PAST WEEK'S NEWS (July 18 – July 24, 2022)

Stocks carried over momentum from late the previous week as investors appeared to welcome signs of a slowing economy and fading inflationary pressures, as well as supported by several other catalysts, such as signs of peaking inflation, relief from rising yields and, most recently, corporate earnings announcements.

Additional data are signalling better news for consumer prices. Wage growth is still healthy but has moderated. Supply chain measures are showing further improvement in bottlenecks, while PMI readings have dipped to levels consistent with lower cost pressures.

Second-quarter corporate earnings season is under way, with the results reasonably positive so far. With about one-fifth of the S&P 500 reporting, profit growth has exceeded consensus expectations by roughly 4%2. Earnings are showing some margin wear and tear from rising input and labour costs, but revenue growth remains healthy, supporting bottom lines.

The best-performing sector was the consumer discretionary sector, which was helped by rebounds in Amazon.com and Tesla after its better-than-expected Q2 report, followed by the materials, industrials, information technology, and energy sectors. Conversely, sector losers this week were the countercyclical health care, utilities and communication sectors. Communication services sector was the worst-performing sector for the week, as weakness in Verizon and Alphabet weighed.

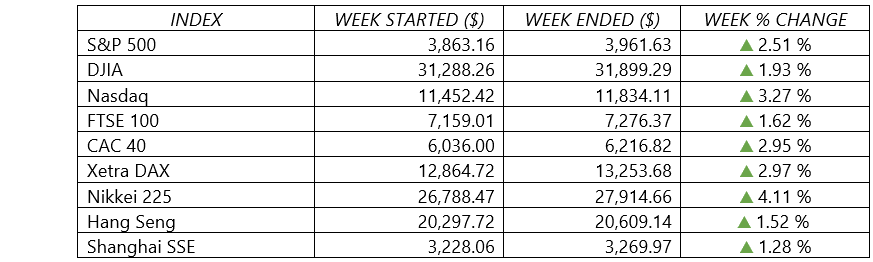

Indices Performance

The major U.S. stock indexes rebounded from the previous week’s declines to post gains of around 2.0% to 3.0%. Although stocks have recently traded in a fairly narrow range, the S&P 500 was up 8.0% on Friday from a recent low in mid-June.

European shares rose as market sentiment remained strong despite a series of discouraging economic data releases and the ECB decision to raise interest rates for the first time in over a decade.

Japan’s stock markets rose over the week, with the Nikkei 225 Index gaining more than 4%. As widely expected, the BoJ maintained its ultra-loose monetary policy to support the country’s still-fragile economic recovery, continuing to diverge from other central banks’ tightening policies.

Crude Oil Performance

Oil prices have been whipsawed between concerns about supply as Western sanctions on Russian crude and fuel supplies over the Ukraine conflict have disrupted trade flows, and rising worries that central bank efforts to tame surging inflation may trigger a recession that would cut future fuel demand.

Other Important Macro Data and Events

In the U.S. economic outlook, The July NAHB Housing Market Index fell to 55 from 67, registering its biggest monthly drop on record outside of the drop seen in April 2020. June housing starts were weaker than expected and building permits (a leading indicator) for single-unit dwellings fell in every region.

Existing home sales meanwhile were weaker than expected in June and declined for the fifth straight month. The July Philadelphia Fed Index fell to -12.3 from -3.3, paced by a sharp decline in the new orders index. The June Leading Economic Index decreased 0.8%, the fourth consecutive decline, prompting the Conference Board to suggest that a U.S. recession around the end of this year and early next year is now likely.

Initial jobless claims topped 250,000 for the first time since mid-November 2021, and the preliminary July IHS Markit Manufacturing PMI slipped to 52.3 from 52.7 while the IHS Markit Services PMI slumped to 47.0 from 52.7.

The weak economic data briefly pushed the yield on the benchmark 10-year U.S. Treasury note down to 2.73% on Friday morning, its lowest level in nearly two months, down from a recent high of 3.48% on June 14. The yield curve remained inverted, with the 2-year note’s yield was at 2.99%, exceeding that of the 10-year bond at 2.78%. The inversion, whereby shorter-dated securities yield more than longer-dated securities, is a reflection of growth concerns and is seen by some as a harbinger of a possible recession.

The European Central Bank meanwhile raised interest rates by a half-percentage point on Thursday, surprising many economists who had expected a smaller increase. In lifting rates for the first time since 2011, the central bank seeks to fight spiking inflation.

Core eurozone bond yields fell as concerns about economic growth drove demand. This trend was amplified by the release of eurozone PMI data, which indicated that economic activity contracted in July. Manufacturing PMI fell to 49.6 in June, from 52.1 in May. The services sector PMI fell to 50.6 from 53, likely reflecting diminished consumer confidence as the cost of living continued to increase.

The Italian 10-year government bond yield rose following Prime Minister Mario Draghi’s resignation but retreated later in the week.

The Bank of Japan for its part left its key lending rate unchanged at -0.10%, as expected.

UK consumer price inflation reached a new 40-year high of 9.4% year on year in June—up from 9.1% in May. The main driver of inflation was an increase in fuel and energy costs and food prices. The UK labour market continued to tighten as the number of people employed continued to rise, and unemployment fell.

Russia restarted Nord Stream gas flows to Europe following its closure for a 10-day maintenance period, but shipments remained at approximately 30% of previous capacity. The pipeline accounts for more than a third of Russian gas exports to Europe. The European Union announced plans for member states to cut demand by 15% amid Russian supply fears.

Commodity prices have fallen sharply in recent weeks, which will provide much-needed relief on the inflation front. Oil prices are down 20% from their recent peak, and copper and lumber prices have fallen 32% and 60%, respectively. Agricultural commodities such as wheat, corn and soybeans are also down materially. Ukraine and Russia signed an UN-supported deal last week that will allow Ukrainian grain exports to resume through the Black Sea. This can potentially boost global food supply, given Ukraine is one of the world’s largest agricultural exporters.

With the earnings season now more than 20% completed, the proportion of S&P 500 companies that are beating analysts’ earnings expectations is smaller than usual. About 68% had exceeded net income expectations as of Friday, trailing the five-year average of 77%, according to FactSet.

What Can We Expect from the Market this Week

The two-day FOMC meeting will be the major event of the week. The U.S. Federal Reserve is widely expected to approve another big interest-rate increase at Wednesday’s U.S. policy meeting, by another 75 points to 2.25% to 2.50%, although futures trading still implies a 20% chance of a 100-point hike.

In June, the Fed lifted its short-term target range by three-quarters of a percentage point— the biggest hike since 1994—and a similar steep increase is expected heading into this week’s meeting, with some economists expecting rates will go up a full percentage point.

Another important economic data being released this week include the consumer confidence, new and pending home sales, durable goods orders, personal income and spending, and U.S. Q2 GDP.

The biggest week of the earnings season also will keep investors heads on a swivel. Expect lots of action next week, as Microsoft, UPS, Google, Meta, Apple, Amazon, Boeing, and Pfizer, just to name a few of the powerhouses due to report.

The upcoming Q2 GDP report will provide the latest read on the state of the economy, and while a recession is not assured at this stage, we think the risk of a mild contraction has risen appreciably. In any event, this most recent rally suggests to us the bear market is maturing and an appetite for risk may be slowly returning, as a faint light at the end of the Federal Reserve’s tightening tunnel begins to emerge.