PAST WEEK'S NEWS (May 23 – May 29, 2022)

Stocks Performance

Major equity markets logged strong gains last week after several weeks of declines. Selling exhaustion, positive retail earnings reports, latest economic data and hints of Fed flexibility all helped the indexes to rebound higher. Most Asia-Pacific stocks meanwhile moderately changed throughout the week.

The first two sessions of the week saw some volatility, before the release of the Federal Open Market Committee’s minutes on Wednesday provided some relief to the markets. Minutes of the Fed's May 3 to 4 policy meeting highlighted, as the market expected, that most participants favour additional 50-basis point rate hikes in the June and July meetings. Though, the Fed also hinted at more flexibility later. The big, early hikes would allow room to pause later in the year to assess the effects of that policy tightening.

Most sectors in the indexes advanced, with consumer discretionary and energy stocks performing especially well. Consumer discretionary sector leading the way after underperforming earlier this month. The sector narrowed its May lost thanks to a bounce in retail stocks after concerns about inflation and strength of consumer spending sent many of these names to their lowest levels in over a year. However, the past couple days saw renewed interest in retailers on hopes that the worst is in the past. The health care sector meanwhile lagged.

In addition to the equity markets rallying through the week, bond yields also rallied. The U.S. 10-year Treasury yield fell modestly, while the 2-year yield fell to below 2.5%, reflecting the easing of interest rate expectations. Corporate bond spreads also fell during the week, which shows improving sentiment towards the economy.

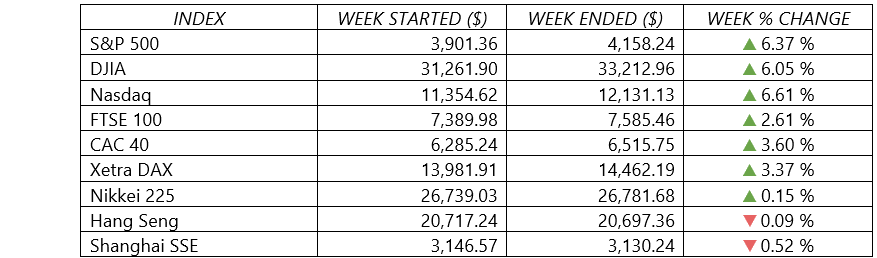

Indices Performance

The S&P 500 snapped a string of seven negative weeks in a row, surging nearly 7%. The sharp turnaround came a week after the S&P 500 narrowly avoided entering a bear market. The Nasdaq outperformed slightly while the Dow lagged a bit but was able to snap its longest weekly losing streak since 1932.

European shares also rose as confidence grew that inflation may be peaking and as central banks signalled that interest rate increases are likely to be gradual. Lagarde appeared to side with hawkish colleagues in a blog post, confirming an early end to the ECB’s bond-buying program in the third quarter and making her first explicit call for interest rate increases.

The Nikkei 225 index in Japan jumped around 1% on Monday, before the positivity was short-lived, undermined by weak data following the release of a survey showing activity in the country’s manufacturing sector grew at the slowest pace in three months in May amid supply bottlenecks.

Chinese markets weakened amid concerns over slowing growth exacerbated by the government’s zero-tolerance approach to the coronavirus.

Crude Oil Performance

Oil prices hovered around a two-month high, supported on the prospect of tight supplies and rising demand from the upcoming start of the summer driving season in the U.S., the world's biggest crude consumer.

Global crude supplies continue to tighten as buyers avoid oil from Russia, the world's second-largest oil exporter, amid sanctions following its invasion of Ukraine. The prospect of an EU embargo on Russian oil also put pressure, though Hungary remains a stumbling block to the unanimous support needed for EU sanctions.

The rise, however, were slightly capped by strict COVID-19 lockdowns increasing concerns about falling fuel demand in China, the world's biggest oil importer, and worries about inflation leading to slower global growth.

Brent crude futures for July rose to its biggest weekly jump in 1-1/2 months. While the price of U.S. crude oil also continued to creep upward after briefly sinking below $100 per barrel on May 10. On Friday, oil was trading around $115 per barrel. Nevertheless, that’s still down from the $123 level that oil reached on March 8, a couple weeks after war broke out in Ukraine.

Other Important Macro Data and Events

The dollar index fell to a second consecutive weekly decline, as traders lowered Fed’s rate hike expectations amid signs the central bank might slow or even pause its tightening cycle in the second half of the year. The dollar index fell as low as 101.43 for the first time since April 25, further pulling away from its 20-year peaks hit two weeks ago.

Treasuries recorded their third consecutive week of gains, drawing some strength from speculation that the Fed could pause its rate hikes in September. The 10-yr yield finished the week just a basis point above its 50-day moving average (2.73%).

Core eurozone bond yields fluctuated but ended slightly higher. Yields initially ticked up after ECB President Christine Lagarde suggested the possibility of positive rates by year-end. Yields retreated somewhat on weaker-than-expected eurozone PMI data.

The minutes from the early-May meeting of the FOMC contained few surprises, with all members voicing support for 50-basis-point rate increases over the next few meetings in an effort to bring interest rates to a neutral level that neither inhibits nor stimulates economic growth. Some participants indicated that a more “restrictive” approach to tightening monetary policy could be in order, depending on how the economic outlook evolves.

Even though the minutes confirmed a hawkish path early on, they also hinted at more flexibility later. The expedited pace of tightening in June and July can allow the Fed to assess the effects of policy firming later this year, implying a pause or slowdown in the pace of rate hikes. If this scenario materializes, it will be well-received by the markets. Fed policy will remain a key focus for investors, and volatility will likely continue depending on the path of inflation, but unless the Fed pushes monetary conditions deep into restrictive territory, we think that the expansion can continue.

The U.S. Federal Reserve’s preferred gauge for tracking consumer prices shows that inflation moderated somewhat in April, although it remained close to the highest level in four decades. The PCE Price Index rose at an annual rate of 6.3%, down from 6.6% in March.

The U.S. economy’s stumble in this year’s first quarter was slightly worse than initially estimated. The government’s latest GDP figure released on Thursday showed that the economy contracted at an annual rate of 1.5%, instead of the initial estimate of a 1.4% contraction. Weaker private inventories and household investment triggered the downward revision.

Markets also remain attuned to the conflict in Ukraine, with a U.S. official saying Russia is making “incremental progress” in the Donbas region. Russia’s Defense Ministry claimed overnight that it will allow foreign ships to leave ports on the Black Sea and Sea of Azov, according to state news agency Interfax, amid mounting concerns about rising global food prices.

Gold prices firmed as the dollar weaken, helped put bullion for a second straight weekly rise.

What Can We Expect from the Market this Week

A monthly U.S. labor market update due out on Friday will show whether the strong growth recorded in April carried over into May. In April, the economy generated 428,000 new jobs—identical to March’s jobs number—and the unemployment rate stayed unchanged at 3.6%.

Another key economic reports due to watch include updates on construction spending, factory orders, U.S. auto sales, and productivity and unit labor costs.

While the EU is not expected to approve a full ban on Russian oil, an embargo of seaborne deliveries or the general nature of the discussion could impact the energy market. OPEC is also on tap to meet next week, although no major fireworks are anticipated with the production statement.

On the corporate calendar, the earnings confessional will see visits from HP Inc., GameStop, and Lululemon, while annual meetings at Alphabet and Walmart will be full of shareholder activism. Finally, next week will be the last chance for investors to buy Amazon before the 20-for-1 stock split becomes effective on June 6.