PAST WEEK'S NEWS (Mar 14– Mar 20, 2022)

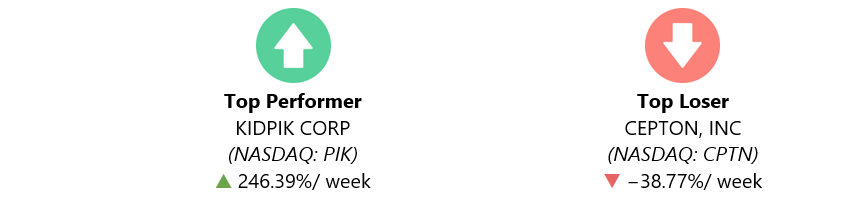

Kidpik Corp. shares jumped for the week to settle at $5.75 on Friday on continued momentum following the company's recently announced partnership with The Walt Disney Co.

Cepton's stock ended the week lower after a wild two days on Wall Street. Shares of lidar company Cepton Inc. ended the week at $4.28 after the stock more than quadrupled Thursday. The stock ended the day at $42 Thursday, up from a $9.47 close the previous day.

Stocks Performance

Last week was a big rally week for equities, ending a two-week losing streak and reclaiming much of the ground lost over the past month. With no single catalyst for the rally, markets were supported by multiple factors, including falling oil prices, news that Russia had avoided defaulting on its sovereign debt, and the outcome of the Federal Reserve’s monetary policy meeting. While fighting continued in Ukraine, investor sentiment was also buoyed during the week by continued optimistic peace talks negotiations to end the conflict.

Investors continue to weigh on the FOMC’s latest hawkish tilt policy. After two years of holding borrowing costs near zero, the U.S. Federal Reserve took the first step toward normalizing its policy last week. The announced 0.25% rate hike was the first since 2018, the first lift-off from zero since 2015, and likely the first in a series of hikes over the next two years. Looking ahead, policymakers indicated they’re inclined to raise rates at each of their six remaining policy meetings scheduled through the end of 2022. The monetary tightening campaign also continued with the Bank of England joining its U.S. Fed counterpart, raising its benchmark interest rate by another 25 basis points to 0.75%.

Indices Performance

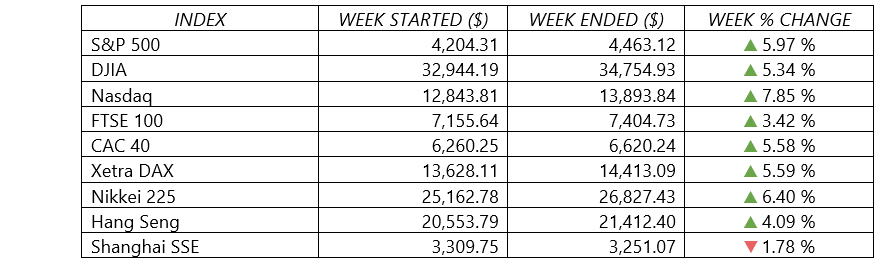

The major U.S. stock indexes posted weekly gains of 6% to 8% to recover all the ground lost in the preceding two weekly declines. Gains were widespread across the indexes, with the tech-heavy Nasdaq Composite staging the biggest rally. It was the strongest weekly result since November 2020 for the S&P 500, the NASDAQ, and the Dow.

Shares in Europe gained ground for a second consecutive week amid cautious optimism that negotiations between Russia and Ukraine could yield a peace plan. China’s announcement that it would take measures to support the economy and financial markets also appeared to boost sentiment.

Japan’s stock markets registered five consecutive days of gains, with the Nikkei 225 Index finishing the week 6.40% higher. Sentiment was supported by the Bank of Japan’s continued commitment to its dovish stance amid a global shift toward tighter monetary policy, as well as the government’s announcement that it was set to lift all remaining quasi-states of emergency given the downward trend in daily coronavirus infections.

Stocks of Chinese companies meanwhile sold off sharply amid concerns about COVID-19 outbreaks and rising geopolitical tensions, though manage to stage a partial recovery after Chinese authorities pledged economic support intended to restore investor confidence. A Hong Kong stock index dropped more than 10% over two days to its lowest closing level in more than six years before gaining more than 9% on Wednesday.

