Stocks Performance (U.S. Stocks)

Major world stock markets retreated last week as positive news on vaccines and government economic stimulus was countered by rising US-China tensions and an unexpected rise in US unemployment claims.

Within the mega-caps, Microsoft (NASDAQ: MSFT) and Tesla (NASDAQ: TSLA) reported better-than-expected earnings results, but disappointing earnings reactions appeared to cause concern about similar responses in Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG), and Facebook (NASDAQ: FB) when they report given their huge runs off their March lows.

Investors were also provided with positive COVID-19 vaccine data from the Pfizer (NYSE: PFE) and BioNTech (NASDAQ: BNTX) collaboration and the AstraZeneca (LON: AZN) and the University of Oxford collaboration. In addition, Pfizer and BioNTech secured a $1.95 billion vaccine supply agreement with the U.S. government upon FDA approval

By sectors, the most outperformed weekly stocks were led by Non-Energy Minerals at 2.41%, followed by Distribution Services at 1.98%, Consumer Non-Durables at 1.59%, and Energy Minerals (1.47%). Meanwhile, the weakest sectors were from the Health Technology sector (-1.97%), Transportations (-1.28%), Commercial Services (-1.20%), and Consumer Durables (-1.17%).

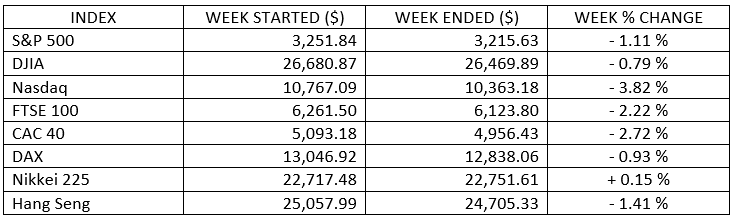

Indices Performance

The week started with a mega-cap rally that powered the Nasdaq Composite to new heights, but the rest of the week saw money flow out of these mega-cap stocks following earnings. The Nasdaq ended the week down 1.3% for its second straight weekly decline

Sentiment in Europe received a boost when European Union leaders agreed on creating a fund to help countries most affected by COVID-19. Nevertheless, all major stock markets fell. German stocks held up best, while Italy and Spain, the biggest beneficiaries of the fund, both underperformed. Most Asian markets also declined. Japan was spared the late week sell-off because its markets were closed Thursday and Friday for national holidays.

Oil Sector Performance

A falling US dollar added to the upward pressure on crude oil prices, though the prices rallied early in the week.

Brent is on track for a fourth straight monthly gain in July while WTI is set to rise for a third month as unprecedented supply cuts from the OPEC and its allies including Russia, as well as in the U.S., propped up prices.

Market-Moving News

U.S.A vs China Tensions

The world’s two largest economies were at odds with one another much of the week, generating anxiety among investors. The U.S. ordered China to close a consulate in Houston, and China responded by announcing plans to close a U.S. consulate in Chengdu. In addition, U.S. Secretary of State Mike Pompeo delivered a speech that was highly critical of China.

Gold's Record Breaking

Gold prices set a record high for the first time in nine years. Gold futures climbed to $1,900 per ounce on Friday, eclipsing a record set in 2011. Investors have also been bidding up shares of gold mining companies. Silver prices hit a nearly seven-year high.

Stocks Modest Retreat

The S&P 500 and the Dow slipped, breaking a string of three weekly gains in a row, while the NASDAQ underperformed its peers, recording its second consecutive weekly decline. Momentum shifted, as the market’s gains early in the week were offset by declines on Thursday and Friday.

Tech Stocks Retreated

For the second week in a row, a handful of the biggest technology stocks weighed on the broader U.S. market, and the tech-oriented NASDAQ again underperformed the S&P 500 and the Dow. The market segment’s slump reflects concerns that many tech names have become overvalued after outperforming by a wide margin year to date.

Earnings Bump

Q2 earnings are coming in a bit better than expected, based on results from the roughly one-quarter of S&P 500 companies that had released numbers as of Friday.

Homebuying Comeback

The U.S. housing market is posting record MoM growth after falling sharply in the spring as a result of the coronavirus pandemic. Sales of existing homes jumped 21% in June, compared with the previous month, according to the National Association of Realtors. That’s the largest monthly increase since tracking of the data began in 1968.

Other Important Macro Data and Events

A falling US dollar added to the upward pressure on gold prices and other commodities, including crude oil. The weaker US greenback boosted several currencies such as the Euro, Canadian dollar and Swiss franc to its highest level since some time.

In other developments, the EU agreed to a €750 billion fiscal stimulus package, U.S. weekly initial jobless claims increased by 109,000 to 1.416 million, China ordered the closure of the U.S. consulate in Chengdu in response to the U.S. ordering the closure of the Chinese consulate in Houston, and a GOP coronavirus relief bill was delayed until next week.

U.S. Treasuries were mixed this week. The 2-yr yield remained unchanged at 0.14%, while the 10-yr yield declined four basis points to 0.58%. Gold futures settled at their highest price ever at $1897.50/ozt amid a 1.6% decline in the U.S. Dollar Index at 94.40.

What We Can Expect from the Market this Week

The earnings season will take center stage, with almost 40% of the S&P 500 companies reporting Q2 results.

GDP ahead: The U.S. government’s initial report Thursday on Q2 GDP is likely to be the most closely watched economic release of the week. Economists’ estimates vary widely because of the uncertainty from COVID-19. In this year’s first quarter, GDP shrank by 5.0%, the worst since late 2008.

Important economic news coming out this week includes durable goods orders on Monday, Federal Reserve policy meeting and Consumer Confidence Index on Tuesday, pending home sales on Wednesday, weekly unemployment claims and Q2 GDP estimate on Thursday, and personal income and consumer spending on Friday.

We believe the pace of improvement in economic data will likely slow as coronavirus cases continue to rise, but the continuing fiscal and monetary stimulus will play a crucial role in supporting the expansion until a vaccine is discovered.