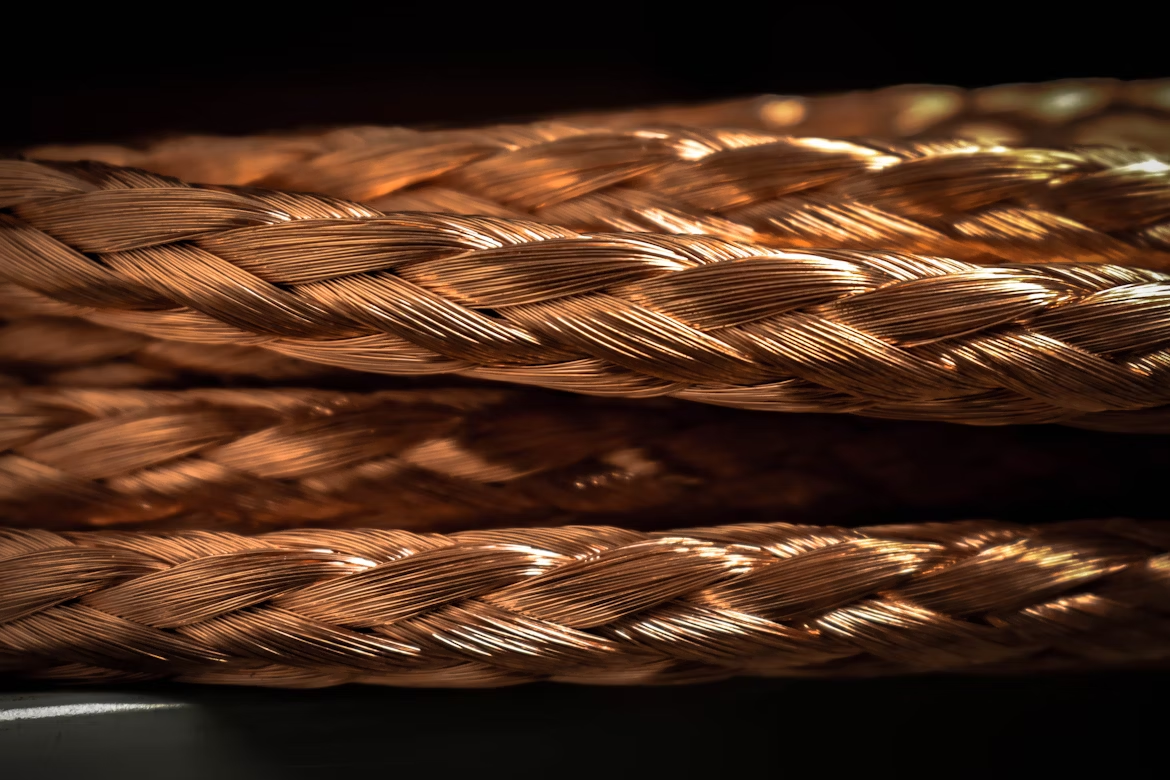

Trump slapped a 50% tariff on copper imports, set to hit August 1st, along with a 25% sweeping tariff on Asian countries, with the main goal of reviving the U.S. copper industry he claims Biden ruined. Prices soared as traders raced to flood U.S. ports before the deadline, rerouting ships to Hawaii and Puerto Rico to shave days off delivery times. Chile, Canada, and Peru scrambled to dodge the hit, while domestic giants like Freeport-McMoRan cheered after its share rallied. Brazil’s Lula slammed Trump’s move as baseless, citing a $410B U.S. trade surplus over 15 years, and threatened tit-for-tat tariffs under Brazil’s retaliation law. Trump tied the tariffs to a bitter feud with Lula, who roasted him as an “unwanted emperor” after Trump accused Brazil of censoring U.S. social media. With global copper flows thrown into chaos, the possibility of a TACO trade or "nothing ever happens" rhetoric could hurt traders that are pulling off last-minute moves to dodge losses, as Trump’s hardline stance usually blows back in his face.

EQUITY

The tech sector rally was led by Nvidia, Meta, Microsoft, and Alphabet to push the S&P 500 higher than Monday's open. FOMC meeting minutes revealed policymakers’ divided views on rates, with some officials advocating for lower rates later this year and others advocating caution. Nvidia became the first company to hit a $4 trillion valuation with what seems to be an endless artificial intelligence revolution in every niche and crevice of life.

GOLD

Gold prices rebounded above $3,300 right after the FOMC minutes were released, debating the timing and scale of interest rate cuts between divided members in determining tariff-driven inflation risks in addition to newly announced steep tariffs, limiting the central bank’s flexibility to ease policy. These trade tensions had only helped shine gold’s appeal, with spot prices extending gains as investors sought refuge from currency weakness.

OIL

Oil prices clung to stability against volatile forces: U.S. crude inventory buildups, Red Sea shipping attacks, and OPEC+’s 548k bpd August output hike (set to rise further in September). Geopolitical chaos set off high volatility, yet OPEC+ downplayed oversupply risks, citing “robust demand” even as Trump’s tariffs on Brazil, copper, and Asia threatened growth and production.

CURRENCY

The U.S. dollar fell on divided Fed members on rate cuts, and Treasury yields plunged, with the 10-year yield falling 1.5%, rushing holders into riskier assets like stocks and cryptocurrencies. Trump’s shocking 50% tariff on Brazil may have triggered a currency crisis, sending the Real to a one-month low, while the euro and pound climb steadily. Bitcoin soars near $112,000, nearing all-time high, as investors bet on central bank easing and trade deal optimism.