PAST WEEK'S NEWS (July 11 – August 15)

The Bank of Japan's monetary policy outlook came into focus after Nikkei retreated 2.2% from record highs, with growing speculation regarding its future interest rate. U.S. Treasury Secretary Scott Bessent's assertion that the BOJ is "behind the curve" in monetary policy management intensified market concerns about imminent policy tightening. The central bank now faces pressure to abandon its current inflation gauge tied to domestic demand and wage growth, which has so far prevented further monetary tightening efforts. Currency market dynamics reflected these policy expectations, with the yen gaining against the dollar as Federal Reserve rate cut bets increased, creating opportunities for Japanese exporters across multiple sectors. The policy risk might prompt widespread profit-taking after the market's recent 9% rally, though a restart in carry trade unwinding could drag the global market down.

The POTUS chickened out once again on his China trade showdown, signing a 90-day extension Monday after failing to meet his own August 12 deadline for a permanent deal. Both countries will keep their painful but manageable tariffs in place, which are 30-50% on Chinese goods and 10-20% on U.S. products. Rather than risk the economic chaos that nearly destroyed global markets when tariffs hit triple digits earlier this year, they decided to probably keep it in perpetuity to blindside stable trade. China quickly matched the extension, keeping rare earth minerals flowing to America while the U.S. maintains chip technology exports, essentially admitting both sides need each other too much to follow through on their threats. The move buys time for negotiations on soybeans, fentanyl cooperation, and other trade issues, but experts expect this grinding trade war to drag on for years with little real progress.

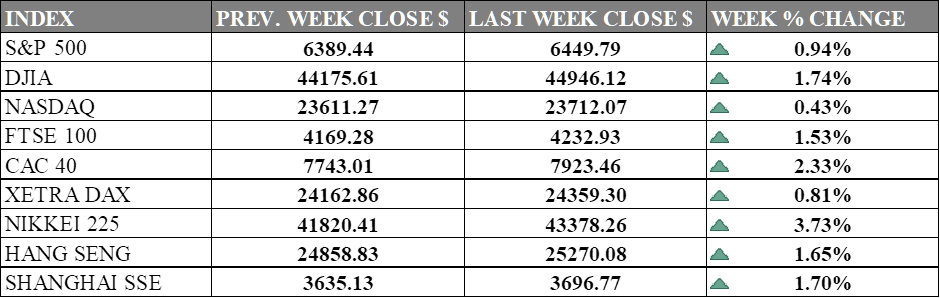

INDICES PERFORMANCE

Wall Street major indices posted modest gains as market sentiment improved. The S&P 500 rose by 0.94%, closing at 6449.79, reflecting cautious optimism in the broader market. The Dow Jones Industrial Average (DJIA) delivered the strongest performance among major US indices with a gain of 1.74%, finishing at 44946.12. The Nasdaq showed more restrained growth with a 0.43% increase, closing at 23712.07, as tech stocks posted mixed results.

European markets also posted positive results during the period, with gains across all major indices. The UK's FTSE 100 advanced by 1.53%, closing at 4232.93. France's CAC 40 delivered the strongest European performance, rising by 2.33% and ending at 7923.46, while Germany's XETRA DAX gained 0.81%, closing at 24359.30. European markets benefited from continued positive sentiment.

Asian markets showed the strongest regional performance, with Japan leading the gains. Japan's Nikkei 225 climbed 3.73%, closing at 43378.26, reflecting strong investor confidence despite global uncertainties. Hong Kong's Hang Seng Index rose by 1.65%, finishing at 25270.08, while mainland China's Shanghai Composite Index gained 1.70%, ending at 3696.77, as Chinese markets continued to show steady upward momentum.

CRUDE OIL PERFORMANCE

Crude markets took a breather this week after getting hammered by geopolitical jitters, with both Brent and WTI shedding nearly 1.5% on Friday on speculation around the Trump-Putin meet in Alaska. The big takeaway from their 2.5 hours talk was Trump's surprising pivot toward Moscow's playbook by ditching the ceasefire-first approach in favor of going straight for a comprehensive peace settlement in Ukraine, which basically took the wind out of fresh sanctions fears. This dovish recalibration spooked the bulls who'd been betting on tighter Russian crude supplies, especially after Trump telegraphed he'd shelve those secondary tariffs on Beijing and New Delhi for now. All eyes are now glued to Trump's upcoming huddle with Zelensky and European reps, where the continent's unified bloc is expected to push back hard against any territorial concessions that could embolden Moscow. With sanctions rhetoric dialed down for now, market mavens reckon the focus will pivot back to mundane supply-demand fundamentals, though expect continued range-bound action until concrete breakthroughs emerge from the diplomatic circus.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer sentiment fell to 58.6 in August from 61.7 in July, driven by rising inflation worries and tariffs. Buying conditions for durables hit a one-year low, while inflation expectations climbed.

U.S. retail sales rose 0.5% in July, below expectations, signaling cooling consumer momentum ahead of the Fed’s September meeting. While softer sales and easing export prices support a dovish case, hotter import costs and upward June revisions complicate the outlook for rate cuts.

What Can We Expect from The Market This Week

PBoC Loan Prime Rate: The People's Bank of China is expected to hold both the 1-year and 5-year loan prime rates unchanged at 3% and 3.5% after cutting them last in late May, maintaining the accommodative monetary stance given concerns about a weakening yuan and economic pressures.

RBNZ Interest Rate Decision: The Reserve Bank of New Zealand held its Official Cash Rate steady at 3.25% in July, its first pause after six consecutive rate cuts since August 2024, noting that annual consumer price inflation is likely to increase toward the upper end of its target band, although another cut is expected.

UK Retail Sales: Consumption volumes jumped back to positive territory in June after falling 2.8% in May, mainly due to warm weather boosting clothing sales and higher food prices increasing grocery spending.

German GDP Q2: Preliminary data shows Germany's economy contracting by 0.1% in the second quarter due to the reversal of temporary export boosts like US frontloading and the negative impact of new US tariffs, which weakened trade and investment, offsetting slight gains in private and public consumption.

Fed Chair Powell Speech: The speech will be held at the annual Economic Policy Symposium hosted by the Kansas City Fed in Jackson Hole, where market participants are anticipating clues against the Fed cutting rates, gauging everything from tonality to vocabulary.