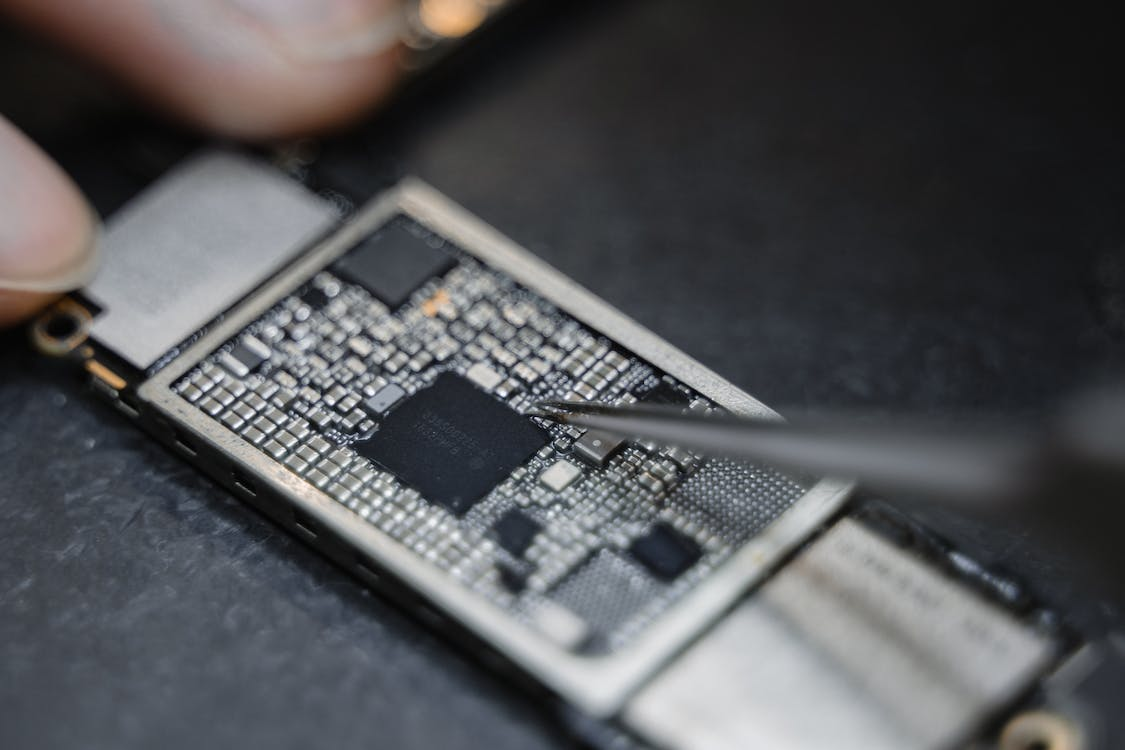

Those who control the chip control the world. Last week, The Biden administration considered restricting AI chip exports to China to maintain dominance and prevent military use. In response, China imposed export restrictions on critical rare earth compounds, especially Gallium and germanium, starting August 1, affecting semiconductors and communication equipment, among other sectors that depend on them. This move aims to gain leverage in negotiations with the US on core technology access. The strategy worked because U.S. Treasury Secretary Janet Yellen's upcoming visit to Beijing aims to improve communication and thaw relations following Secretary of State Antony Blinken's meetings back in June, where they agreed to stabilise the deteriorating ties.

EQUITY

U.S. stocks had a modestly positive start to the second half of the year. Tesla's shares surged by 6.9% on strong sales. The Fed's upcoming July meeting and the release of its minutes are anticipated this week, with the market betting on another 25-bps hike. Meanwhile, U.S. manufacturing surprisingly contracted, with factories resorting to layoffs, although price pressures at the factory gate eased. Additionally, the housing sector showed signs of recovery, driven by low inventory and increased demand even in a high-interest environment.

GOLD

Gold prices steadied above key support levels as investors awaited clues on monetary policy and economic data. Relief in bullion prices came from lower inflation and weak U.S. manufacturing data, but gold remained close to a four-month low. Market caution prevailed ahead of the release of the Fed's June meeting minutes and labour market data, which are expected to influence interest rate decisions and limit the gold recovery this year.

OIL

Oil prices stabilised on Tuesday after a turbulent session as investors monitored supply cuts by Saudi Arabia and Russia alongside concerns about a global economic slowdown. Saudi Arabia plans to extend its 1 million barrels per day cuts, while Russia will reduce oil exports by 500,000 barrels per day. However, weak manufacturing data from major economies heightened worries about reduced crude demand.

CURRENCY

The US dollar remained stable against major currencies but gained against the Japanese yen, which raised intervention concerns, although Finance Minister Shunichi Suzuki confirmed close communication between Tokyo and Washington regarding currency moves. US manufacturing slumped in June, while other economic indicators showed growth. The euro rebounded after weakening due to slowdowns in China and the eurozone's factory activity.