The Moscow stock exchange remained closed during the week of March 18. Despite reports that negotiations between Ukraine and Russia had made some progress toward a framework for ending the conflict, subsequent developments, and comments from the leadership of both nations appeared to raise doubts about a near-term diplomatic solution. Russia’s President Vladimir Putin reportedly told German Chancellor Olaf Scholz that Ukraine was delaying ceasefire talks with counterproductive proposals, and the Russian army stepped up its shelling of Ukrainian cities. Meanwhile, Ukraine President Volodymyr Zelensky continued to seek arms and other assistance from the West. Russian bonds rallied on Friday, buoyed by reports that the correspondent bank had processed interest payments on two of the country’s sovereign bonds and transferred the funds to the payment agent to disburse to investors. Earlier in the week, Russia had indicated that it might need to remit the payment in rubles if sanctions prevented the transaction from taking place in U.S. dollars, raising concerns about a possible default.

Crude Oil Performance

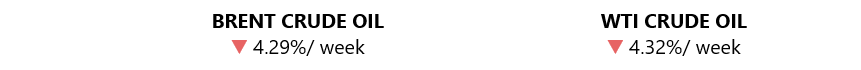

Oil prices extended their rally on Friday, rose sharply and back over $100 after slow progress in peace talks between Russia and Ukraine raised the spectre of tighter sanctions and a prolonged disruption to oil supply.

However, despite the rebound, both benchmark contracts end the week down about 4%, after having traded in a $16 range. Prices have dropped from 14-year highs hit nearly two weeks ago.

The supply crunch from sanctions on Russia, stuttering nuclear talks with Iran, dwindling oil stockpiles and worries about a surge of COVID-19 cases in China hitting demand all drove the rollercoaster ride over the week.

Other Important Macro Data and Events

Amid a rising-rate environment and high inflation, prices of government bonds fell, sending yields sharply higher for the second week in a row. Yield increases were most notable in shorter-maturity Treasuries, which are generally more sensitive to changes in monetary policy. Amid a further flattening of the Treasury curve, the 5-year yield briefly eclipsed the yield of the 10-year Treasury note during intraday trade Wednesday and did so again early Friday morning. The yield of the 10-year U.S. Treasury bond climbed to about 2.15% on Friday—the highest level in nearly three years, and up from 1.73% just two weeks earlier.

In Europe, the core eurozone bond yields climbed modestly. The benchmark German 10-year bund yield at first rose on hoped of progress in Ukraine-Russia peace talks and growing expectations that central banks would pursue more-hawkish policies to quell surging inflation. Yields moderated after ceasefire negotiations appeared to stall.

The UK central bank on Thursday raised its key interest rate for the third time over the course of three policy meetings. With U.K. inflation recently hitting a 30-year high, the BoE lifted its key rate to 0.75% from 0.50% and said further increases might be needed over the coming months.

Besides the Fed’s announcement, economic data seemed to have a limited impact on markets. February retail sales were disappointing, although the January numbers were revised upward. Continuing claims for unemployment insurance fell to a 52-year low, showing continued strength in the labor market. In a possible sign of peaking inflation, the headline producer price index decelerated during the month of February and the gain in core prices held steady with January’s pace. Meanwhile, mortgage rates in the U.S. soared, surpassing 4% for the first time in almost three years.

Meanwhile in Japan, the BoJ’s March monetary policy meeting reaffirmed the central bank’s stance as among the most dovish in the world. The BoJ maintained its short-term policy interest rate at -0.1% and its target for the 10-year JGB yield at around 0%. It will continue with quantitative and qualitative monetary easing with yield curve control as long as it is necessary to achieve and maintain its price stability target of 2%. Japan’s core consumer prices rose 0.6% year-on-year in February, as energy costs soared due to higher oil prices.

Gold has failed to get much of a lift from safe-haven flows or inflation concerns, losing more than 3% last week.

What Can We Expect from the Market this Week

The stock market is likely to face more twists and turns in the Russia-Ukraine drama, leaving investors clutching at hopes for an eventual peace deal, adding to investor anxiety over the pace and impact of interest rate hikes and inflation trends.

A key question is whether last week’s stock rebound and moderation in volatility are durable.

Investors will be awaiting a speech later Monday (March 21) by Federal Reserve Chair Jerome Powell, less than a week after he and his colleagues kicked off a campaign of interest-rate hikes to fight the highest inflation in a generation. Markets expect the Fed to lift its target rate to around 2% by the end of this year.

Important economic data being released this week include the PMI index, new home sales, unemployment claims and building permits.