghi moved to form a national unity government.

UK stocks were also higher after reports that Britain’s real GDP was stronger in the final quarter of 2020 than had been forecast.

Asian trading week was shortened by holidays, including China’s Lunar New Year and Japan’s National Foundation Day. The Japan’s Nikkei 225 Index climbed to its highest level in over 30 years, Hong Kong Hang Seng ended at a 3-week high and Shanghai Shenzhen CSI 300 Index jumped to an all-time high.

Oil Sector Performance

Oil extends weekly gains amid signs of improving global demand.

On the week's closing, Brent crude price breached the $60 mark and closed the week higher at $62.43 a barrel. The WTI crude price also extended its rally and closed the week higher at $59.47 a barrel.

Market-Moving News

Record Heights

The major U.S. stock indexes all posted gains of more than 1% and set new record highs amid mostly quiet trading. For the S&P 500, Friday produced the index’s tenth record closing price of 2021. The NASDAQ outperformed the other major indexes and on Tuesday eclipsed the 14,000-point level for the first time to set another record high.

Small-Cap Surge

A big rally on Monday for small-cap stocks lifted the Russell 2000 Index, a small-cap benchmark, to another week of outperformance relative to large caps. The index climbed more than 2% for the week.

Earnings Catalyst

With Q4 results in from about ¾ of companies in the S&P 500, more than 80% have surpassed analysts’ earnings forecasts, according to FactSet. That’s above the five-year average ‘beat’ rate of 74%.

Bitcoin Rally

Bitcoin soared past $47,000, recording a roughly 24% gain for the week, after Tesla disclosed that it had purchased $1.5 billion worth of bitcoin and will start accepting the cryptocurrency as a payment method for its cars.

Inflation Gauge

U.S. government bond yields slipped on Wednesday after a measure of inflation came in lower than expected. CPI remained unchanged in January compared with the previous month.

U.K. GDP Drop

The UK’s economy in 2020 posted the biggest annual GDP decline among the world’s most advanced economies, with a 9.9% drop. However, the U.K. economy grew at an annualized rate of 4.0% in the final quarter of the year, aided by government spending and an uptick in business investment.

Platinum Shines

The price of platinum climbed to a near 6-year high to about $1,231 a troy ounce. So far this year, the price has risen about 14%; about double its March 2020 level.

Other Important Macro Data and Events

Quarterly earnings results continued to prosper, as more than 80% have surpassed analysts’ earnings forecasts. The results have been beating expectations by a wider-than normal margin, especially in the technology, communication services and financials sectors.

The optimistic mood also lifted oil and other commodities, including copper and platinum, which reached an 8-year and 6-year highs. Even gold prices, which typically retreat in tandem with falling safe-haven demand, joined in the advance, mainly due to a weaker U.S. dollar.

In U.S. economic news, inflation and jobs data came in below expectations, as growth has stalled, and continuing claims remain significantly higher than pre-pandemic levels. The core CPI unchanged in January, below consensus estimates. Weekly jobless claims fell to 793,000.

Core eurozone government bond yields fell on softer-than-expected U.S. inflation. Eurozone yields also came under pressure from the ECB’s perceived dovishness and the European Commission’s gloomy economic outlook. Peripheral eurozone government bond yields also fell. Easing political tension in Italy helped the country’s 10-year yield hit a new low on Friday. Mario Draghi, the former president of the ECB, was poised to become Italy’s prime minister after receiving the backing of the populist 5-Star Movement, the largest party in Parliament, for his national unity government.

Germany extends lockdown despite vaccination programs implementation, until March 7, while also close its border with the Czech Republic and Austria’s Tyrol region.

In the UK, Prime Minister Boris Johnson said he planned to outline a plan for reopening the economy in two weeks’ time.

The UK economy contracted 9.9% in 2020, its most since 1709. Although the economy grew in the final quarter of the year at annualized rate of 4.0%.

More companies started to venture into the cryptocurrency space. Tesla (NASDAQ: TSLA) disclosed a $1.5 billion investment in bitcoin with plans to accept the digital coin as a payment option, MasterCard (NYSE: MA) said it plans to support cryptocurrencies on its payment network this year, and BNY Mellon (NYSE: BK) reportedly said it will hold, transfer, and issue cryptocurrency for its asset-management clients.

What We Can Expect from the Market this Week

Going forward, the path ahead for economic and earnings growth remaining favourable, supported by additional fiscal stimulus, accommodative central-bank policies, and the rollout of vaccines.

More light shone into digital currencies/ cryptocurrencies as more companies started to venture into the space.

Important U.S. economic data being released this week include the FOMC minutes, February preliminary Markit PMI, producer inflation, import export and retail sales growth.