PAST WEEK'S NEWS (MAY 01 - MAY 05, 2023)

The S&P 500 and the Dow experienced modest declines, while the NASDAQ was essentially flat. The US labor market exceeded expectations by adding 253,000 jobs in April, with the unemployment rate falling to 3.4%, its lowest level since 1969. The US Federal Reserve raised its benchmark interest rate for the tenth meeting in a row but hinted at a possible pause. Regional banks' stocks plunged on Thursday but recovered most of that ground on Friday. First-quarter results for S&P 500 companies have come in better than their one-year averages, and the earnings outlook for full-year 2023 has improved. Congress and the White House are under pressure to avoid a potential default, with the treasury secretary saying that the government's capacity to use special accounting measures to keep paying bills may be exhausted by June 1. The European Central Bank increased its benchmark rate to 3.25%, the highest in nearly 15 years.

Shares in Carl Icahn's holding company, Icahn Enterprises LP (IEP), have dropped by 35% in the wake of a critical report from short seller Hindenburg Research, bringing the valuation drop since the short seller attacked it to more than $6 billion. Hindenburg accused IEP of overvaluing its holdings and relying on a "Ponzi-like" structure to pay dividends. Icahn owns about 85% of IEP and has pledged over 60% of his stake as collateral for personal loans. The Hindenburg report has wiped $7.5 billion off Icahn's fortune, leaving him with a net worth of $10.8 billion, according to Forbes.

US commercial banks saw a drop in deposits towards the end of April, reaching their lowest level in almost two years, while credit provided by banks rose, led by outstanding loans and leases. The recent rate hikes have increased the cost of borrowing for consumers and businesses, affecting deposits and other financial products. Total banking system credit has yet to show contraction despite recent banking system turmoil and aggressive interest rate increases by the Federal Reserve over the past year. PacWest Bancorp's confirmed that it is exploring strategic options, including a sale, a pattern observed in the fall of SVB and FRC. The stock halted trading multiple times and the contagion has also spread to other regional bank such as Western Alliance Bank and Metropolitan Bank.

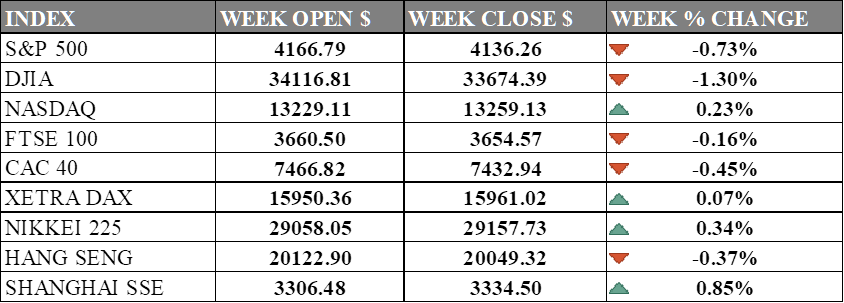

INDICES PERFORMANCE

The US market was mixed last week, with the S&P 500 and Nasdaq slightly up and the DJIA slightly down. The Fed raised rates by 25 basis points and hinted at a possible pause in hikes, while Apple reported better-than-expected earnings.

The European market was also mixed, with the FTSE 100 and XETRA DAX slightly up and the CAC 40 slightly down. The ECB raised rates by 25 basis points as well, but signalled more hikes to come, while inflation data showed a slight rise in headline inflation and a slight fall in core inflation.

The Asian market was mostly positive, with the NIKKEI 225, HANG SENG and SHANGHAI SSE slightly up. China's services activity grew but at a slower pace, while Hong Kong followed the Fed rate hike and Japan's central bank remained cautious.

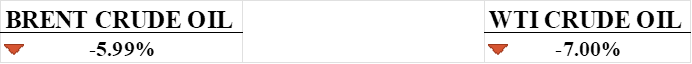

CRUDE OIL PERFORMANCE

Crude oil ended up recovering some of it losses after prices rose on Friday for the first time in five sessions. This follows a drop of 11% over the previous four sessions due to lower demand for refined products and weak economic data from China, while higher US interest rates raised concerns for the health of regional banks. However, overnight buying and better-than-expected US hiring last month, with the country adding 253,000 new jobs, boosted prices as it signalled the economy is still growing despite higher interest rates. OPEC also announced it will hold a ministerial meeting in person on June 4, indicating it may take further steps to support prices.

OTHER IMPORTANT MACRO DATA AND EVENTS

US stock markets had modest declines in the previous week, with the S&P 500 and the Dow falling by roughly the same amount as the previous week's gains, while the NASDAQ was relatively unchanged. Despite large daily movements, the stock market has traded in a narrow range since April. On the positive side, the US labour market performed well, with 253,000 jobs added in April, exceeding expectations, and the unemployment rate dropping to 3.4%, the lowest level since 1969.

The U.S. Federal Reserve has raised its benchmark interest rate for the tenth time in a row but hinted at a potential pause in its rate-hiking cycle. The new policy statement removed language suggesting that additional rate hikes may be necessary. While the overall stock market volatility remained steady, the stocks of regional banks took a hit on Thursday, with some plunging by as much as 50%. This was likely due to concerns about their balance sheets in the wake of recent bank failures. However, these stocks rallied on Friday, recovering most of their losses.

The US government's ability to use special accounting measures to avoid defaulting on its debt may be exhausted by June 1, earlier than expected. Pressure is increasing on Congress and the White House to negotiate a solution to avoid default. The President has invited congressional leaders to meet on May 9 to discuss potential deals to lift the debt ceiling.

What Can We Expect from The Market This Week

Australia Retail Sales: increased by 0.4% in March 2023, driven by food retailing and dining out, and are expected to continue rising.

German Industrial Production and CPI: Inflation in the region eased to 7.2% from 7.4% YoY, while productivity in the industrial sector was expected to slump due to the war in Ukraine and supply chain disruption.

Bank of England Interest Rate Decision: The market anticipates a 4.5% rate increase from the central bank. However, analysts believe inflation will fall over the year as energy prices and supply bottlenecks ease.

US CPI and PPI: CPI rose 5.0% YoY in March 2023, which was lower than the previous month and below market expectations, while PPI for final demand decreased in February 2023, with prices for goods and services both falling.

UK GDP Q1: The market expects UK GDP to grow moderately in the first quarter of 2023 and more strongly in the year, but faces some downside risks.