PAST WEEK'S NEWS (NOVEMBER 06 – NOVEMBER 10, 2023)

The Fed chief cautions that victory over inflation is uncertain, despite recent encouraging signs. Though gratified by cooling prices, policymakers remain unconvinced their tightening stance has fully lowered demand, hinting hikes may still come. Powell pledged continued vigilance and was willing to act if needed to reach the 2% target, warning markets against premature Fed pivot hopes. Stocks stumbled on his hawkish tone as Treasury yields climbed, with traders reassessing forecasts for 2023 rate cuts. Powell walked a nuanced line, recognising the risks of overtightening but making clear that the inflation fight continues despite economic resilience.

As President Biden and China's Xi Jinping prepare for a high-stakes meeting, tensions simmer between the superpowers over Taiwan, the economy, and more. However, both desire reduced pressure and seek progress on Ukraine, Israel-Hamas, and military de-escalation. Outcomes remain uncertain, but Xi could leverage Chinese influence on issues like Iran for concessions from the U.S. Meanwhile, hosting the Asia-Pacific Economic Cooperation summit brings San Francisco $53 million, although its downtown despair persists despite recent clean-up efforts. Ultimately, the leaders hope their summit leads to diplomacy, but major differences persist on numerous fronts.

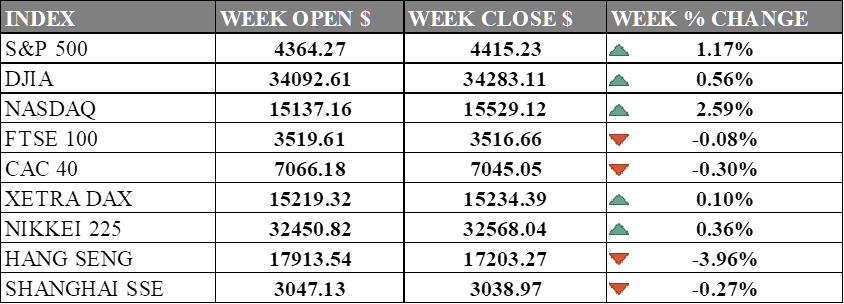

INDICES PERFORMANCE

The major U.S. stock indexes ended higher last week amid stabilization of Treasury yields ahead of inflation reading. The S&P 500 climbed 1.17% to close at 4415.23, up from its open of 4364.27. The Dow Jones Industrial Average rose 0.56% to finish at 34283.11 compared to its starting point of 34092.61. The tech-heavy NASDAQ posted the largest gain, surging 2.59% to 15529.12 after opening the week at 15137.16. The advance was fuelled by heavyweight tech and growth stocks. Diminished bets for a December rate hike has also contributed to the market's recovery and the gains in major indexes.

In Europe, the major indexes barely moved. The UK's FTSE 100 fell 0.08% to close at 3516.66 compared to its open of 3519.61. France's CAC 40 slipped 0.30% to end the week at 7045.05 after opening at 7066.18. Germany's DAX ticked up 0.10% to settle at 15234.39 from its starting point of 15219.32. The UK economy stagnated in the third quarter, with initial figures showing no growth in the three months to the end of September. Investors were awaiting data for clarity on the economic outlook namely Eurozone inflation data.

Asian indexes were mixed on the week. Japan's Nikkei 225 gained 0.36%, closing at 32568.04 versus its open of 32450.82. Hong Kong's Hang Seng plunged -3.96% to finish at 17203.27 from its starting level of 17913.54. China's Shanghai Composite slipped -0.27% to close at 3038.97 compared to its open of 3047.13. China's largest chipmaker, SMIC, posted an 80% drop in third-quarter profit due to global demand weakness, which had a negative impact on the market. Negative sentiment in the U.S. markets had a spillover effect on the Asian markets, contributing to the overall decline.

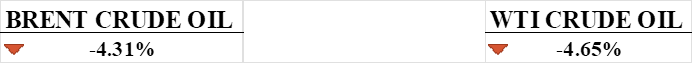

CRUDE OIL PERFORMANCE

Plummeting crude prices reached lows of $75/barrel as OPEC+ oil exports rise ahead of a key meeting, while speculative buyers flee the market amid economic uncertainties. Persistently high inflation data fuels expectations of sustained Fed tightening, further dampening demand as China reports soft economic figures and reduced crude imports. Major funds rapidly unwind long positions, with net speculative length approaching 2011 lows, as leading managers point to vanishing physical market strength despite upbeat demand revisions. technical signals turn bearish as WTI breaks the 200-day moving average, facing resistance at $78 and $80 on any rebounds from oversold territory near $75.

OTHER IMPORTANT MACRO DATA AND EVENTS

The still-snug labour market shows faint fraying as jobless claims creep up and hiring cools, prompting the Fed to hit pause on rate hikes while inflation gently retreats. Though resilient, cracks emerge in America's robust job engine as vacancies contract and the unemployed struggle more to find work, putting rate cuts on the horizon for when price rises sufficiently recede.

Britain's frothy housing market deflates as asking prices plunge the most in years, squeezed by the vice of rising mortgage rates and waning demand as affordability erodes for many buyers. The boom turns to bust as the once red-hot property sector rapidly cools, with sales slumping below pre-pandemic levels as more homes come to market but fewer can afford the now lofty prices.

China's consumer and producer prices declined in October, pointing to weak domestic demand as exports contracted, foreign investment turned negative, and PMIs signalled contraction; despite supportive measures by authorities, risks remain from the property crisis, local debt, and policy divergence with the West.

What Can We Expect from The Market This Week

US CPI October: measure of changes in prices paid by consumers for goods and services, with the median estimate for the CPI for October 2023 being 3.3% year-over-year. The index for shelter was the largest contributor to the monthly increase in all items, accounting for over half of the increase in September. The estimate is possible as the price of oil declined 9% in October.

US Retail Sales: measures the total receipts of retail stores in the United States. Reported figures have been beating expectations, suggesting that analysts have been underestimating retail sales figures, which are currently at 0.7% and expecting -0.1%.

Japan GDP Q3: Japan's economy is expected to have contracted in the July–September period, marking the first decline in four quarters. This downturn is attributed to subdued consumption and exports. The challenges include accelerating inflation and reduced demand in China, which are negatively impacting Japan's fragile economic recovery.

US Building Permits: Measures the change in the number of new building permits issued by the government. Recent data for US building permits indicates a decline, with the current level at 1.471 million, down from 1.473 million last month. It suggests a grim outlook for the future performance of the construction industry and the overall economy.

Eurozone CPI: Measure consumer price inflation in the euro area. Inflation in the euro zone fell to its lowest level in two years in September, with consumer prices rising by 4.3% from the previous year, the slowest pace since October 2021. The expectation for October sits lower at 2.9%, an ambitious figure that was reported but revised last month.