PAST WEEK'S NEWS (February 15 – February 21, 2021)

Stocks Performance (U.S. Stocks)

Equities began the week rallying as new COVID-19 cases fell, vaccine distribution ramped up, and most economic data pointed to a strengthening recovery. However, stocks reversed course and declined after inflation fears took centre stage after the U.S. Producer Price Index in January posted its largest monthly increase since 2009, hence raised concerns that rising commodity prices and borrowing costs would soon weigh on corporate profit growth and the relative attractiveness of equities.

Prices of U.S. government bonds fell, sending the yield of the 10-year U.S. Treasury bond to the highest level in nearly a year. The 10-year yield rose on Friday to around 1.34%; the 30-year U.S. Treasury also rose, with a yield of around 2.14%.

Canaan Creative stock surged in trading last week as cryptocurrencies continued to boost associated stocks. CAN stock is particularly well-positioned to benefit as a maker of Bitcoin mining machines, presently scarce and in high demand. Gaucho Group Holdings led the losses after the company recorded a fall in revenue YoY.

Strength in oil prices benefitted energy sector while financials reacted positively to higher interest rates and bond yields, which is supportive of bank profitability. By sectors, the most outperformed weekly stocks were led by Energy Minerals sector at 5.02%, followed by Non-Energy Minerals at 4.44%, Finance (2.45%), and Transportation at 2.02%. Meanwhile, the weakest sectors were from the Consumer Durables at -2.73%, Utilities at -1.96%, Health Services (-1.70%), and Health Technology sector (-1.65%).

Indices Performance

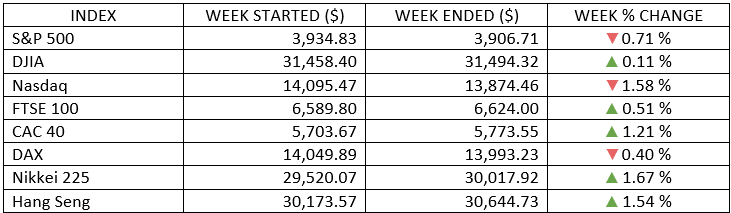

The S&P 500, Nasdaq Composite and Dow Jones Industrial Average indices all touched record highs Tuesday, before pulled back on Thursday morning.

European and Asia-Pacific markets were mixed. Italy and Germany retreated, while France and the UK made modest gains.

Japan’s Nikkei 225 Index rallied to its highest level since mid-1990, after the country reported a better-than-expected Q4 GDP and the manufacturing PMI climbed in February at its fastest pace since 2018.

Chinese shares ended on a mixed note after a weeklong Lunar New Year holiday. The China’s financial markets only reopened Thursday.

Oil Sector Performance

Brent extends weekly gains, while the U.S. oil could not sustain the $60 mark, slipped to around $59 on Friday.

WTI crude oil on Tuesday rose briefly to its highest price in more than a year amid supply disruptions resulting from a deep freeze that hit Texas. However, dropped at week’s end as Texas operations resumed, and Saudi Arabia announced plans to reverse production cuts.

Market-Moving News

Mixed Direction

It was a mixed week for stocks, as the Dow recorded a slight gain and the S&P 500, and the NASDAQ posted modest declines. An improved economic outlook lifted many stocks in the energy and financials sectors.

Yield Spike

Prices of U.S. government bonds fell, sending the yield of the 10-year U.S. Treasury bond to the highest level in nearly a year. The 10-year yield rose on Friday to around 1.34%; the 30-year U.S. Treasury also rose, with a yield of around 2.14%.

Value Resurgence

Large-cap U.S. value stocks have been outperforming their large-cap growth counterparts’ year to date, and they outperformed again in the latest week. A value stock benchmark rose 0.3% while a growth benchmark fell 1.7%.

Small-Cap Setback

Small-cap stocks’ long run of outperformance versus their large-cap peers was interrupted, as the Russell 2000 Index, a small-cap benchmark, fell around 1% for the week. Nevertheless, the index has gained around 50% since the end of September 2020.

Fed Update

Wednesday’s release of minutes from the U.S. Federal Reserve meeting in late January showed that policymakers viewed economic conditions as being “far from” the Fed’s long-term goals despite currently accommodative policies.

Oil Comeback

The price of U.S. crude oil on Tuesday eclipsed $60 per barrel for the first time in more than a year amid supply disruptions resulting from a deep freeze that hit Texas. However, the price couldn’t sustain that level, and oil slipped to around $59 on Friday.

Retail Sales Data

U.S. retail sales rose 5.3% in January compared with the previous month, surpassing economists’ expectations and snapping a three-month string of decreases. The rebound was attributed in part to stimulus payments that Americans received as part of a $900 billion measure that Congress approved in late December.

Housing Market Data

The housing market continues to be a catalyst for the broader U.S. economy, as a shortage of homes for sale continued to push prices higher in January. The National Association of Realtors said that sales of existing homes rose 0.6% in January compared with December. Relative to January of 2020, sales jumped nearly 24%.

Other Important Macro Data and Events

Prices of U.S. government bonds fell, sending the yield of the 10-year U.S. Treasury bond to the highest level in nearly a year. The 10-year yield rose on Friday to around 1.34%; the 30-year U.S. Treasury also rose, with a yield of around 2.14%.

As yields moved higher, the price of gold slid to an 8-month low. Meanwhile copper prices climbed to their highest level in almost 9-years, and lumber futures, that buoyed by a robust housing market, jumped to an all-time high.

Weekly jobless claims, reported Thursday, jumped to 861,000, the most since mid-January, but most other data suggested a remarkably strong U.S. economy. Retail sales surged much more than expected in January, industrial production rose at twice the expected rate, and building permits jumped to their highest level since 2006.

Core eurozone bond yields also rose. The 10-year German bund yield reached about -0.32% on Friday—its highest level since June 2020—as growing reflation expectations in the U.S. weighed on core asset demand. Strong PMI numbers also put upward pressure on yields. Yields on peripheral eurozone bonds largely tracked core markets. Ten-year gilt yields reached 0.64% on Friday, up from 0.57% at the start of the week.

UK and Switzerland set to ease lockdowns. The latest UK health data showed that the number of coronavirus cases in England, Wales, and Northern Ireland fell to their lowest levels since early October. Meanwhile, Switzerland said it would start lifting some restrictions in March, reopening shops, museums and libraries, zoos, gardens, and sports facilities.

Cryptocurrency market breached milestones as the market cap exploded above $1.7 trillion for a new record. Bitcoin shows no signs of slowing down after another record above $56,500. While Ethereum touched $2,000, and numerous other altcoins heading towards uncharted territory as well.

What We Can Expect from the Market this Week

As things stand, the economy is expected to recover to levels before COVID-19 as 2021 progresses on the back of fiscal stimulus, continued easy monetary policy, a better-than-expected Q4 earnings season, progress in fighting the coronavirus, and gradual easing of restrictions, which in turn are positive catalysts for the stock markets. Nevertheless, investors should focus on things they can control, including having clear, long-term investment targets and maintaining a well-diversified portfolio while keeping costs low.

Important U.S. economic data being released this week include the January leading economic index, consumer confidence, new & pending home sales, durable goods orders, and personal income and spending.

Investors also will have another chance to gain insight on the Fed’s thinking, as Chair Jerome Powell is scheduled to testify before congressional panels on Tuesday, February 23, and the following day.