PAST WEEK'S NEWS (Oct 18 – Oct 24, 2021)

Digital World Acquisition soared after the company on Wednesday announced a deal to merge with Trump Media & Technology Group. The combined company intends to launch a new social network to compete with the likes of Facebook and Twitter. Trading in the stock was halted due to volatility multiple times. Friday’s rally brought the SPAC’s two-day gains to more than 800%.

The news also appeared to spark investors' interest in Phunware (NASDAQ:PHUN). The advertising software company reportedly worked with Trump's re-election campaign to develop mobile apps, bringing its gains last week to nearly 750%. Traders appear to be betting that Phunware could play a role in the creation of Trump's new social network, though there have been no reports of a partnership between Phunware and Digital World Acquisition.

Shares of the clinical-stage biotech Atea Pharmaceuticals plummeted after announcing that its oral antiviral pill failed to reduce the amount of circulating SARS-CoV-2 virus in patients with mild or moderate cases compared to patients who received a placebo.

Stocks Performance

Favourable earnings momentum helped offset concerns about inflation, Fed asset purchase tapering, and supply chain constraints, helping lift sentiment of global stock market. The third-quarter earnings season is off to a solid start, with investors paying close attention to how higher energy and raw materials prices were affecting the Q3 profits and future guidance.

Hopes for additional fiscal stimulus also appeared to bolster sentiment. Negotiations continued between Democrats in the U.S. Senate over the size of the Biden administration’s proposed social infrastructure bill.

The global stocks also lifted after the China Evergrande Group reportedly had wired funds to a trustee account on Thursday for a bond interest payment due Sept. 23, a deadline that would have plunged the embattled developer into formal default.

On the other hand, with monetary policy remaining in focus, bonds have been pressured, sending the 10-year yield hit the highest since May amid concerns around persisting inflation.

Along with real estate and utilities stocks, healthcare sector led the gains, boosted by insurance providers. Communication services shares were strong through much of the week, but social media stocks dropped sharply on Friday following downward guidance from Snapchat parent Snap, which the company blamed on new privacy settings on Apple’s iPhones. Energy shares also underperformed.

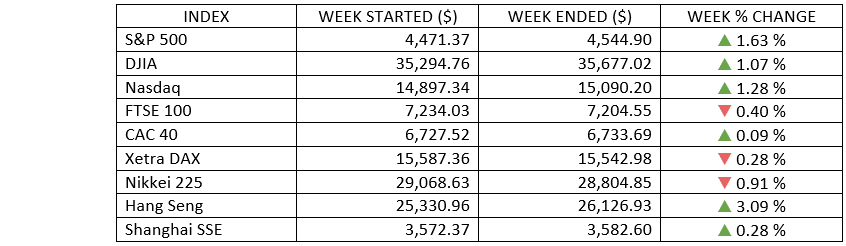

Indices Performance

The major U.S. stock indexes traded higher throughout much of the week. The S&P 500 notched a seven-day winning streak, set intraday and closing record highs together with the Dow Jones Industrial Average.

Japan’s stock market registered losses for the week, ahead of its October 31 general election. China’s stock markets advanced after fears about the property sector and China Evergrande Group were calmed after the company made a delayed coupon payment. Chinese stocks got off to a weak start after data released Monday showed that the country’s GDP rose a lower-than-expected 4.9% in the Q3 as power shortages and property sector curbs reined in expansion.

Oil Sector Performance

Oil markets hit multi-year highs earlier in the week on the back of a global coal and gas crunch, before ends flat as coal and gas prices eased, curbing fuel-switching which had stoked demand for oil products for power.

U.S. crude and fuel inventories data showing stockpiles tightened further, with supplies of gasoline hitting a two-year low. On Wednesday, the U.S. Energy Information Administration said U.S. crude stocks fell by 431,000 barrels in the week to Oct. 15 to 426.5 million barrels, against expectations for an increase. Gasoline stocks fell by 5.4 million barrels in the week to 217.7 million barrels, the lowest since November 2019, while distillate stocks fell to levels not seen since April 2020.

Other Important Macro Data and Events

U.S. Treasury yields increased through most of the week, with the 10-year U.S. Treasury note yield reached as high as 1.69% on Friday morning, up from 1.59% the previous week and a five-month high. However, the yield slipped in the afternoon following public comments from Federal Reserve Chair Jerome Powell, that said that the U.S. central bank was on track to begin reducing its asset purchases soon. However, he said it’s not yet time to raise interest rates because employment levels are still too low.

The 2-yr yield rose seven basis points to 0.47%, and the U.S. dollar Index fell 0.3% to 93.62.

The week’s economic data were mixed. In housing sector, both housing starts and building permits came in well below expectations on Tuesday, while existing home sales, reported Thursday, jumped unexpectedly to their highest level since January. Industrial production fell 1.3% in September, weekly and continuing jobless claims fell more than consensus expectations and reached new pandemic-era lows.

Core eurozone bond yields climbed as continued hawkishness among some major central banks spurred concerns that rate increases might come sooner than previously expected in the Eurozone. UK yields also jumped after Governor Andrew Bailey said that the BoE would “have to act” if inflationary pressures prove persistent, raising expectations of a rate increase as early as next month.

UK inflation unexpectedly slowed to 3.1% year over year in September, down from the 3.2% registered in August but still well above the BoE’s 2% target.

In cryptocurrencies, Bitcoin climbed to a record high on Wednesday, a day after the first U.S. bitcoin futures-based ETF began trading. The ProShares Bitcoin Strategy ETF closed up 2.59% at $41.94 in its first day of trading, with around $1 billion worth of shares trading hands on Intercontinental Exchange Inc's NYSE Arca exchange under the ticker BITO.

What Can We Expect from the Market this Week

Big tech companies Apple, Amazon, Facebook, Alphabet and Microsoft dominate a huge week of earnings this week with over 25% of the S&P 500 constituents due to step into the earnings reporting.

In Washington, negotiations continued between Democrats in the U.S. Senate. A vote on the infrastructure and a trimmed down reconciliation spending proposal expected will go to a vote.

The U.S. initial estimate of Q3 GDP growth is scheduled to be released Thursday. The growth figure will show how much of a negative impact the Delta variant and supply chain disruptions had on growth in the latest quarter. In the Q2, GDP rose at a 6.7% annual rate. Meanwhile the GDP growth for Eurozone is scheduled a day later.

Another important U.S. economic data being released this week include the new home sales and pending home sales, consumer confidence, durable goods orders, and personal income and spending.