OIL PRICE CRISIS: WHAT DOES THE FUTURE HOLDS?

Since earlier this year, the spread of COVID-19 has prompted crude oil market tumbling and uncertain. With China being the world’s largest importer of oil and second largest consumer of oil, implicated by the shut down due to the outbreak, crude consumption of the country has declined sharply, leaving a glut on the global market and triggering big price drops. While on the supply side, crude price war between Russia and Saudi Arabia also escalated an ongoing crisis. Global oil storage could overflow in the coming weeks as the coronavirus pandemic has dealt a severe blow to demand while Saudi Arabia has promised to supply 12.3 million barrel per day—not just in April but also over the next few months.

Prices, already on a downward trend, have collapsed 30% in less than a week, bringing the total fall to nearly 50% since highs in early January. Intensifying recession fears has drove US oil prices down a staggering 24% on Wednesday to $20.06 a barrel, lowest since February 2002, on pace for their worst month ever, down more than 50% each. Although on Thursday, oil reverse losses by posting largest one-day gain on record, recouping some losses from a week slump. A 25% surges were happened after President Donald Trump says that he'll get involved in the Russia-Saudi price war stand-off at an 'appropriate time' to find some middle ground. Currently, U.S. benchmark WTI crude is at $25.78 per barrel while Brent crude settled at $28.63 per barrel, as of writing time (UTC+08.00).

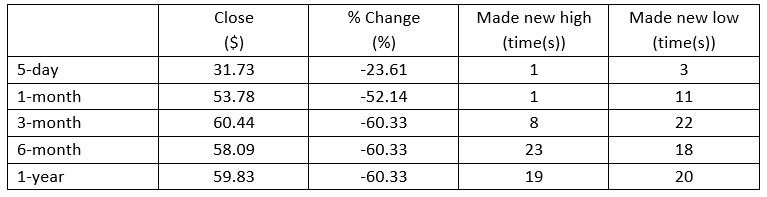

West Texas Intermediate crude oil price for the last:

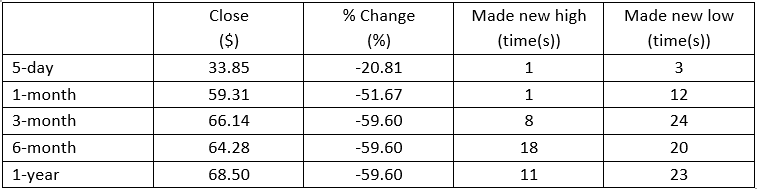

Brent crude oil price for the last:

When the coronavirus first hit, the Energy Information Administration predicted global oil demand would fall to 100.3 million barrels per day in the first quarter of 2020, down about 900,000 barrels, or 1%, from what was estimated in January. The agency said it expects global oil demand to rise by 1 million barrels per day in 2020, which is lower than its growth prediction last month of 1.3 million barrels per day this year. Those numbers were released in mid-February, before the number of reported cases outside of China began to rise significantly and oil price war started, so analysts expect estimates to get worse.

With travel restrictions and quarantines accelerating, energy analysts are scrambling to downgrade their oil demand forecasts. U.S. government has lowered its 2020 expectations for U.S. crude-oil production by 1.6% from its previous forecast to 12.99 million barrels a day and reduced WTI oil price forecast by 31% to $38.19 a barrel while Brent crude shed theirs by 29% to $43.30 for this year. Meanwhile, OPEC slashed its forecast for 2020 growth in oil demand by 920,000 barrels a day to 60,000 barrels a day, reflecting expectations for slower economic growth.

Also, as per Russia envisioned, U.S. shale also has started to decline, with companies starting to take precautionary actions, with most are axing their budgets, hoping to staunch the bleeding as the oil market continues to melt down. Apache Oil Corp says it would cut the budget by 37%, Devon Energy by 30%, Murphy Oil (35%), PDC Energy (20%-25%) and Marathon Oil (20%), while Matador Resources says that they will cut rigs in half and Chevron is considering, a report said.

This crisis has forced governments around the world to consider several monetary stimulus measures, as economic fallout is already being felt, with several indicators deteriorating sharply and Wall Street predicting a recession this year. Consumers’ confidence in the economy is tanking as the coronavirus outbreak and oil price war strangles spending activity and closes business throughout the country.

On Monday, U.S. announced that they’re preparing to start buying as much as 77 million barrels of oil for its emergency stockpiles within the next two weeks to support the domestic industry and boost reserves at cheap prices. Since COVID-19 outbreak, Fed bailout has top $2 trillion for the country.

Oil market uncertainty also forcing Saudi Arabia to slash their spending by 5% in addition of $13 billion stimulus package announced earlier, says the Kingdom’s official. Decision held is to offset the impact of plunging oil prices and the effects of the new coronavirus on its economic outlook and deficit.

If the virus is not contained and the price of oil keeps falling fast, we may continue to see pump prices falling in the coming weeks. Consumers, of course, are eager for gasoline prices to go down, but the story is far more complicated than that. If we see long-term lower prices for the oil industry, both the industry and the economy will feel the effects. Companies are going to have to scale back production growth and this will result in lower rig counts. Energy companies tend to cut back on investment and jobs. In 2016’s U.S. for instance, a freefall in gasoline prices has led to a sharp drop in the U.S. business investment, one of the reasons of the country’s economic growth slowed to 1.6% that year from 2.9% in 2015.

On broader global impact, these infamous trends situation can surely be expected – on economic sector - damage to other oil producing countries such as Malaysia, Indonesia, Azerbaijan, Kazakhstan, Iraq, Iran, Venezuela, Nigeria etc. Also, bankruptcies, unemployment and rural decay in U.S. states where the oil boom, such as Texas, New Mexico, Utah, Colorado, North Dakota, Alaska, Ohio, among others.

On environment - governments policy to advance action on lowering emissions will be interrupted. Cheap fuel will turn public interest and vehicle manufacturer away from higher fuel economy and efficiency, including non-transport uses. Cheap fuel could become a possible hurdle to all-electric transport, as major car and truck manufacturers bring out full lines of electric vehicles through 2025. Subsequently, decline in the value of recyclable plastics as manufacturing new plastic becomes cheaper compared to the cost of recycling.