EQUITIES

Asia-Pacific markets lower in Thursday trade. Mainland Chinese stocks dipped, with the Shanghai composite declined to 0.20%, and Hong Kong’s Hang Seng index drop -0.40%. Singapore’s Straits Times index down -0.37%, Australia’s S&P/ASX 200 slipped -0.64%, and South Korea’s KOSPI -0.53% lower. Meanwhile in Japan, the Nikkei 225 rose 0.21%.

Overnight on Wall Street, the Dow Jones Industrial Average ended the session slightly in the red, down 0.08%, while the S&P 500 gained 0.77%, and the Nasdaq Composite added 2.01%. European shares also rose for a third straight day since Monday, offsetting worries over spiking coronavirus infections.

OIL

Crude oil prices extended their rally, to rose toward 2-month highs, as OPEC cuts demand estimate for its crude again amid new lockdowns. Brent crude futures traded to $43.89 a barrel, while U.S. crude at $41.57.

On Wednesday, Brent closed at $43.80 per barrel, while WTI futures ended at $41.45 per barrel.

CURRENCIES

The dollar index gained ground as riskier currencies lost against the greenback, sat at 93.03, just below a 1-week high hit overnight.

In early Asia trade, the Chinese yuan was a fraction firmer offshore at 6.6166 per dollar. The Australian dollar was flat versus the greenback at $0.7284. The New Zealand dollar climbed to a 19-month high after the RBNZ kept rates on hold as expected.

GOLD

Gold dipped, hurt by a stronger dollar, and increased risk appetite which push investors away from the safe-haven metal.

Spot gold currently trading at $1,869.8 per ounce, while stands around $1,868.50 per ounce for gold futures. Previously closed at $1,865.20 and $1,861.60, respectively.

Silver trading at $24.22, platinum trading at $860.00 and palladium trading at $2,233.00.

ECONOMIC OUTLOOK

Stocks in Asia reverses their gains on Thursday, as vaccine momentum is starting to fade as there are still several obstacles to clear before a vaccine can be distributed. Crude oil prices rose toward 2-month highs after OPEC cuts demand estimate.

Algeria’s energy minister said on Wednesday that OPEC+ could extend current production cuts of 7.7 million bpd into 2021 or deepen them further if needed.

To date, number of confirmed worldwide cases for COVID-19 pandemic has surpassed 52.048 million affecting 213 countries and territories around the world and 2 international conveyances, recording more than 1.282 million fatality globally.

TECHNICAL OUTLOOK

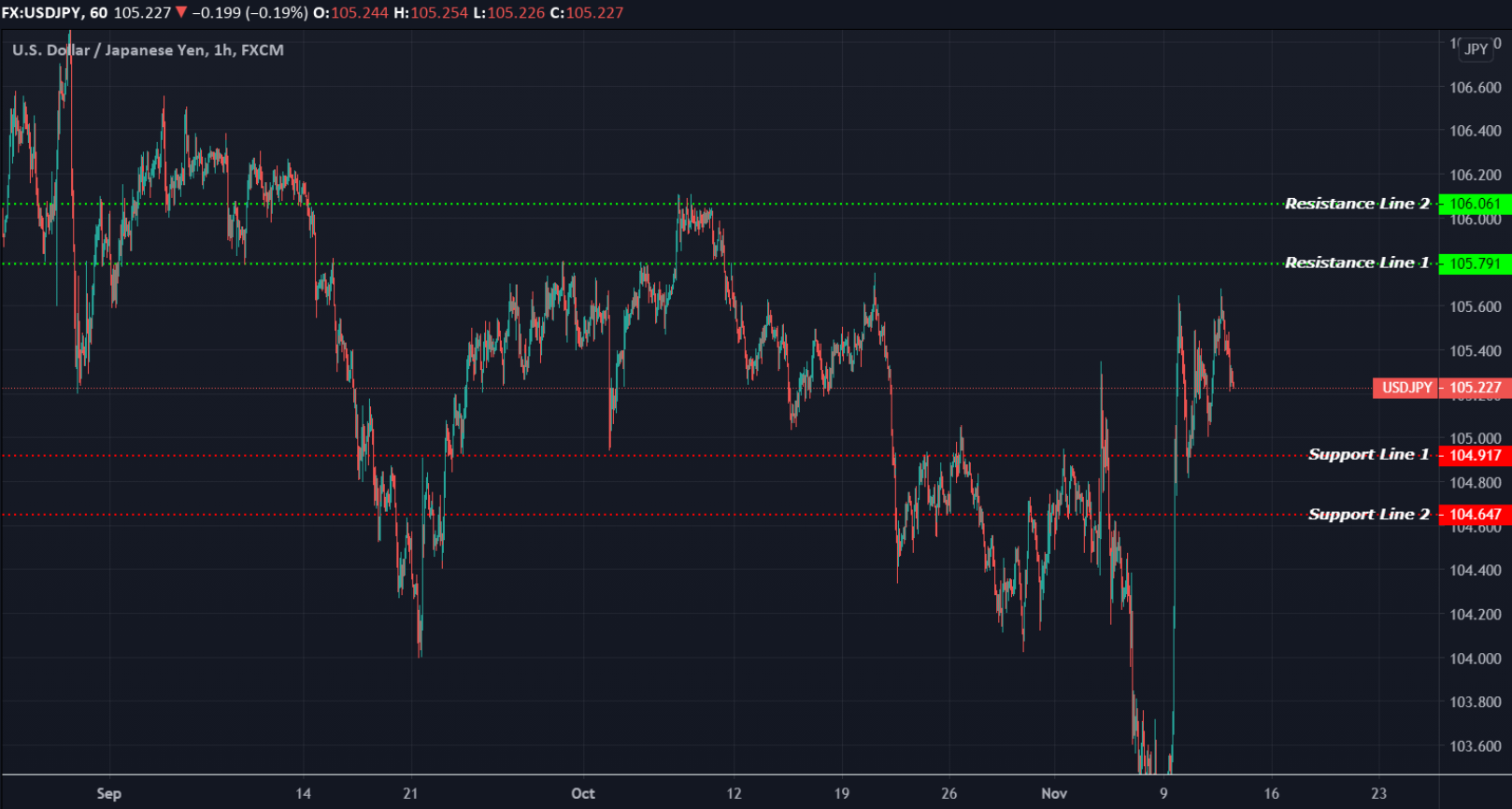

[USDJPY]

Important Levels to Watch for Today:

- Resistance line of 105.791 and 106.061.

- Support line of 104.917 and 104.647.

Commentary/ Reason:

- The dollar is now at 105.227 against Japanese yen, weakened some 0.20% after recording a 3-week high overnight.

- The dollar gained ground and the safe-haven yen weakened on hopes that a medical solution to the pandemic could jump start economic growth.

- Initial optimism about coronavirus vaccine testing pushed the dollar up against the safe harbour yen, though the momentum is starting to fade as the government made statement that there are still several obstacles to clear before a vaccine can be distributed, while the cases in the U.S. increasing daily.