PAST WEEK'S NEWS (April 07 – April 11)

Mayhem in the bond market as Trump's tariff policies take centre stage. At first, tensions in the world’s biggest debt market sparked a sell‑off in both stocks and Treasuries, sending the 10-year yields spiking as traders braced for the economic fallout. The narrative shifted dramatically when Trump paused his higher reciprocal tariffs in the afternoon, posting on Truth Social to buy, igniting a risk-on bonanza that sent the market into a frenzy buying. This policy reversal recovered Treasury yields to "normalised" levels as traders reduced expected Federal Reserve rate cuts from four to three by year-end, while thirty-year yields dropped as inflation fears subsided. The chaos intensified as investors unwound leveraged bond bets, a move Trump acknowledged in his comments, further amplifying the market’s volatility. Ultimately, the bond market may become the only stopping force for further tariff measures, highlighting the more complex market dynamic than Trump might have hoped for.

Following the U.S. imposition of "reciprocal" tariffs on numerous countries, the global reaction has not been pleasant. Countries such as Vietnam, South Korea, Thailand, Japan, Mexico, Canada, the U.K., India, and Australia have shown a willingness to negotiate with the U.S., seeking to lessen the tariffs' economic impact, with Vietnam even offering to eliminate all its tariffs in a potential deal. In contrast, China has adopted a hostile stance, imposing retaliatory tariffs of 34% on U.S. imports and suspending negotiations related to TikTok's sale and rare earth export bans and taking a public stance against "blackmail". The European Union and Canada, while preparing countermeasures—such as Canada’s reciprocal tariffs on $21 billion of U.S. goods—remain open to dialogue to resolve the trade tensions, whereas Brazil has passed legislation enabling retaliation against any nation imposing tariffs on its goods. This varied landscape highlights the complex strategies nations are employing in response to the U.S. tariff policies, and Trump's hope for the "best deal" might just happen.

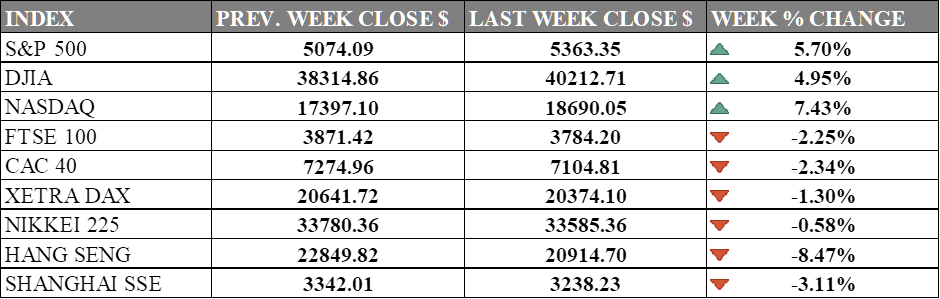

INDICES PERFORMANCE

Wall Street experienced a dramatic recovery rally last week. The S&P 500 surged by 5.70%, closing at 5363.35, reflecting significant broad market strength. The Dow Jones Industrial Average (DJIA) saw a substantial gain of 4.95%, finishing at 40212.71, showing resilience amid market optimism. Meanwhile, the Nasdaq led with an impressive advance of 7.43%, closing at 18690.05, as tech stocks commanded strong buying interest. This sharp upward movement suggests renewed investor confidence rather than mere short-covering.

European markets diverged from the global rally. The UK's FTSE 100 declined by 2.25%, closing at 3784.20. France's CAC 40 experienced a decrease of 2.34%, ending at 7104.81, while Germany's XETRA DAX declined by 1.30%, closing at 20374.10. European markets appear to be responding to regional economic concerns despite the positive sentiment in U.S. markets.

Asian markets also showed weakness, with varying intensity. Japan's Nikkei 225 posted a modest loss of 0.58%, closing at 33585.36. Hong Kong's Hang Seng Index showed significant vulnerability, falling by 8.47%, finishing at 20914.70. In mainland China, the Shanghai Composite Index declined by 3.11%, ending at 3238.23, potentially reflecting concerns about economic growth and regional tensions especially in tech where most vital resources are still imported from the states.

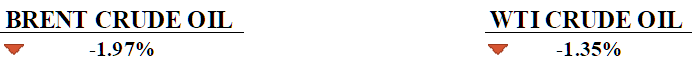

CRUDE OIL PERFORMANCE

WTI crude oil settled at $61.43 per barrel on Friday, up 2% for the day but down 1.35% for the week, while Brent crude rose 2% to $64.65 but recorded a 1.97% weekly loss. Friday's gains were mainly supported by factors such as weakening dollar, U.S. Energy Secretary Chris Wright's comments about blocking Iran's 1.6 million barrels per day exports, and ongoing Middle East tensions. However, the escalating trade war between the U.S. and China—with tariffs reaching 145% and 125% respectively, created significant headwinds for oil prices by threatening global economic growth and energy demand. The Energy Information Administration responded by cutting its 2025 global oil demand growth forecast from 1.3 million to 0.9 million barrels per day, while also projecting inventory builds beginning in the current quarter. Adding to market concerns, OPEC+ is proceeding with plans to increase production by 411,000 barrels per day in May even with weakening outlook.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer sentiment fell 11% in April to its lowest since 2009, as inflation fears and escalating trade tensions raises recession worries and widespread pessimism about the economy.

U.S. consumer prices fell to 2.4% and monthly prices dipping 0.1%, as falling gas costs offset food and utility hikes, though the data preceded Trump's tariff delays and did not reflect his latest move to raise China-specific levies to 125%.

What Can We Expect from The Market This Week

ECB Interest Rate Decision: The European Central Bank last cut its key deposit facility rate by 25 basis points to 2.65% in March, marking its sixth rate cut since June 2024 as monetary policy becomes "meaningfully less restrictive". The ECB revises its inflation forecast upward to 2.3% for 2025 while lowering economic growth projections to 0.9%, expected to cut another 25 bps to 2.40%.

Fed Chair Powell Speech: at the Economic Club of Chicago, Federal Reserve Chairman Jerome Powell will be delivering a speech regarding economic outlook, potentially discussing the recent tariff and falling value of the dollar.

OPEC Monthly Report: Oil prices declined to around $70/bbl in February and early March as OPEC+ announced plans to start unwinding voluntary production cuts in April, with current projections suggesting global oil supply may exceed demand by around 600 kb/d this year in conjunction with an escalating trade war between the two biggest economies.

UK CPI March: The Kingdom's inflation is currently at 2.8%, down from 3.0% in January, with the official March figures forecast to fall to 2.7%. According to Bank of England forecasts, inflation is expected to rise in the coming months, potentially spiking to 3.7% between July and September 2025, while the central bank has maintained its interest rate at 4.5% in its March meeting.

BoC Interest Rate Decision: The Bank of Canada cut its key interest rate to 2.75% at its March meeting, its second cut this year after another in January. TD Economics is forecasting another cut thanks to U.S.-imposed tariffs on Canadian exports, while projecting the BoC will eventually bring its lending rate down to around 2% by the end of 2025.