INTRADAY TECHNICAL ANALYSIS APRIL 13th (observation as of 06:00 UTC)

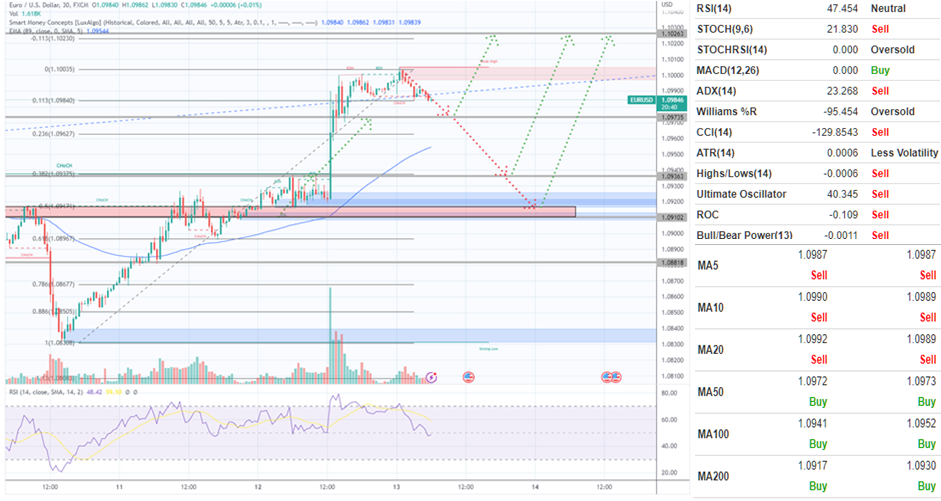

[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.1026

- Support line of 1.0973

Commentary/ Reason:

1. The price exploded upside after testing support at 1.0936 in CPI report by the US that send the greenback tumbling.

2. The Euro losing ground on Thursday after hawkish fed bets for quarter point hike in May.

3. Initial Jobless and PPI data from the US will come in focus today as main driver of volatility and price changes.

4. The price is expected to trade in wide range on the downside until US macro data either push it further or increase the price to resistance at 1.1026.

5. If the price break below 1.0973, expect the price to go lower at 1.0936 and 1.0917 where the support is at its strongest due to 50% Fibonacci retracement and strong support-become-resistance level.

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.9005

- Support line of 0.8934

Commentary/ Reason:

1. The pair have been in strong downtrend but drop tremendously, perhaps due to CPI report.

2. The price formed consolidative move and broke to the upside, indicating bullish signal although the current candle is strong bearish engulfing.

3. There will not be any significant macro data from the Swiss, but US heating labour market is about to be reassessed today with initial jobless claims data.

4. The price is expected to recover once it tests the support at 0.8934 but it is entirely dependent on the volume of seller coming into market to either push it down first or to reverse after a clear consolidative breakout to the upside.

5. If the price break above its resistance at 0.9005, there is reason to believe that the price will go higher and test 0.9028 before losing any traction to the upside.

[USDJPY]

Important Levels to Watch for:

- Resistance line of 133.753

- Support line of 132.990

Commentary/ Reason:

1. The pair were previously lose traction on the upside after retesting the same area of resistance without breaking through.

2. The price is now uncertain in the short term, but it is showing strength in its long-term price movement.

3. The pair is also dependant on US macro data to determine its next direction in the short term as Yen has no significant macro data to be expected this week.

4. The price is expected to break in either side of its consolidative range and continue to move in that direction. However, a movement to the downside is more likely after a strong price pressure downward and breakage from medium term trendline.

5. The price could break below support at 132.990 and go lower. If the price gain to break its consolidative range, the price could go higher to 133.753.

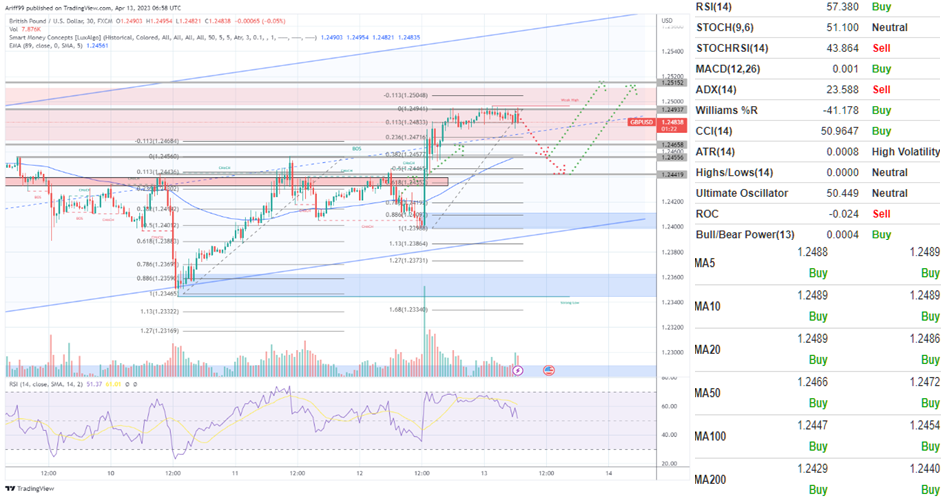

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.2493

- Support line of 1.2465

Commentary/ Reason:

1. The pair have been on strong rise in prices but recently consolidate at a resistance level.

2. The movement is probably affected by macro headwinds that pushed GBP higher as USD weakened but condition for USD have stabilized.

3. UK GDP come in at 0%, indicating slower growth while trade balance have also reported lower. However, the weakness was offset by US macro data that saw the dollar fell.

4. The price is expected to retreat lower at 1.2465 and 1.2455 before having any potential of continuing its uptrend to 1.2515.

5. Fibonacci retracement saw an increase to its crucial 168% before consolidating and possible retracement to 38.2% or 50% before continuing its uptrend movement.