PAST WEEK'S NEWS (March 29 – April 4, 2021)

Stocks Performance (U.S. Stocks)

Global stock markets advanced as a combination of hopeful vaccine news, fiscal stimulus plans, and stronger economic data overpowered continuing uncertainty about the potential negative effects of rising bond yields. The 10-yr yield eased after flirting with 1.78% early in the week.

The week started on a cautious note after Japan’s Nomura and Credit Suisse of Switzerland warned of potential substantial losses after one of their clients, reportedly Archegos Capital Management, defaulted on margin calls and was forced to sell more than $20 billion in stock in the prior week. Though, the contagion effects were dismissed as the firm’s unwinding didn’t shake the markets more broadly and several U.S. banks said that the losses were immaterial.

Separately, President Biden unveiled a $2.3 trillion infrastructure spending plan on Wednesday that included increases in corporate taxes to help finance the spending.

Vaccine optimism received another shot in the arm as the U.S. vaccine rollout continued to surpass targets, and as the Pfizer said its vaccine proved to be 100% effective in 12-15-year-olds.

The rest of the week saw a return of the large capitalization and growth-oriented stocks. Cyclical stocks meanwhile underperformed despite the ISM Manufacturing Index for March and Conference Board's Consumer Confidence Index edged higher.

Liberty TripAdvisor Holding’s shares jumped after announces the completion of the repurchase of 39% of the outstanding series a Preferred Stock from Certares Management LLC. Meanwhile, the highly volatile share price HighPoint Resources Corp over the past 3 months continues last week as it hit rock bottom. HighPoint Resources is set to release earnings on 5/3/2021.

Advancing sectors were led by Electronic Technology sector at 5.49%, followed by Non-Energy Minerals 5.42%, Technology Services (4.92%), and Producer Manufacturing at 3.86%. Meanwhile, the weakest sectors were from the Health Services at 0.24%, Utilities at 0.24%, Consumer Non-Durables (1.07%), and Communications sector (1.22%).

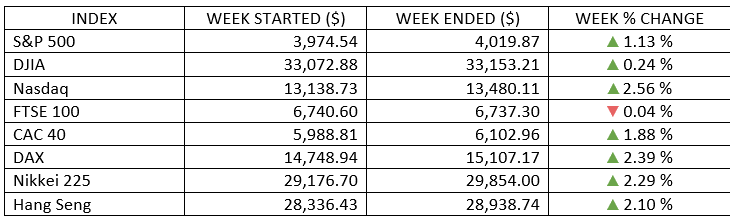

Indices Performance

The S&P 500 reached a new milestone last week by topping the 4,000 mark for the first time on Thursday, although the NASDAQ Composite outperforming with a 2.6% gain. The Dow Jones Industrial Average also set an all-time high, but it barely ended the week higher.

Markets were closed Friday in observance of the Good Friday holiday.

Germany led European markets higher, on better-than-expected economic data. UK stocks lagged as the country starts to ease lockdown restrictions.

Stock indices in Japan were higher after better-than-expected rises in the manufacturing PMI and the Tankan Large Manufacturers Index.

Oil Sector Performance

Oil prices initially dropped after the freeing of the ship that had been blocking all traffic in the key oil shipping route in the Suez Canal. However, the price of crude jumped when the OPEC+ laid out a plan to unwind previous production cuts at a surprisingly slow pace.

Market-Moving News

Positive Territory Indexes

All three major U.S. stock indexes finished in positive territory in a holiday-shortened trading week, with the NASDAQ outperforming the Dow by a wide margin in a reversal of recent trends. The NASDAQ finished nearly 3% higher, the S&P 500 was up more than 1%, and the Dow rose slightly.

S&P 500 New High

The S&P 500 eclipsed 4,000 for the first time on Friday. It’s been a rapid rise to the 4,000 mark, as the index first breached 3,000 on July 12, 2019. It took nearly three times that long to rise from 2,000 to 3,000.

