EQUITIES

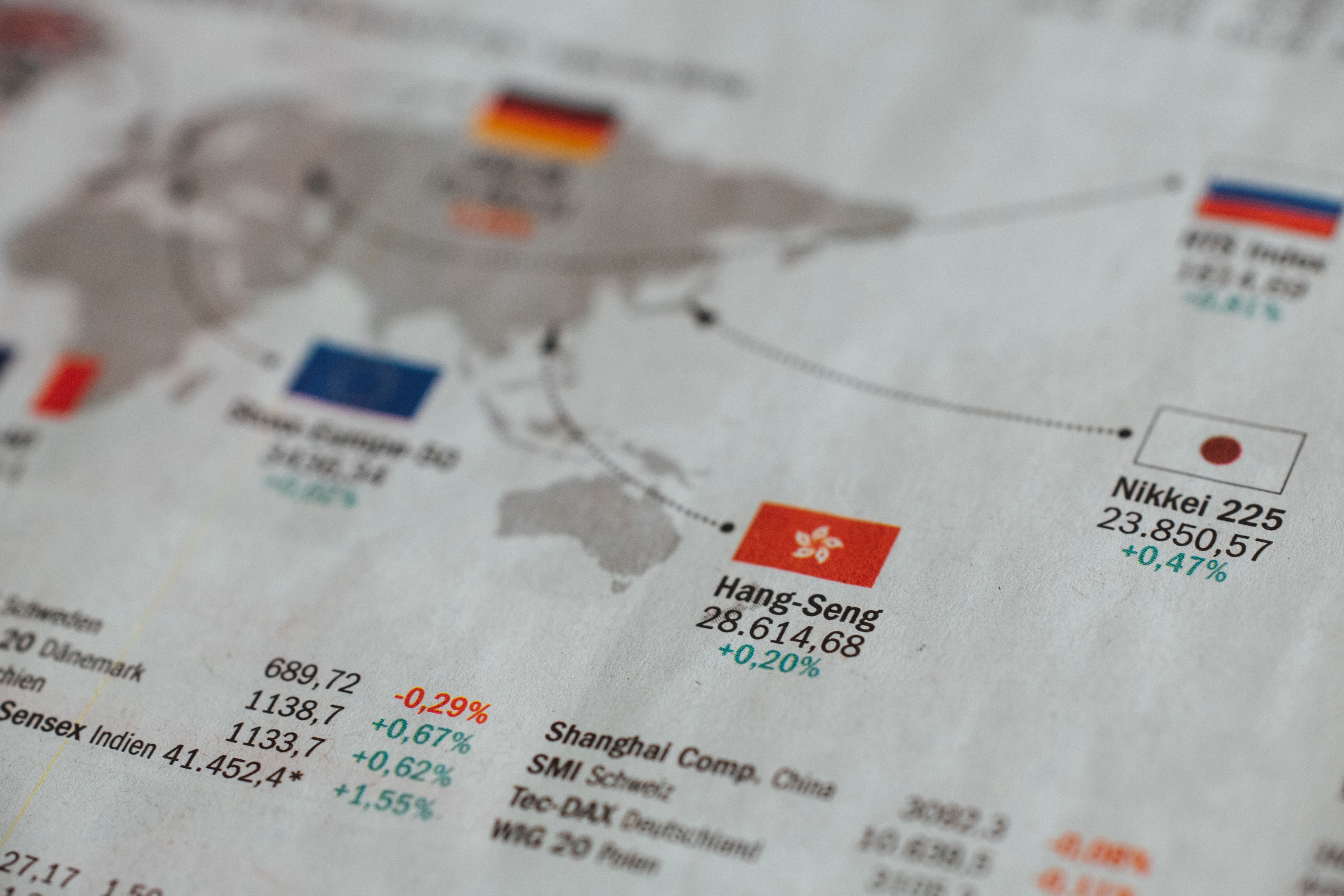

Asian shares rebounded higher in morning trading. Mainland Chinese stocks were higher in early trade, with the Shanghai composite up 0.29% while Hong Kong’s Hang Seng index advanced 0.05%. South Korea’s KOSPI rose 0.88%, Japan’s Nikkei 225 gained 0.66% and Australia’s S&P/ASX 200 advanced 0.05%, while Singapore’s at -0.44% lower.

Wall Street ended higher on Wednesday after investors ploughed into technology stocks, taking advantage of the recent dip. The Dow Jones Industrial Average rose 439.58 points, or 1.6%, to 27,940.47, the S&P 500 gained 67.12 points, or 2.01%, to 3,398.96 and the Nasdaq Composite added 293.87 points, or 2.71%, to 11,141.56.

OIL

Oil futures fell in early trade on Thursday, easing overnight gains, on worries about fuel demand after data showed U.S. crude stockpiles rose last week, rather than dropping as expected, and COVID-19 cases continued to rise around the world.

Brent crude futures traded to $40.60 a barrel, while U.S. crude at 37.80.

On Wednesday, Brent closed at $40.79 per barrel, while WTI futures ended at $38.05 per barrel.

CURRENCIES

The U.S. dollar slid from a four-week high on Wednesday, led by losses against the euro after a report about European Central Bank officials becoming more confident in their outlook for the region’s recovery.

The dollar index against a basket of six major currencies was at 93.17.

The Australian dollar fell to $0.7268 amid concerns abound worsening diplomatic ties with China over the treatment of the two countries' journalists.

GOLD

Gold currently trading at $1,945.90 per ounce, while stands around $1,954.30 per ounce for gold futures. Previously closed at $1,946.20 and $1,954.90, respectively.

Silver trading at $26.61, platinum trading at $896.00 and palladium trading at $2,159.00.

ECONOMIC OUTLOOK

Asian markets are expected to swing higher on Thursday, after U.S. stocks reversed course from a three-day losing streak that led the technology-heavy Nasdaq into correction territory.

Later today, the ECB is expected to announce its interest rate decision as well as monetary policy statement.

Japan’s core machinery orders rose 6.3% in July from the previous month.

To date, number of confirmed worldwide cases for COVID-19 pandemic has surpassed 28 million affecting 213 countries and territories around the world and 2 international conveyances, recording more than 908 thousand fatality globally.

TECHNICAL OUTLOOK

[USDJPY]

Important Levels to Watch for Today:

- Resistance line of 106.418 and 106.626.

- Support line of 105.745 and 105.538.

Commentary/ Reason:

- The dollar was little changed at 106.07 yen.

- USD/JPY rose earlier, as a sharp rebound in stocks reduced liquidity demand for the dollar and curbed safe-haven demand for the yen.

- Economic data was also positive for the dollar after Japan August machine tool orders fell -23.3% YoY, the 23 consecutive months that orders have declined but the smallest drop in 1-1/2 years.

- Comments on Wednesday from Japan Chief Cabinet Secretary Suga, the likely successor to outgoing Prime Minister Abe, was supportive for USD/JPY when he said that an economic revival from the pandemic was a greater priority than fiscal health, which suggests he favours additional yen-negative stimulus measures.