PAST WEEK'S NEWS (JULY 24 – JULY 28, 2023)

The recent Federal Reserve meeting saw the Fed raise interest rates again to fight inflation. The Fed's 0.25% rate hike to 5.25–5.50% was the 11th of this aggressive cycle, leaving investors uneasy about the impact on growth. Powell tried to reassure markets that the Fed wouldn't blindly hike rates, but his vagueness gives no clue for the September meeting. He conceded that slower growth is required to tame inflation, stoking recessionary fears. While inflation is moderating, prices remain painfully high for many Americans, especially food prices. However, The Fed is laser focused on lowering inflation but tiptoes towards a rate pause as recession risks grow. Markets yearn for clarity or clues as to whether more rate pain is in store, but as of now, nothing is clear.

Worldcoin, a new project by OpenAI CEO Sam Altman, is scanning people's eyeballs globally in exchange for digital IDs and a promise of free cryptocurrency, but privacy advocates warn it could become a "privacy nightmare." Many users are intrigued by the futuristic technology and financial incentives, often overlooking privacy policies and regulators' concerns in their eagerness to get the free crypto tokens worth $2.5 on the open market. Though Worldcoin claims biometric data is secure, privacy groups caution that eye scans could increase state and corporate control over individuals. This little stunt not only garnered the attention of crypto players but may trigger concerns among regulators as to the complexity of the newly developed systems and regulatory framework around them.

In recent meetings, the FDIC has proposed new rules that would require big banks to hold more cash to prevent financial disasters like bank runs. The rules would apply to banks with $100 billion or more in assets and would increase core capital requirements by 16%, which covers the top 30 banks in the U.S. While the new rules would make banking safer, they could also make it harder for small and medium-sized businesses to borrow money. The banking industry is naturally opposed to the changes, arguing that they'll drive business to shadow banks. The plan is still in the development phase, but it may be the trade-offs the banks need to prevent another turmoil.

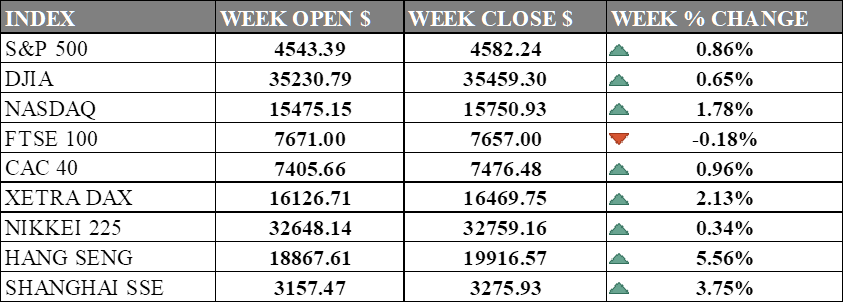

INDICES PERFORMANCE

Last week, most of the indices showed positive performance, except for the FTSE 100 which had a slight decline. The S&P 500 increased by 0.86%, the DJIA increased by 0.65%, and the NASDAQ increased by 1.78%. The XETRA DAX increased by 2.13%, the CAC 40 increased by 0.96%, the NIKKEI 225 increased by 0.34%, the HANG SENG increased by 5.56%, and the SHANGHAI SSE increased by 3.75%.

The HANG SENG had the highest increase, which can be attributed to the positive news of the Hong Kong government's announcement of a new economic stimulus package. The SHANGHAI SSE also had a significant increase, which can be attributed to the Chinese government's announcement of new policies to support the economy. The XETRA DAX had a positive performance due to the strong economic data from Germany, which showed an increase in exports and a decrease in unemployment. The NASDAQ had a strong performance due to the positive earnings reports from technology companies such as Apple, Amazon, and Facebook. The S&P 500 and DJIA had a positive performance due to the strong earnings reports from companies in the financial and healthcare sectors.

On the other hand, the FTSE 100 had a slight decline as traders look ahead to a Bank of England decision later this week when interest rates are expected to rise further. The CAC 40 had a positive performance as investor embrace fresh data indicating that inflation in France eased, while the economy experienced a faster-than-expected growth rate of 0.5% in the second quarter.

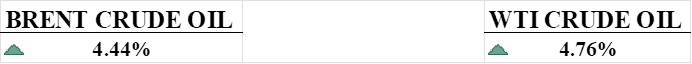

CRUDE OIL PERFORMANCE

While oil prices have rallied significantly in recent weeks on the back of OPEC+ production cuts, demand remains sluggish and US inventory data does not yet reflect the touted market tightness. Gasoline demand has been underwhelming this summer, with distillate demand also lacklustre. Though US oil rig counts are down, production has held up well. The high prices could also pose a risk if they trigger additional inflation and force further Fed rate hikes, potentially hampering economic growth and oil demand. While technical suggest potential for further upside, the market seems detached from underlying fundamentals. Prices may be susceptible to a correction if momentum falters. Overall, the outlook is uncertain and depends heavily on whether demand accelerates to validate the supply-side narrative underpinning the recent rally.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. economy grew at a faster pace of 2.4% in the second quarter despite the Federal Reserve's aggressive interest rate hikes, buoyed by resilient consumer spending and a strong labour market that has kept recession fears at bay for now. U.S. labour costs rose at a slower pace in the second quarter as wage growth moderated, providing some relief to the Federal Reserve as it battles high inflation. The Employment Cost Index, a broad measure of labour costs, increased 1.0% for the quarter, below expectations and down from 1.2% growth in the first quarter, signalling easing pressure on wages.

China's industrial profits declined 8.3% in June and were down 16.8% for the first half of 2022, extending a months-long downturn as weak demand weighed on manufacturers' margins, underscoring the challenges facing the country's economic recovery. Policymakers have pledged more support for the economy after growth slowed to 6.3% in the second quarter but are unlikely to pursue aggressive stimulus given concerns over mounting debt risks.

German business confidence deteriorated for the third straight month in July as the Ifo institute's survey index fell to 87.3, reflecting broad concerns over the economy's struggle to rebound from a recession earlier this year amid slowing global growth, high energy prices, and tight monetary policy. Analysts warn the outlook remains gloomy with second quarter GDP growth expected to be marginal and the risk of another decline in the third quarter as headwinds persist for Germany's key industrial sector.

What Can We Expect from The Market This Week

Eurozone CPI and GDP Q2: The market is expecting slightly lower inflation growth and healthy but slow economic growth as the market is slowing on higher interest rates with concern of a mild recession next year. until 2025 for growth to return to normal.

RBA Interest Rate: The Reserve Bank of Australia is expected to raise interest rates by 25 basis points to 4.35% in August following the Fed hike last week, with a possible terminal rate of 4.6%.

US Labour Market: JOLT job openings, Nonfarm Payroll, and US Employment are going to provide a clearer picture of the labour market. The market expects a gradual slowdown in job growth in the US labour market. However, wage growth is expected to remain steady despite the easing labour market conditions.

BoE Interest Rate Decision: The Bank of England is expected to raise interest rates by a quarter-point to 5.25%, with the expectation that the terminal rate will be 5.5%. With the inflation rate at 7.9%, the rate may stay higher for longer.

ISM (Non)Manufacturing PMI: The ISM Manufacturing Index surveys purchasing managers on indicators like new orders and production to provide an early economic indicator, which is expected to slightly expand.