Growth Stocks Outperformed

For the first time in eight weeks, U.S. large-cap growth stocks outperformed their value counterparts. Some of the biggest technology stocks had a strong week for a change, while stocks of companies more sensitive to cyclical economic changes lagged.

Stock Market Calm

A measure of investors’ expectations of short-term stock market volatility fell to the lowest level in about 14 months, as the Cboe Volatility Index slipped to 17 on Thursday. Twelve months earlier, in the early days of the pandemic, the so-called VIX was above 50.

Labor Market Recovery

Friday’s labor market report delivered two positive surprises. The U.S. economy generated 916,000 jobs in March exceeding expectations and initial jobs gain estimates for January and February were revised upward by a total of 156,000.

Infrastructure Price Tag

The Biden administration detailed its financial plans to spend $2.25 trillion to improve America’s infrastructure. The cost would be covered by $2 trillion in corporate tax increases over 15 years, with the corporate tax rate rising to 28% from the current 21%.

Yield Volatility

Yields of U.S. government bonds saw little movement overall in a week that concluded a tumultuous quarter in the fixed-income market. In the first three months of 2021, the yield of the 10-year U.S. Treasury bond posted its biggest one-quarter rise since 2016. The 10-year note finished the week at 1.69%, up from 0.92% at the end of 2020.

Other Important Macro Data and Events

For the currencies, this is how they've changed since last week. The. The dollar index increased 0.13% to stay at 93.011. EUR/USD advanced 0.29%, USD/JPY declined -0.03%, GBP/USD rose 0.29%, and USD/CHF slipped -0.22%.

The 10-yr yield increased two basis points to 1.68%, although it was flirting with 1.78% early in the week.

Economic data was mostly positive, bolstered by vaccines, business reopening and fiscal stimulus. The Conference Board’s consumer confidence index surged to post its biggest monthly gain since 2003. Labor market report that the U.S. economy generated 916,000 jobs in March—far exceeding expectations—and initial jobs gain estimates for January and February were revised upward by a total of 156,000.

PMI’s figure showed U.S. manufacturing expanding at the fastest pace since 1983, while Eurozone manufacturing PMI also expanded at its fasted pace in over 25 years. Japan’s manufacturing PMI and the Tankan Large Manufacturers Index also rose better-than-expected.

Biden's plan, named "American Jobs Plan," proposes $2.25 trillion in new spending over eight years on infrastructure, manufacturing, research and development, and clean energy, among other things. This is likely the first of a two-part recovery package that could approach $4 trillion, with the second part focusing on social spending, like universal pre-kindergarten and national childcare.

The World Trade Organization (WTO) increased its projection of global GDP this year.

Core eurozone government bond yields ended higher overall. They rose early in the week with U.S Treasuries, which sold off on expectations of more U.S. fiscal stimulus and U.S. vaccination progress. However, surging coronavirus cases in Europe amid vaccine rollout challenges and widened lockdown measures in some countries, including France, drove demand for core bonds, causing yields to fall midweek onward.

Inflation in the eurozone rose in March to 1.3% from 0.9% in February. The ECB said there would be a temporary spike in inflation, which will then slow to well below the 2% target in the years ahead.

UK gilt yields rose primarily due to the sell-off in U.S. Treasuries, the efficient vaccine rollout in the UK, and the easing of restrictions in England.

What Can We Expect from the Market this Week

The path ahead for the stock market may be a bit windier. The inflation and interest rate will be a primary source of anxiety, though we don't think that will undermine the larger expansion and bull market. Nevertheless, we are still in the beginning of the recovery phase and going forward corporates are expected to deliver the required growth to catch up with the fast-rising equity markets. Reflecting back over the last one year since the start of the pandemic, a long-term strategy to investing and a disciplined approach will continue to be rewarded.

To position, consider these key drivers for the equity markets: (1) the reopening of the economy, (2) additional fiscal spending, and (3) central bank easing.

Important economic data being released this week include an inflation update, durable goods orders, the PMI composite, PPI and the trade balance.