PAST WEEK'S NEWS (Jan 17 – Jan 23, 2022)

Blue Star Foods Corp. shares spiked last week to lead the weekly gains, with most profits came on Friday, though the sudden rise was not triggered by any major catalyst. In fact, Blue Star Foods hasn’t seen any news in almost a month. In December, the company said it is buying certain assets of Gault Seafood LLC in South Carolina. The bullish trend of the stock likely due to the chatter on social media.

Revelation Biosciences shares meanwhile drop to hit its 52-week low, after the company announced its clinical phase 1b REVTx-99 study. The main goal is to evaluate the effects of REVTx-99 versus placebo on safety and tolerability. The data is expected in the Q2.

Stocks Performance

Stocks fell for the third week in a row, with major U.S. indexes posting their sharpest weekly declines since March 2020, early in the pandemic. Underperformance by technology stocks heavily weighed on the Nasdaq, as the index on Wednesday fell into a correction. The Nasdaq is down 16% from its recent high and is having the worst start of a year since 2008.

Fears that the Federal Reserve will need to act aggressively to curb inflation loomed large over sentiment. Rising interest rate fears and growth worries pushed the indices lower over the week. Also keeping a lid on risk taking were the sell-off in bonds, as the 2-year yield brushed up against 1.08% and the 10-year yield brushed up against 1.90%.

Investors are also in jittery due to concerns over the still-spiking COVID-19 cases, the elevated crude oil prices and increased political tensions over Russia-Ukraine.

The consumer discretionary sector was the weakest sector with an 8.6% decline, dragged down by the weakness in automakers and home improvement retailers. The technology stocks followed the fall, while the declines in financial giants JPMorgan Chase and Goldman Sachs took a toll on financial services shares. A more than 20% decline in Netflix shares following its Q4 earnings report contributed to the indexes’ losses on Friday. The utilities sector outperformed on a relative basis with a 0.8% decline.

Indices Performance

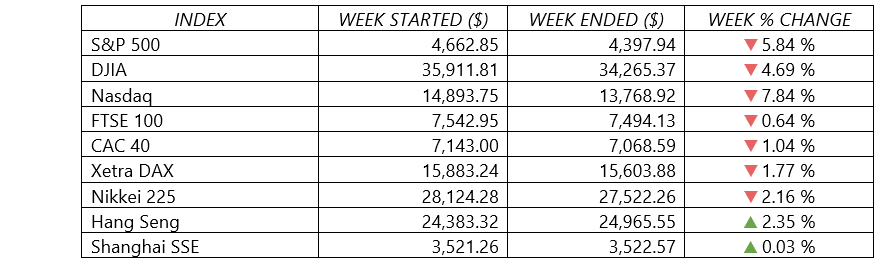

The major U.S. indexes posting their sharpest weekly declines since March 2020 over the holiday-shortened week. (Markets were closed Monday in observance of the Martin Luther King, Jr., holiday.)

Shares in Europe also ended lower, as expectations grew that the ECB would raise interest rates this year and that the BoE would also need to tighten its monetary policy.

Japan’s stock market returns were also negative for the week, amid new coronavirus infections record nationwide, with Tokyo and 12 other prefectures were under a quasi-state of emergency.

Chinese markets meanwhile bucked the overall trend, posted a weekly gain, supported as the government stepped up monetary easing measures and signalled additional support for the beleaguered property sector.

Last Monday, the PBOC unexpectedly reduced the interest rate on one-year medium-term lending facility (MLF) loans to some financial institutions by 10 basis points to 2.85%, the central bank’s first reduction since April 2020. In response, Chinese banks cut their loan prime rates for 1- and 5-year loans.

Crude Oil Performance

Oil prices rose to a seven-year high last week as investors worried about global geopolitical tensions involving major producers could exacerbate the already tight supply outlook. The Brent touched $89.50 a barrel on Thursday, its highest since October 2014, while the U.S. WTI crude futures rising to its highest since October 2014 on Wednesday.

Yemen’s Houthi rebels claimed responsibility for a deadly attack in Abu Dhabi earlier the week, leading to fresh tensions in the region and worries about possible supply disruptions. The UAE vowed to retaliate against them. UAE is OPEC's third-largest producer.

Meanwhile, Russian troops are lined up on the border of Ukraine, with the White House calling the crisis extremely dangerous and saying Russia could invade at any point. Russia is the world's second-largest oil producer.

Oil prices however, slipped on Friday, as an increase in U.S. crude and fuel stockpiles prompted investors to take profits from the rally. Gasoline inventories in the U.S. rose by 5.9 million barrels, to their highest since February 2021, according to the U.S. EIA. Meanwhile crude stockpiles rose by 515,000 barrels last week, against industry expectations.

Other Important Macro Data and Events

The latest U.S. housing market data were mixed. Housing starts and permits in December surprised to the upside, while existing home sales slumped over the month. An unexpected jump in weekly jobless claims seemed to have the biggest impact on markets. Claims rose to 286,000, the most since mid-October.

The U.S. jobs data appeared to result in the flattening of the Treasury yield curve—or the relationship between short- and long-term yields. The yield on the benchmark 10-year U.S. Treasury note hit 1.90% on Wednesday—its highest level since late 2019—but fell back sharply in the wake of Thursday morning’s weaker-than-expected jobless claims report.

Core eurozone bond yields fell as ECB President Christine Lagarde squashed expectations for an interest rate increase this year and as geopolitical tensions over Ukraine intensified. UK gilt yields ended slightly higher, as inflation at a 30-year high led to markets pricing in the higher likelihood of a BoE rate hike in February.

In China, the GDP figures made a comeback, when annual growth rates were 4.9% and 4.0%, respectively. The strong figure for the full year was in part the result of a favorable comparison to the economy’s relatively weak growth of just 2.2% in 2020 as COVID-19 initially surged. China also cut its benchmark mortgage rates on Thursday, the latest move in a round of monetary easing aimed at propping up an economy soured by the country's troubled property sector and worries over the Omicron variant of coronavirus.

The price of Bitcoin stumble for the week with most of the decline coming on Friday. The cryptocurrency fell below $40,000 for the first time in nearly six months. In early November, Bitcoin traded as high as $67,000. Bitcoin shed 16% last week and Ethereum lost 24%.

Gold prices rose for a second consecutive weekly gain in three this month as investors turned to safe-haven assets while awaiting signals of interest rate hikes from the U.S. Fed’s meeting this week.

What Can We Expect from the Market this Week

At a policy meeting on Wednesday, U.S. Federal Reserve Board members will dominate the conversation with more clarity on the end of quantitative easing anticipated and potential clues on the pace of interest rate hikes that could swing Treasury yields. While the next morning, the U.S. also due to release an initial estimate of the nation’s GDP growth rate in the recently completed Q4.

Other agenda in U.S. economic calendar in the week ahead also features updates on home price index, consumer confidence index, weekly unemployment claims, durable goods orders, pending home sales, and personal income and consumer spending.

Investors also dig in the week with the Nasdaq and S&P 500 Index coming off their worst weekly loss since March of 2020. A huge rush of earnings reports could shift the focus with the list of major companies heading into the earnings confessional including Apple, Microsoft, Tesla, Intel, McDonald's and Robinhood Markets.