INTRADAY TECHNICAL ANALYSIS MAY 25th (observation as of 08:00 UTC)

[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.07427

- Support line of 1. 07125

Commentary/ Reason:

1. The price broke out of its sideways position, pushed below, and now almost at the end of its downtrend.

2. The pair has moved into the lower bound in its parallel channel and nearing the lowest since March.

3. The German GDP ended up lower for the second quarter which officially put it in the recessionary period while US GDP is also expected to be released later today.

4. The price is expected to trade lower if the price is able to break support to lowest level at 1.069 but it has a slight chance of a rebound to resistance 1.07427 although slim.

5. Technical indicator saying sell across the board with some of more sensitive indicator pointing to oversold and bound to rebound.

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.90563

- Support line of 0.90426

Commentary/ Reason:

1. The pair are in a strong uptrend but faced with pullback the seen the price inability to break resistance set by previous rally.

2. The price does not have enough momentum to continue its uptrend in the upper bound of the price parallel channel and now moving into the lower bound.

3. There is no significant macro data from Switzerland while the US is expecting to report lower gdp although is not recessionary numbers.

4. The price is expected to fell to support at 0.90426 before rebounding to targeted Fibonacci important price level at -11.3% at 0.90740.

5. Technical indicators is mixed with some saying sell but most are holding at neutral while moving average for longer term is still holding buy signals while shorter term are at sell.

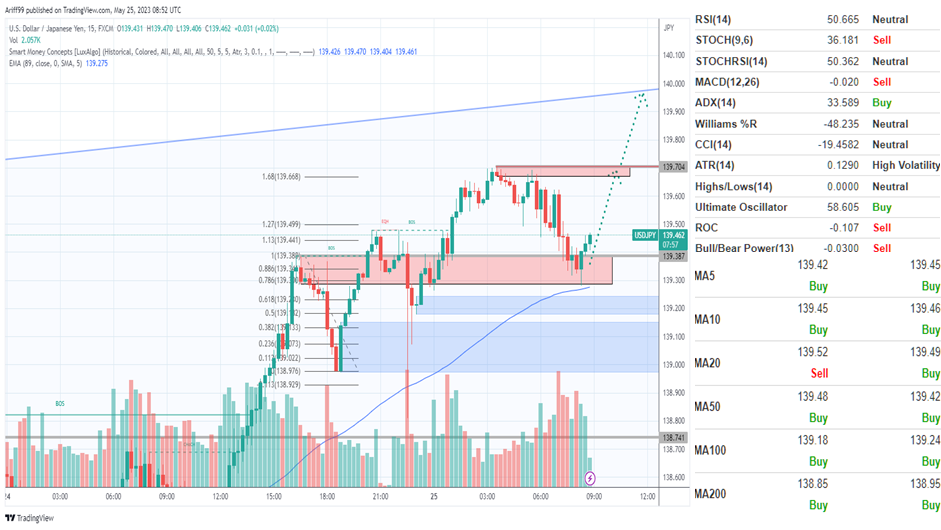

[USDJPY]

Important Levels to Watch for:

- Resistance line of 139.704

- Support line of 139.387

Commentary/ Reason:

1. The pair were on a strong uptrend and volatile price action that seen price of the pair crashed before recovering on us market early opening.

2. The price may be affected by FOMC meeting minutes that saw sign of further tightening is imminent.

3. There will be US GDP q1 report later today and Tokyo cpi that is expecting lower cpi for core cpi but higher for non-core cpi.

4. The price is expected to continue upward after pulling back to about 50% of its small rally to the upper bound of the sideways trend with no clear medium-term direction.

5. Technical indicators are mixed with more sell than buy while moving average are actively moving into all-buy territory.

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.23918

- Support line of 1.23578

Commentary/ Reason:

1. The pair have been on steady downtrend, but it went below the parallel channel bound and now moving back into bound.

2. The price is recovering fast as it deviate too far from moving average although USD is strengthening.

3. There is no significant economic data from the UK but US GDP Q1 and initial jobless claims as slowing economies is expected in the US albeit resilient labour market.

4. The price is expected to recover into the middle channel of the parallel channel that coincides with resistance level 1.24094 but it need to break above resistance 1.23918 before the price can see any further strengthening.

5. Technical indicator is blaring with buying signal but some indicators are overbought while the longer moving average are putting sell signals which could translate to short-lived rally before continuing downside probably staying in the lower bound in the price channel.