[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.21852 and 1.22092.

- Support line of 1.21076 and 1.20836.

Commentary/ Reason:

- The euro little changed on Tuesday, to stay at $1.2149, trading near a weekly high touched on Monday, and is just below the 2-1/2 year high from December 4.

- U.S. dollar fell at the open of trade, with progress on COVID-19 vaccines lifting risk appetite. The euro also firmed as Britain and the EU agreed to continue talks on post-Brexit trade beyond Sunday's deadline.

- Meanwhile for dollar, an added hurdle will be when Federal Reserve's policy meeting on Dec. 15-16. The market is assuming the central bank will merely refine its forward guidance on policy rather than buying more bonds or "twisting" its portfolio to add more longer-dated debt.

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.89007 and 0.89204.

- Support line of 0.88368 and 0.88170.

Commentary/ Reason:

- The dollar was little changed on Tuesday against the Swiss franc, to stay at 0.8869 against the Swiss franc, not far from 0.8850, a 5-year low touched overnight.

[GBPUSD]

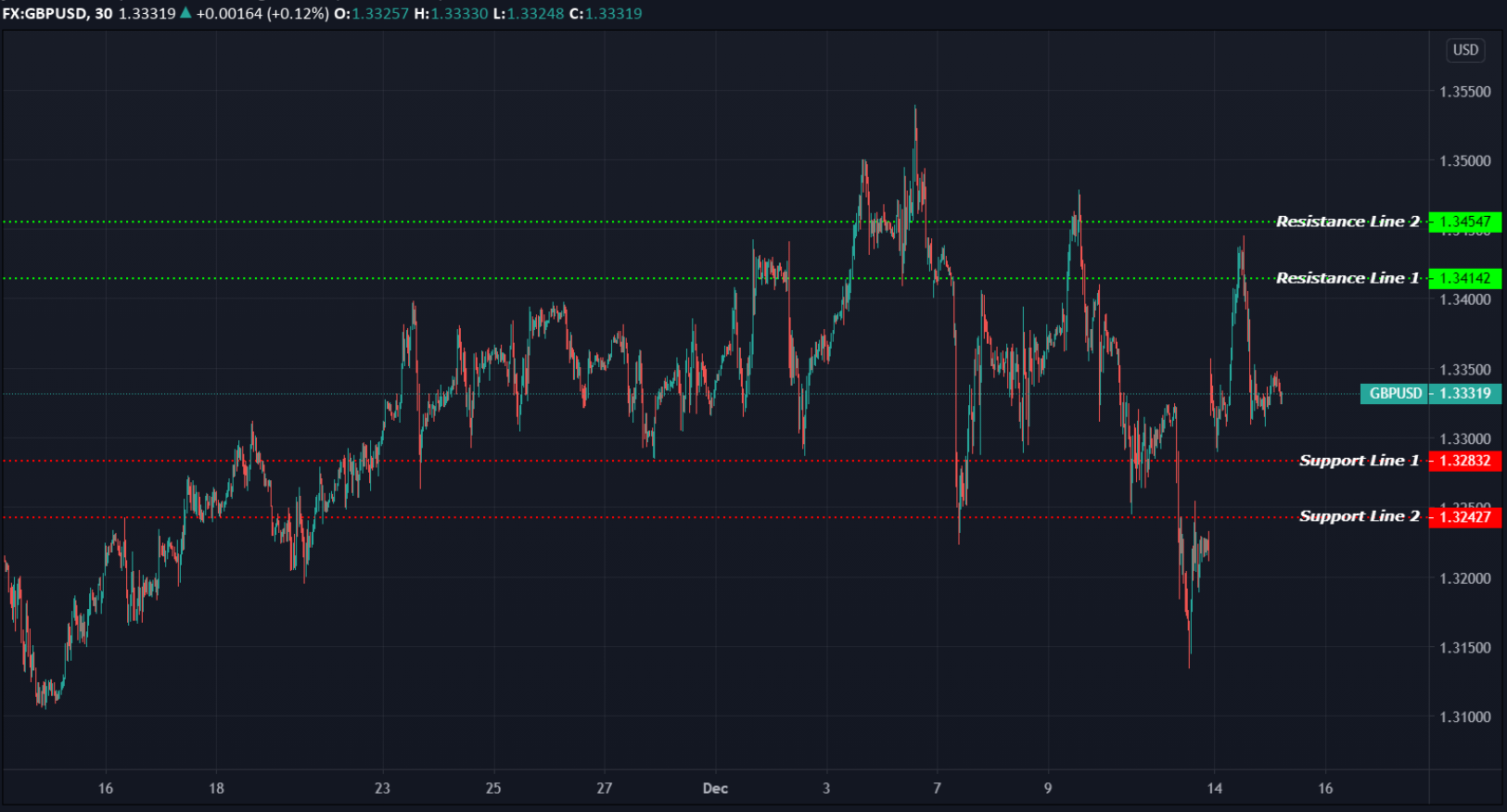

Important Levels to Watch for:

- Resistance line of 1.34142 and 1.34547.

- Support line of 1.32823 and 1.32427.

Commentary/ Reason:

- The British pound added 0.12% against the dollar at $1.3319, rising as the UK and Europe agreed to carry on with the Brexit talks. It reached a 2 1/2-year high of $1.3540 earlier this month.

- U.S. dollar fell at the open of European trade, with progress on COVID-19 vaccines lifting risk appetite.

- The EU Brexit negotiator, Michel Barnier, said today that sealing a new pact with Britain was still possible as the date for the country's departure from the bloc edged nearer.

- Tighter COVID-19 restrictions is expected to be imposed on London as the government citing increased infection rates that may be partly linked to a new variant of the coronavirus.

- The elusive trade agreement will end on Dec 31. If by then there is no agreement to protect around US$1 trillion in annual trade from tariffs and quotas, businesses on both sides would be hit hard.