PAST WEEK'S NEWS (January 20 – January 24)

Upon taking the oath of office, President Trump immediately enacted a sweeping series of executive orders that marked a distinct transition from previous U.S. policies. In a bold move to advance his "America First" agenda, he nullified 78 Biden-era directives. The administration had also implemented a temporary freeze on new regulations while instituting a federal hiring pause, aimed at optimising government efficiency and requiring federal employees to return to in-person work full-time. Internationally, Trump took decisive steps to withdraw American participation from both the Paris Climate Agreement and the World Health Organisation, citing the need to strengthen national sovereignty and unfair contribution volume compared to other constituents. The executive actions extend to several other key areas, introducing measures to combat rising costs of living, enhance free speech protections, and strengthen border policies. These comprehensive changes reflect a broad strategy to reshape American policy, with particular emphasis on achieving energy independence and bolstering national security.

The Bank of Japan just lifted interest rates to 0.5%, their highest level since the 2008 financial crisis, with growing confidence that rising wages and consumer prices can sustain inflation near their 2% target. Policymakers see a path to ending Japan’s decades-long battle with stagnant growth and deflation—though one board member pushed back, arguing the economy still needs more support, even with companies promising another round of strong pay hikes this spring. The central bank also bumped up its inflation forecasts for the next three years, pointing to higher food and energy costs, a weaker yen, and labour shortages as key drivers pushing prices higher. Markets remain wary of global trade risks under the new U.S. administration and whether Japan can keep raising rates without derailing its fragile economic recovery. Governor Kazuo Ueda stressed future moves depend on how the economy holds up, leaving the door open for more hikes but avoiding any firm commitments.

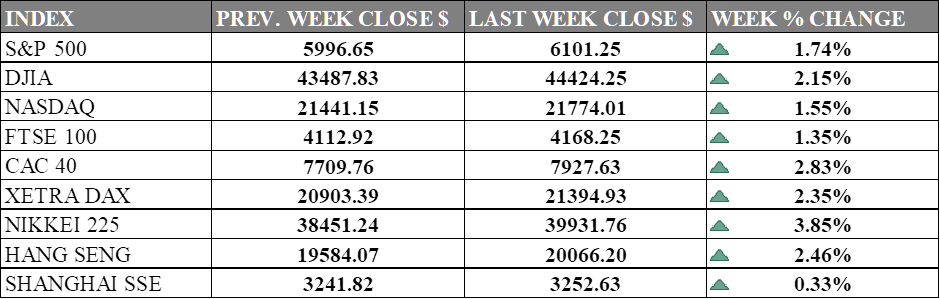

INDICES PERFORMANCE

Wall Street ended the week with notable gains across major indices. The S&P 500 rose 1.74% to close at 6,101.25. The Dow Jones Industrial Average (DJIA) climbed 2.15%, finishing at 44,424.25, while the Nasdaq posted a smaller increase of 1.55% to close at 21,774.01. This uptick was supported by favourable inflation data and strong earnings from major banks, which improved investor sentiment. However, concerns over emerging competition from Chinese AI companies like DeepSeek became a risk to tech-heavy Nasdaq that could collapse if investor pull out their trillion-dollar investment into AI boom.

European markets also showed strength. The UK's FTSE 100 gained 1.35%, closing at 4,168.25. France's CAC 40 saw a notable rise, increasing 2.83% to close at 7,927.63. Germany's XETRA DAX advanced by 2.35%, ending at 21,394.93. The positive sentiment can be contributed to corporate developments and broader economic conditions such as projection of a lower interest rate environment that will support growth.

Asian markets performed strongly as well. Japan's Nikkei 225 led the gains, surging 3.85% to close at 39,931.76. Hong Kong's Hang Seng Index rose 2.46% to finish at 20,066.20, while the Shanghai Composite Index in mainland China edged up 0.33% to end at 3,252.63. Japan market were supported by bank of Japan decision to increase interest rates while the Chinese market performed on gains in technology and financial sectors.

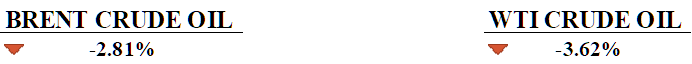

CRUDE OIL PERFORMANCE

Oil markets ended their four-week winning streak as Brent crude settled at $78.44 and WTI at $74.53, posting weekly declines of 2.8% and 3.6% respectively. President Trump's demands for OPEC to lower prices to pressure Russia and potentially end the Ukraine war contributed to lower expenditure, though OPEC+ has shown no immediate signs of changing its production policy. Market fundamentals revealed U.S. crude inventories hitting their lowest levels since March 2022, providing some bullish support. Saudi Aramco's CEO Amin Nasser projects healthy market conditions ahead, forecasting global oil demand growth of 1.3 million barrels per day this year. In a notable development, Saudi Aramco made its first purchase of WTI Midland crude, highlighting the grade's growing importance since its inclusion in the dated Brent benchmark in June 2023.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. business activity hit a 9-month low in January as rising costs kept inflation concerns alive. But hiring surged to the highest in 2.5 years, with businesses, especially in services, adding jobs thanks to an improved outlook.

Trump questioned if the U.S. should spend anything on NATO, saying, “We’re protecting them; they’re not protecting us.” He pushed for NATO allies to raise defence spending from 2% to 5% of GDP, a move experts call unrealistic.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The Fed is not expected to issue any rate cuts until June with the current projection, although there is political pressure from President Donald Trump, the man who "hired" the current federal reserve chairman. Domestic risk with heightened labour disruption from ICE raids and deportation will likely become significant in the near term.

BoC Interest Rate Decision: The Bank of Canada is projected to gradually cut its interest rate with headline inflation reaching the desired level, although core inflation and wage growth may limit the pace of easing. CIBC projects a 100 bps cut for 2025 in four sequences.

ECB Interest Rate Decision: The European Central Bank is likely to continue reducing its rate by another 25 basis points, although its services inflation is flat at 4%. Dax rising for the 5th consecutive week makes it seem likely, although the Trump tariff threat remains a risk.

US GDP Q4: Preliminary data on U.S. economic growth is expected to come in lower at 2.7% from 3.1% in Q3, mainly due to weaker retail sales in December and reduced contribution from private inventory investment in the new Fed's GDPNow model.

US PCE Price Index: Household consumption index is nearing the Fed's 2% target back in October before rising back to 2.4% and core figures higher at 2.8%. Service inflation and wage growth have become the main focus for the Fed, with risks tilted toward fewer cuts as projections skew away from the target.